October 2024: Q3 Sea Cliff - Lake Street Insider

As we roll into the second weekend of October we are about one-third of the way into the fall market. Citywide, inventory was up about seven percent compared to the beginning of last fall; obvious reason being interest rates (i.e. sellers not motivated to trade a ~3% mortgage for 7.5%). So far this fall, the biggest change I see (in the market) is resurgence on the top end. Last fall, buyers had their choice of dozens of $5M+ homes in District 7 (Pacific Heights, Presidio Heights, Cow Hollow) as sellers competed hard for a buyer. In the last month, that market is hot. Listings in D7 are getting absorbed much quicker than last year. Is there new confidence in our fair city? Possibly. I tend to see a different reason; markets & money. In the past five years, the DOW is up 56%, the NASDAQ is up 126% and S&P 500 is up 93%. That alone can drive the San Francisco luxury market. Couple that with declining interest rates and you get folks that feel like it’s time for an upgrade.

Speaking of interest rates, the recent cut really helped fuel the market over the past six weeks. The entry level market relies on the lower cost of capital but this fall that segment of the market has not yet kicked into high gear. There is still a lot of very good <$2.5M inventory sitting; primarily in the condo category. My sense is the second fall rate cut (after 11 consecutive increases going back to March of 22…fingers crossed) will accelerate this segment. Until then, I see some very good values in good neighborhoods.

Last quarter a new policy was instituted in the real estate market as it relates to agent compensation. As you may have read, NAR (National Association of Realtors) settled the lawsuit (Burnett v. National Association of Realtors) and a seller is no longer ‘paying’ a buyers agent any compensation. Now, if a buyer would like to engage a licensed Realtor and or see a property with a Realtor, they must have a signed buyer representation agreement and this would spell out specifics of the relationship as to any compensation a buyer would pay to the agent to work on their behalf. This has been a big transition on ‘how’ we operate, but at a high level not much has changed. As with my clients and I, it has always been about the ‘net to seller’ on the closing statement. What happens above the line is a moving target. In the past six weeks I’ve had sellers pay the buyer agent compensation, I’ve have a buyer pay both agents compensation as well as received unrepresented offers (with no compensation). I see the Assessor’s Office looking into the new practice a bit closer as it will reduce the tax coffers.

For reference, if you sold your home for $4M and agreed to pay both listing and buyer agent compensation (5% as was practice before mid-August), the seller would pay transfer tax based on $4M and the buyers base would be $4M. But, if the buyer agreed to cover the commission the sale would close at $3.8M…which would be the same ‘net to seller’ as the prior scenario, but the tax collector (a) collects less and (b) the tax base is lower. I don’t see the tax collector being comfortable with this scenario. We will see as time progresses.

On to our corner of the city. Single family sales are moving quickly; as in less than two weeks on the market. Our inventory levels are what I would consider typical for this time of year, yet demand is up. We’ve also seen more off-market sales in our corner of the city than past Y-o-Y and recent quarter numbers. This can be attributed to many reasons, but the most common is the owner that; (a) has a “number” and (b) does not want to move out until they have a committed buyer. If this is you; reach out. I can put your home in front of a target rich pool of buyers.

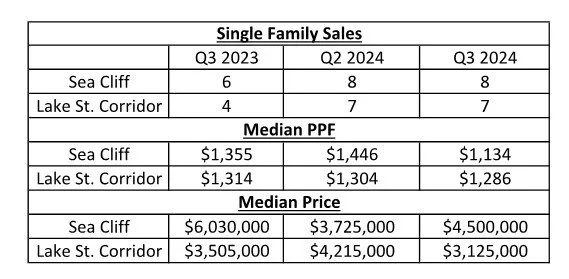

Some numbers for the quarter reflecting how quickly homes are selling in the northwest corner:

Other numbers for the quarter. Sea Cliff realized a couple $10M+ sales (and one $25M+) but overall the numbers were steady. In the Lake Street Corridor, I would say it was back to core homes and not the flurry of North of Lake homes we’ve experienced recently.

The top sales of the quarter.

That is it for now. If you are ready to move up, trade down or simply out; please reach out. Likewise, if you have friends or colleagues looking to get into the neighborhood market, feel free to pass my name along.

Call or email, anytime.