May 2024: San Francisco Real Estate Insider

Hello and Happy Thursday.

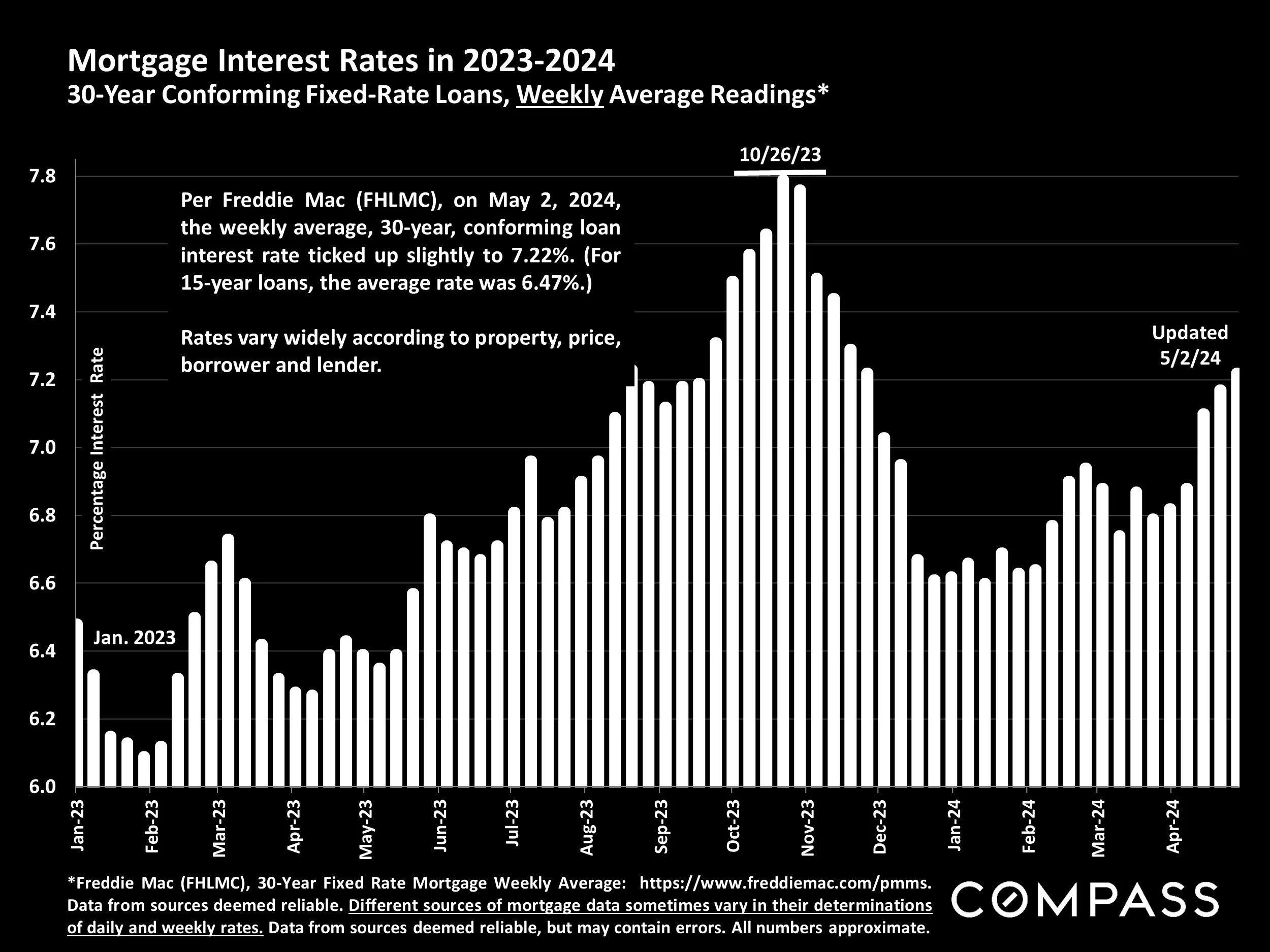

What a difference a few weeks can make in a local real estate market. Coming into April, the market was incredibly active with moderately low inventory and motivated buyers – partially fueled by optimism for a May interest rate cut. As we hit late-March / early-April, sellers were rushing to list their homes to capture the perfect storm; low inventory and motivated buyers. As we moved into the first few weeks of April, the opposite happened. Inventory hit its highest point since 2022 and the Fed said they would not cut interest rates in May. This announcement sent a harsh message to the market; interest rates jumped approx. 40 basis points and the buyer enthusiasm and (market) momentum instantly stalled out.

