November 2024: San Francisco Real Estate Insider

With the election in the rear view mirror, the market (primarily buyers and sellers) have one less excuse as to why they are “distracted” or “out.” Does the real estate market suffer from election “uncertainty” and cause some form of a stall? Maybe but I don’t think so. The issue of election uncertainty comes up every four years, but even with data (going back to 1990) I have never seen any evidence that it plays a large role in market dynamics, sales volume or prices — both locally and nationally. Simply, macroeconomic trends are behind most market movements. The market in September and October was pretty steady and no real “drop off” in sales activity occurred as we closed in on the first week of November. If anything, we did recognize a slight uptick in activity as I did see more available homes go into contract (and new inventory trailed off).

Locally, for those of you with rental units, there is good news. The 2022 measure passed by San Francisco voters that taxed property owners who have vacant property(ies) was overturned by San Francisco Superior Court. If you recall, the measure (scheduled to go into effect in April 2025) would levy taxes on owners of buildings that were vacant 182 or more days in a tax year. The levies were to start at $2,500 to $5,000 a year per empty unit, based on its size, and were due to increase up to $20,000 per unit in future years.

Let’s get to the local real estate market; we have a lot of inventory on the books. But, I still see buyers with FOMO syndrome; they see a property they love but feel that “next week something better will come on the market.” At this time of year, that is a fools bet. Regardless, there are over 6300 active listings in the Bay Area.

Approximately 60% of listing inventory has been on the market more than 30 days

35% (3750 listings) has been on the market more than 60 days

24% (2500 listings) has been on the market more than 90 days

800 listings have been on the market for over six months

For buyers actively in the market (or thinking of jumping into the market), the next eight weeks offer the best opportunities for aggressive negotiating. The issue with many of these long-DOM listings comes down to overpricing. With a series of interest rate cuts queued up for the first half of 2025, expected buyer activity / competition will increase.

