January 2021: Q4 Sea Cliff - Lake Street Insider

Looking back at 2020, thousands of San Franciscan’s experienced two things real estate related as a result of COVID. First, their home was no longer suitable for their new living/working situation. Second, if they no longer needed to commute to an office, would they rather live elsewhere. These two scenarios were the drivers of activity but now these trends have tapered a bit, mostly due to the holidays. But single family homes are still very hot - multiple offers are the norm.

Could the San Francisco exodus continue or have most people already moved? There are a couple of “TBD” factors (as of this report), that depending on the outcome, could set off more urban flight.

First, lets look at work. When we get the green light to go back to the office, will employers require some form of in office activity? If not and long term work at home is the new norm, you will see more flight out of San Francisco. Second, for families with school age kids, will we return to full time schooling in the classroom anytime soon? If parents cannot get kids back to school full time in San Francisco in the near term, you’ll see an exodus to communities that have open schools that have been safely functioning with no outbreaks. I know the school situation has caused a ton of stress as well as financial burden for many families. Work at home with young kids on Zoom and/or paying for daily pod support is not ideal. SFUSD and the teachers union are on track to remain at loggerheads over re-opening, likely dragging out negotiations long enough to scuttle the entire school year. Many parochial and private schools are open, but students are not physically in class all days of the week. Nobody wants to under estimate the health and safety of our kids or educators, but somewhere in the ivory towers, decisions are being made for self-preservation and the status quo when the charter and focus of “what is best for the kids” no longer seems to matter. Hopefully that changes soon.

Last quarter I published data on the exodus of San Francisco residents and I heard back from several of you with follow up questions. The data definitely piqued interest. To follow up on that trend, I have some more data published by the Postal Service. Although the data is not super robust, it does give more insight to where people are going (as well as where they are departing from in SF). Some data points of interest:

The USPS received 124,131 change of address requests originating in San Francisco zip codes between March and November 2020.

Of the 124,131 requests, only 28% were for change of address within SF.

Zip codes with the most change of address requests (in order of # of requests): 94109/Nob Hill - Polk Gulch, 94110/The Mission, 94107/South Park -South Beach - Dogpatch - Potrero and 94103/SOMA.

Top destinations outside of the Bay Area: Las Vegas is number one. Next was Palm Beach County, Seminole County, Denver and Beaverton (Or). (again, low to no tax trends).

456 SF households relocated to Marin County. The #1 destination was Mill Valley (with an estimated 66% of Marin-bound households) followed by Belvedere-Tiburon, with 14% of households.

There were 608 change requests to San Mateo County, 453 to Alameda County and 44 relocating to Contra Costa County.

Keep in mind a "household" to the USPS can be a single resident or a large family.

U-Haul also released data on migration trends since the pandemic started. In 2019, slightly more U-Haul trucks arrived in San Francisco than left, but in 2020, departures made up a whopping 58% of all one-way U-Haul traffic (from March to June). U-Haul said the numbers likely would have been higher if more trucks had been available to rent. The top destinations for its customers leaving the Bay Area during the pandemic were the Sacramento/Roseville area, Stockton and San Diego. The top out of state destinations were Reno, Las Vegas, Portland, Phoenix and Seattle.

Looking at luxury real estate, nationally and locally; there were some very expensive sales in 2020. First, on a national scale, of the top nine closed transactions, two topped $100 million (down from a record six in 2019) according to data from appraiser Jonathan Miller and research by The Wall Street Journal. Five were in California (in Los Angeles and Santa Barbara County). Two were recorded in Palm Beach and two in the Hamptons. The top five:

The Warner Estate in Los Angeles sold at $165 million. Jeff Bezos purchased the estate from David Geffen (Geffen turned around and purchased the Foothill Estate in Beverly Hills for $68 million).

Jeffrey Katzenberg Estate in Beverly Hills sold at $125 million. The buyer was the co-founder of WhatsApp. Katzenberg paid $35 million for the property in ‘09.

The Calvin Klein Compound in Southampton, N.Y. sold at $84 million. The buyer was Ken Griffin, founder of Citadel (hedge fund).

Two Trousdale Estates in Los Angeles sold at $75.5 million. The sale consisted of two properties and the buyer was the son of the founder of Foxconn Technologies (think iPhone).

Waterfront Florida Estate in Palm Beach sold at $71.85 million. Energy financier and entrepreneur Robb Turner was the seller and the buyer remained anonymous.

Locally, the top sale(s) were 3199 Jackson Street and 950 Lombard Street. Both closed at $27 Million. These are two very different homes; Jackson was over 24,000 square feet and Lombard was ultra-modern new construction.