As we enter the second week of May I am starting to a pickup in requests for private showings, open house traffic and phone calls. Did buyers get their heads around the “new normal” with interest rates (~7.25%) and set their sights on getting into the market before a (potential) last summer/early fall uptick in competition (due to an interest rate cut)? I think so.

These two charts should provide some insight to the above points on inventory and interest rates.

What should we expect for the next few months? I think we have a lot of inventory coming to the market. My network of stagers, photographers and property inspectors as well are all very busy. The chatter in my colleague network(s) is also looking bullish for spring-summer inventory. This is unusual as a lot of this cyclical inventory flow would wait until the fall market. But, for whatever reason a lot of sellers are ready now (see my earlier comments about sellers rushing to market to capture the winter buyer frenzy).

Will these sellers be late to the party? If they have move-in ready homes with market pricing, they will do very well. If they bought during the COVID highs of 2022, I think it may be a long road to find a suitable exit. As with any market with a lot of supply, I think we’ll see some buyers getting a good value in the coming months. Sure; the “best” houses always get the most attention, but there are a lot of very good homes that often get overlooked.

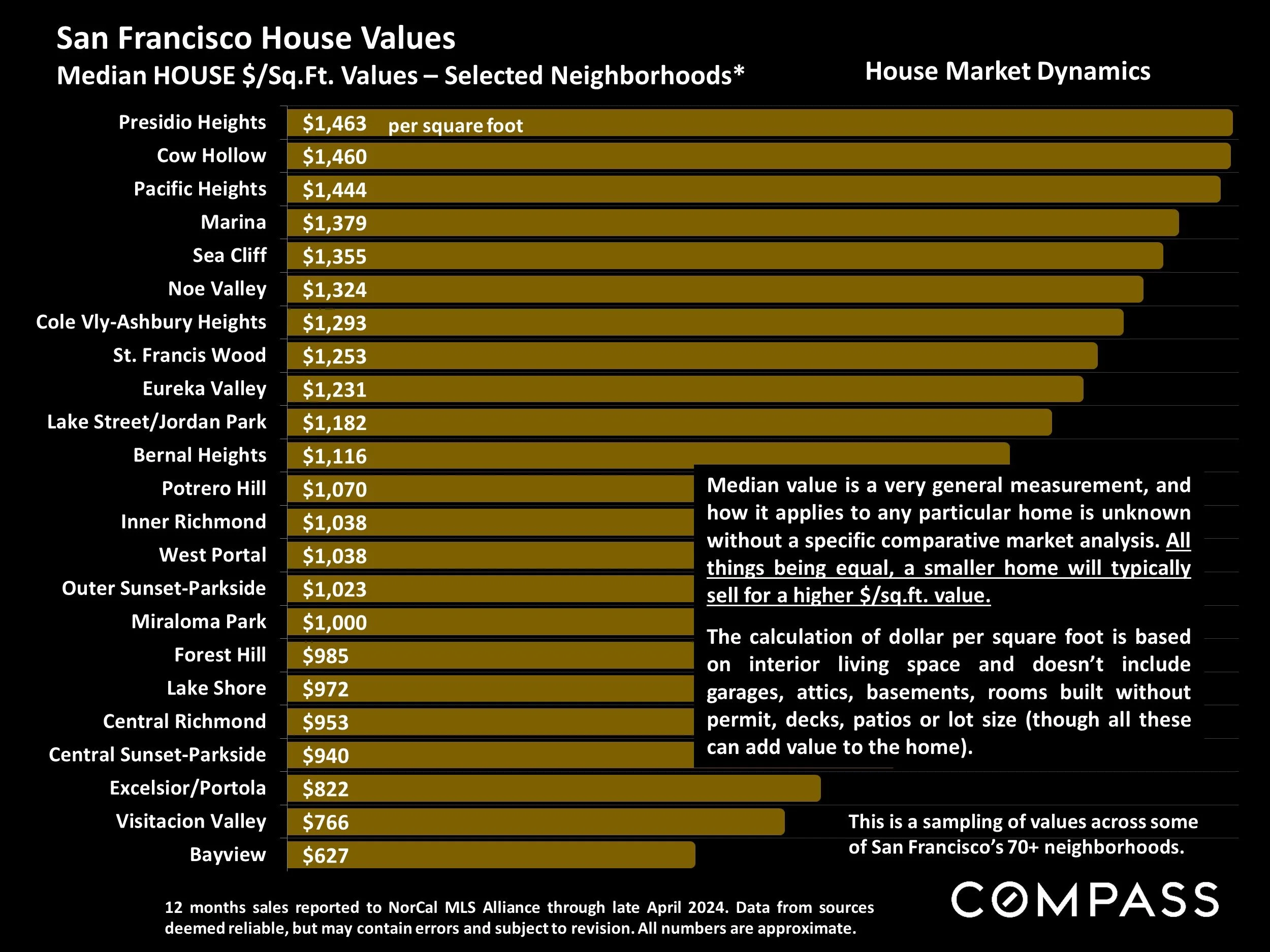

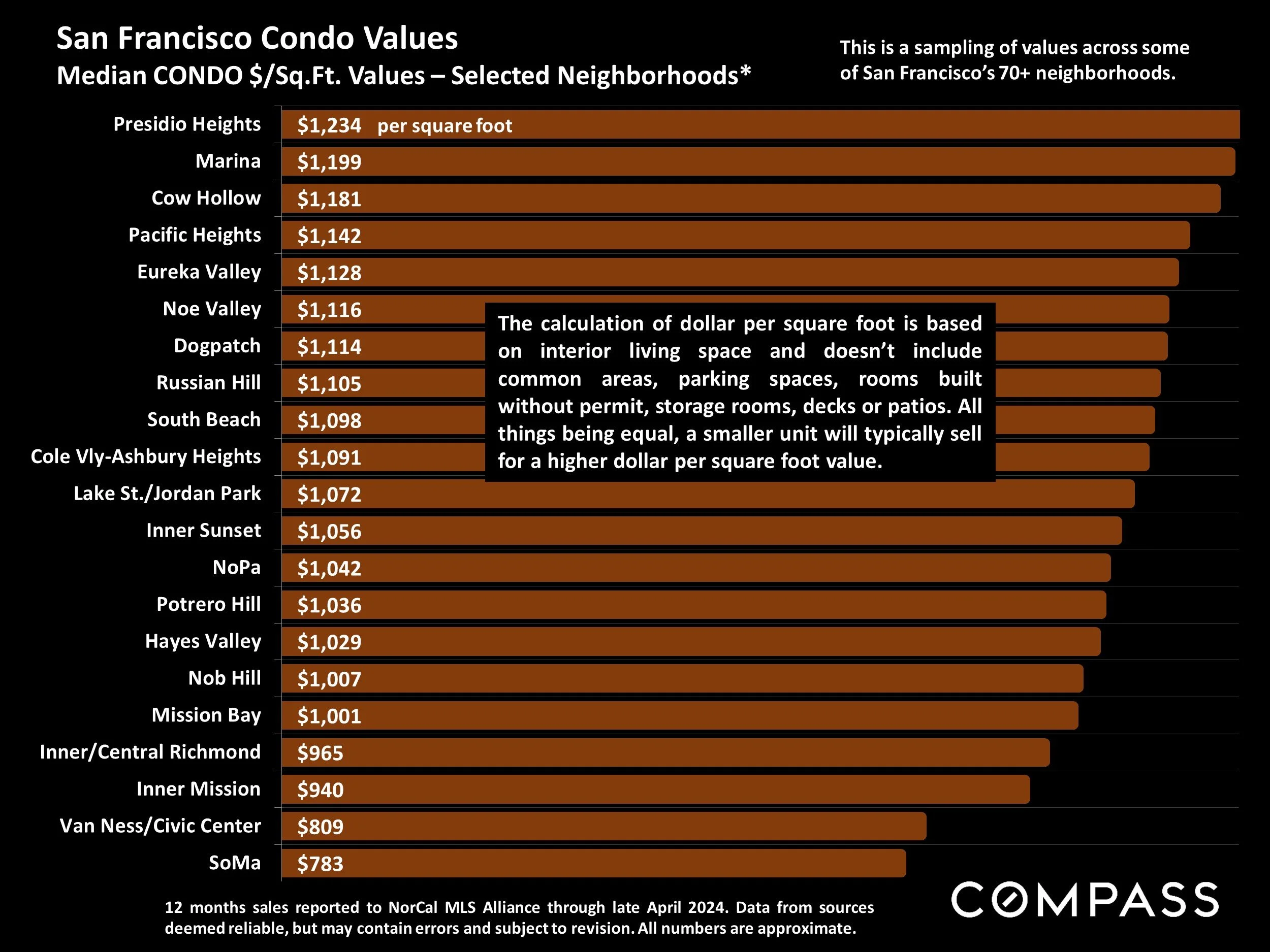

If you are looking at a specific neighborhood for a new home, the charts below will provide some clarity to the budget needed to gain entry.