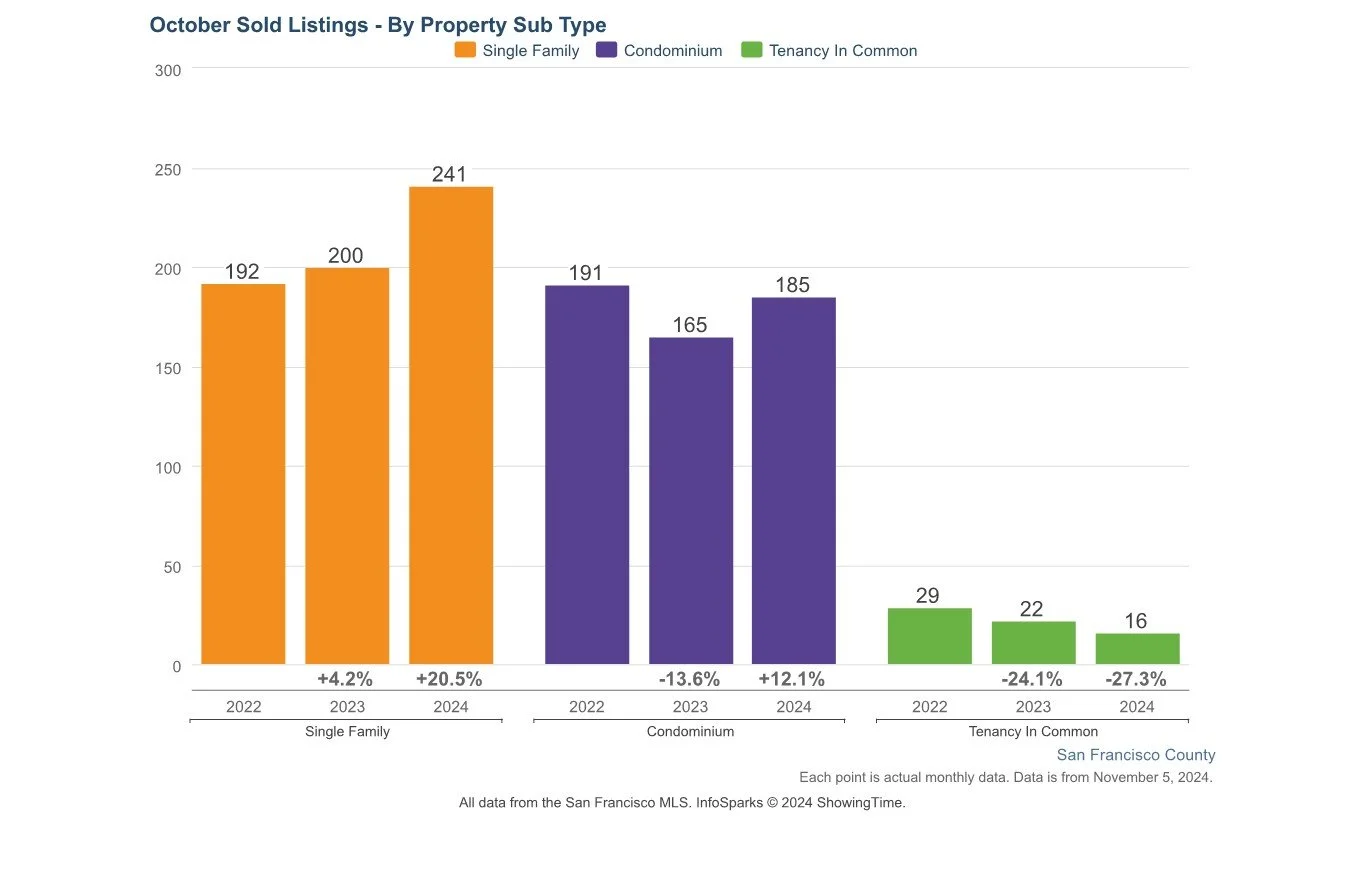

In San Francisco, year-over-year numbers look pretty good for October. Sales are up double digits for houses and condos; not so much for tenancy in common properties.

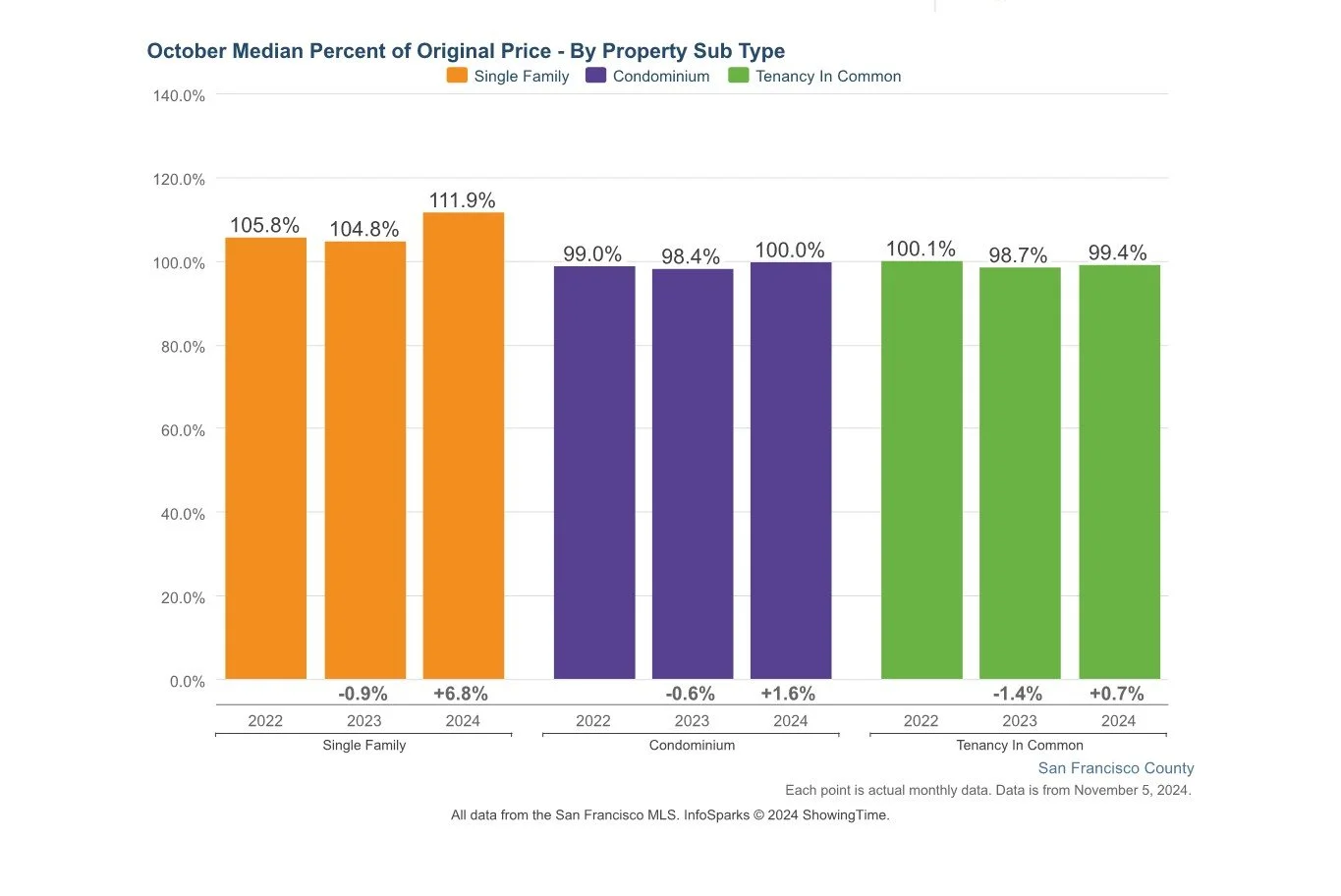

Looking at the competitive nature of sold properties, quality of product rises to the top. Single family homes are selling 10%+ over asking when looking at a median overbid amount.

When considering the sales in terms of price segments, the $2M-$3M and $3M+ segments are up over 30%. That is great but it does not account for the previously mentioned unsold inventory.