Q1 Sea Cliff - Lake Street Corridor insider

I hope this email finds you and your family safe and healthy. Real estate is definitely not the top priority as we deal with family, working from home and hoping we can quickly get back some form of normalcy to our daily lives. But life and business continues around us as we all know (and hope) there is a quick end to these unprecedented times. How the local residential real estate market reacts to the COVID-19 crisis will not be known for some time and I would not speculate as it’s too early to tell. I do know some apartment investors are looking at a potential exodus of tenants and how that will impact their business. Some business leaders (some in the neighborhood) with substantial leases downtown may come out the other side of this crisis and determine that work-at-home was hugely efficient and decide to cut 50% of its leased office space at its next renewal (current Class A rates are approx. $85/PSF). Restaurants, hotels and other service-heavy businesses are definitely in dire straits.

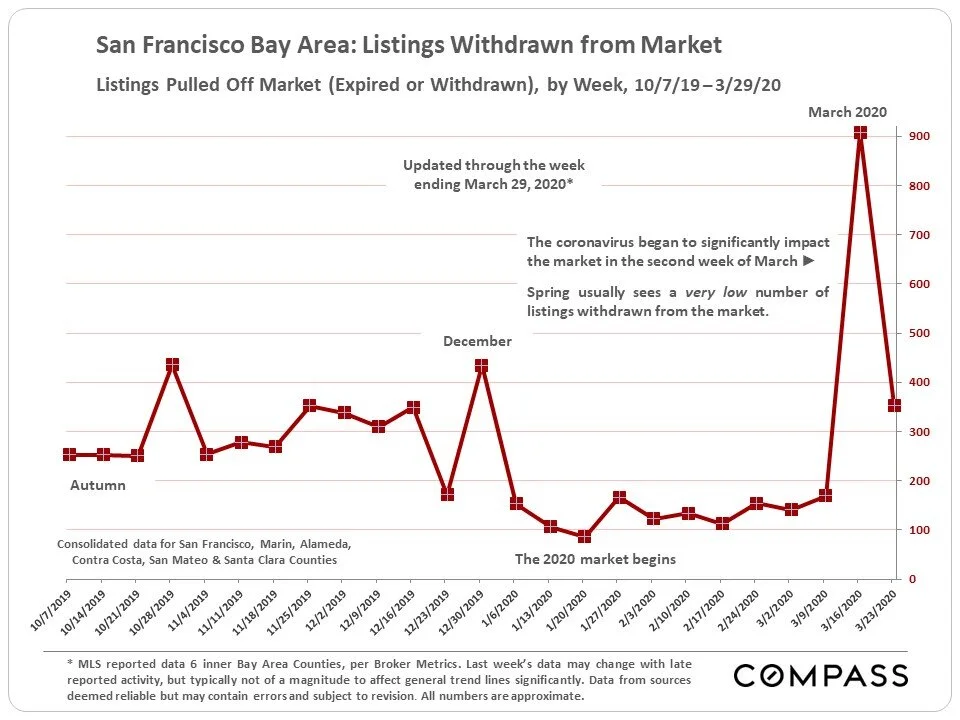

The current business lockdown (for non-critical business) has without a doubt slowed the residential market. Numerous sellers removed their property from MLS until they can (a) see clarity out of this crisis and (b) return to a point in time where their agent can effectively market their home. What I have personally experienced over the past month is that the demand is still very high. Properties are getting exposed off-market and showings are happening with only the buyer(s) in the home to view (while the agent remains outside or in their vehicle). Properties are going into contract, but again, this is all off-market.

The two charts below are pretty self-explanatory as it relates to what has happened to the public face of the inventory. Keep in mind the majority of the withdrawn properties are still available off-market.

So what is going on in our corner of the City?

The quarter was definitely cut short but you wouldn’t know it by solely looking at the Lake Street Corridor numbers. Year over year numbers have transactions up 80% and price per foot numbers up 18%. There is pent up demand for Lake Street properties and that is true through the COVID-19 crisis. Sea Cliff on the other hand was fairly steady. This was partially due to a few properties that made multiple attempts to find a buyer, but never found true love.

Here are the sales numbers for the quarter:

Looking at the top sale in of the two neighborhood areas, there were no eight figure sales but Lake Street had a sale that came in just under $2,000 per foot. A++ location and the sale was transacted privately. Here are the top sales:

In neighborhood news 178 Sea Cliff and its proposed renovation appear to be brewing a large storm with the neighbors. The project plans were promptly hit with a discretionary review and from speaking to some of the neighbors, the size and design of the project is way out of bounds. Remember 224 Sea Cliff? I reported last quarter that it finally found a buyer in the $13,000,000 range but the sale was subject to bankruptcy court approval. It was expected to close in Q1 but as of this report, it’s not closed. You will likely read about it in the Q2 report. 224 Sea Cliff and 178 Sea Cliff will bring two very large construction projects “sandwiching” the three properties between them. Fun times and you can see both properties here.

In “other” neighborhood news, do yourself a favor and try Devil’s Teeth Bakery on Balboa. I became familiar with their original location on outer Noriega as I shuttled my kids back and forth to sports activities at St. Ignatius on weekends. Devils Teeth took over the old Marla Bakery location (Marla moved out of SF to Novato).

Andronicos? It can’t open soon enough. The latest status shows it has cleared CEQA and building permits have been issued. Now, it’s simply down to getting the build-out completed, permits signed off, stocking the shelves and opening the doors.

On the Compass SF front, due to desire of some sellers in San Francisco, we have a new program that accommodates one, if not your most valuable commodity; privacy. The decision to sell your home is a personal one and the “Private Exclusive” listing allows you to control what information is shared about your home (and who sees it), while still getting exposure to buyers across the country through our network of top agents. Get in touch to learn more if this may of interest to you.