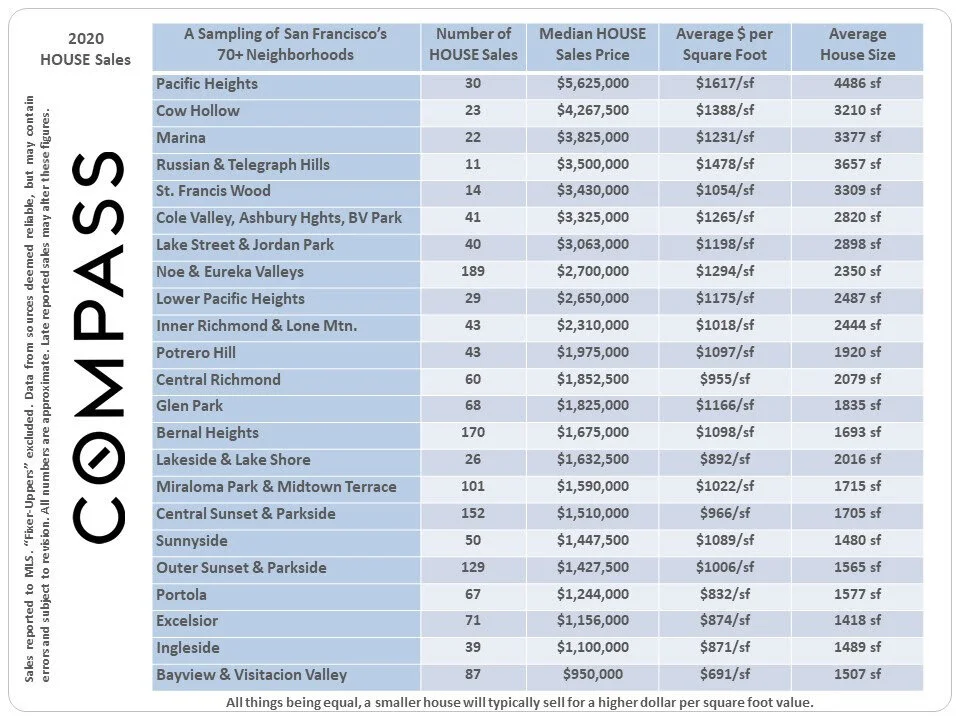

As far as City sales volume by price segment as well as sampling of sales values by neighborhood, the charts below are pretty straight forward.

Looking at condo values by neighborhood.

On to our corner of the City, although not the most expensive sale in the City in 2020, 190 Sea Cliff Avenue sold for $24 million. The story of that sale is quite interesting as it was in and out of contract twice before it found its new owner. Two points of interest; (1) the number of active buyers in the $20 million+ segment was very high during a pandemic and (2) the new owner also owns 170 Sea Cliff AND 178 Sea Cliff. One person now controls three contiguous parcels totaling almost 150 feet of ocean front real estate in San Francisco. Keep in mind from my previous report(s), despite large scale neighborhood resistance, 178 Sea Cliff was recently approved to be demolished. Although the demo is approved, the battle is not over. Could the potential of the long, noisy construction project next door be a reason for the sale of 190 Sea Cliff? I would assume it was a factor.

Sea Cliff and Lake Street sales activity was very good in 2020 as the fourth quarter continued the trend. Transactions in Sea Cliff were way up and on Lake Street prices were up. The numbers:

Looking at the top sales of the quarter, as previously mentioned 190 Sea Cliff was the sale of the year for the neighborhood. For the Lake Street Corridor, 34 West Clay Park was the top sale. Although not “in” Sea Cliff, West Clay Park often times gets overlooked as it is very exclusive and uniformly has outstanding properties.

Looking to the 2021 market we see a lot of positive reasons to buy. First, the San Francisco conforming loan limits were raised to $822,375 (up from $765,600 in 2020). For reference, most of the country is at $548,250. Second, the Fed is doing its part to keep mortgage rates low. The average rate for a 30-year fixed-rate mortgage hit a new all-time low, clocking in at 2.71%. That is cheap money.

I’ve heard and read some accounts about a new trend; buyers retuning to the San Francisco high rise condo market. Although I have seen some uptick in high rise condo sales, I do not buy into the ‘trend” status. I see a slight trend of renters outside of San Francisco returning (to San Francisco), but those are not buyers. That will obviously help the rental market to stabilize, but its not going to have an impact on the high rise sales.

Finally, I expect Prop 19 to impact the market. If you recall, prop 19 allows eligible homeowners (age 55+) to transfer their tax basis anywhere within the State and to a property of greater value (previously homeowners were limited to transfers within certain counties and to homes of the same or lesser market value). Secondly, Prop 19 requires market-value reassessments for inherited properties that are not used as the heir’s principal residence.