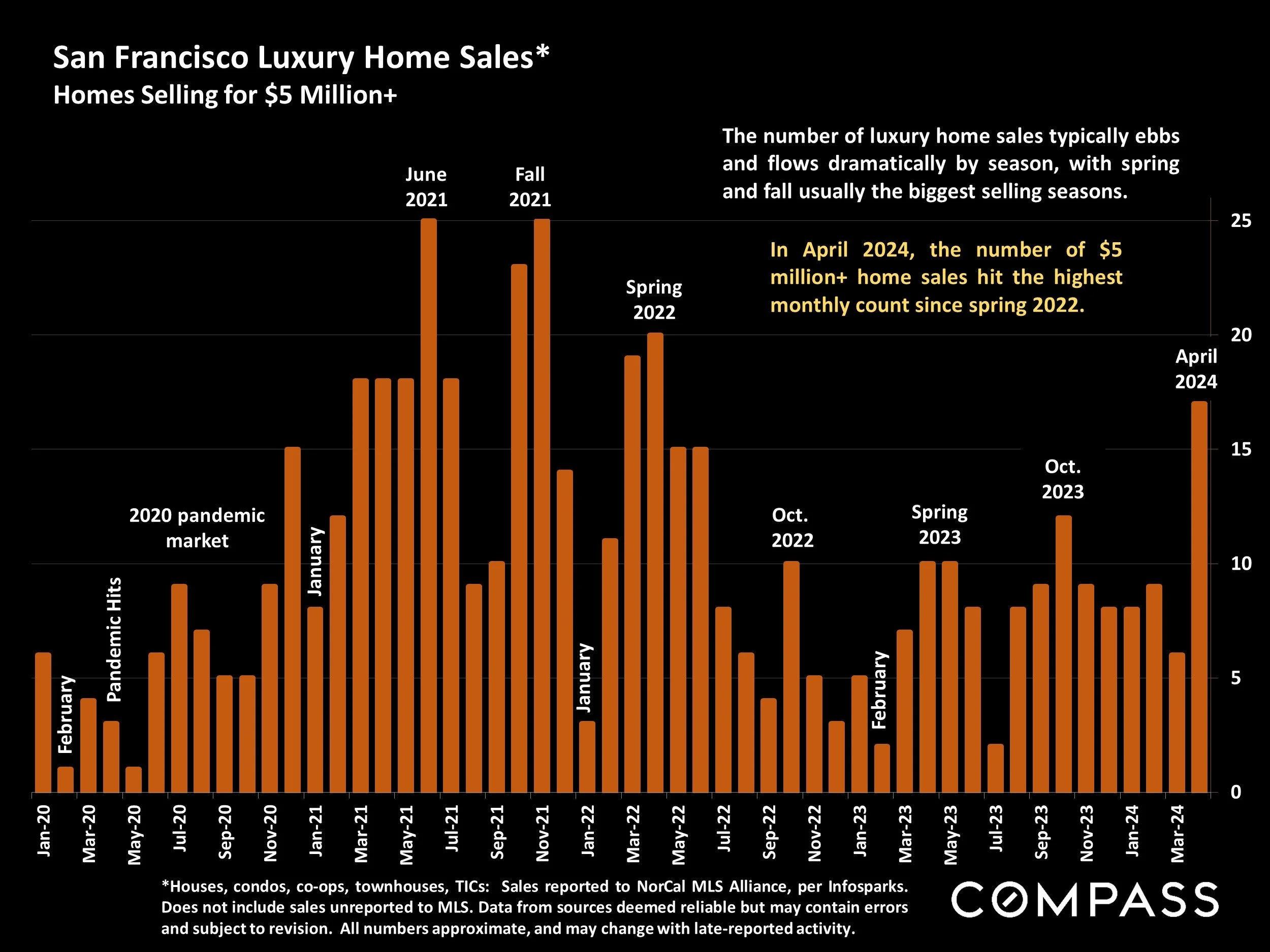

Also, as I covered last month, the top end of the market is coming back. We’ve seen more $5M+ sales since the COVID high of 2022. Hopefully, this continues as it’s another vote of confidence for the overall market.

That is it for now.

Call or email, anytime.