April 2024: Q1 San Francisco Apartment Insider

Hello & Happy Thursday:

Hopefully you and your family are back or about to return from a well-deserved break. We are seeing some movement in the multi-family market in San Francisco as some sellers seem to be nervous about a possible third attempt, this fall on a Costa Hawkins repeal. We are still a long way out from November; we'll see how this plays out in the next few quarters.

Remember the coming “eviction cliff”? It was predicted as a fatal blow to tenants once the eviction moratorium expired last August. Well…………. it never happened. Now evidence shows that between July 2 and Dec. 1, 2023, San Francisco registered a total of 262 eviction notices, according to data from the Rent Board. This figure is much lower than the 474 eviction notices between the January 1 and July 1 2023.

Looking at location of evictions, in general they are evenly spread across the city except for a dense cluster in the Tenderloin and another running south, along Mission Street. Looking at the specific reason for the eviction(s):

The most common type of eviction involves nuisance violations (the only type of eviction that was allowed during the early stages of the pandemic).

Capital improvement evictions were the second-most common type of eviction.

Non-payment of rent came in at the third most common.

Keep in mind landlords are not required to register evictions due to non-payment, so numbers may be much lower than the actual number of notices handed out to tenants.

Keep in mind, in 2022 there were a total of 1,299 eviction filings.

Looking at legal buyout agreements, there were 260 recorded agreements in 2023. That number was a 33% drop from 2022 numbers. The highest reported buyout was approx. $204,000 to a single tenant. The 2022 average total buyout was $53,828 and in 2023 it dropped to $43,124. The average buyout per tenant was $28,720 per tenant, which was down from an average of $35,720 per tenant in 2022 (the lowest average payout per tenant in six years).

Where are the most buyouts happening? Not the Mission for the first time in six years.

The Sunset led the way with 29 buyout agreements in 2023, followed by the Mission (25), Ingleside (20), Haight-Ashbury (18), the Inner Richmond (18), and Parkside (17).

A quick follow up on the Brookfield / Ballast acquisition of the two Veritas loans tied to 62 apartment buildings. It looks like the acquisition was completed via a $410M loan from Apollo Global Management. Brookfield & Ballast acquired both loans; the $674.8M loan for $513M and approx. $100M for the $130M loan. The numbers show the acquisition comes in at just under $300k per unit.

Speaking of Veritas, they are now marketing another 762 units across 23 buildings in San Francisco. The 23 buildings are backed by a $291.4M loan that originated in May 2021. Eastdil Secured was retained to market the portfolio.

On the tails of the Veritas portfolio default comes another portfolio default; this time by longtime San Francisco owner/operator Mosser Companies. Mosser defaulted on an $88M loan that was backed by 459 rental units across 12 buildings in San Francisco. The lender is now actively working to sell the non-performing loan and has hired Cushman and Wakefield to market the portfolio. For reference, the loan was originated in 2018 when the portfolio was 94% occupied (and appraised for $154M).

Additionally, Mosser Capital and the Swig Company have fallen behind (30+ days in arrears) payments on a $68M loan tied to five apartment buildings in San Francisco. Mosser and Swig spent $104M to buy the five buildings in 2015.

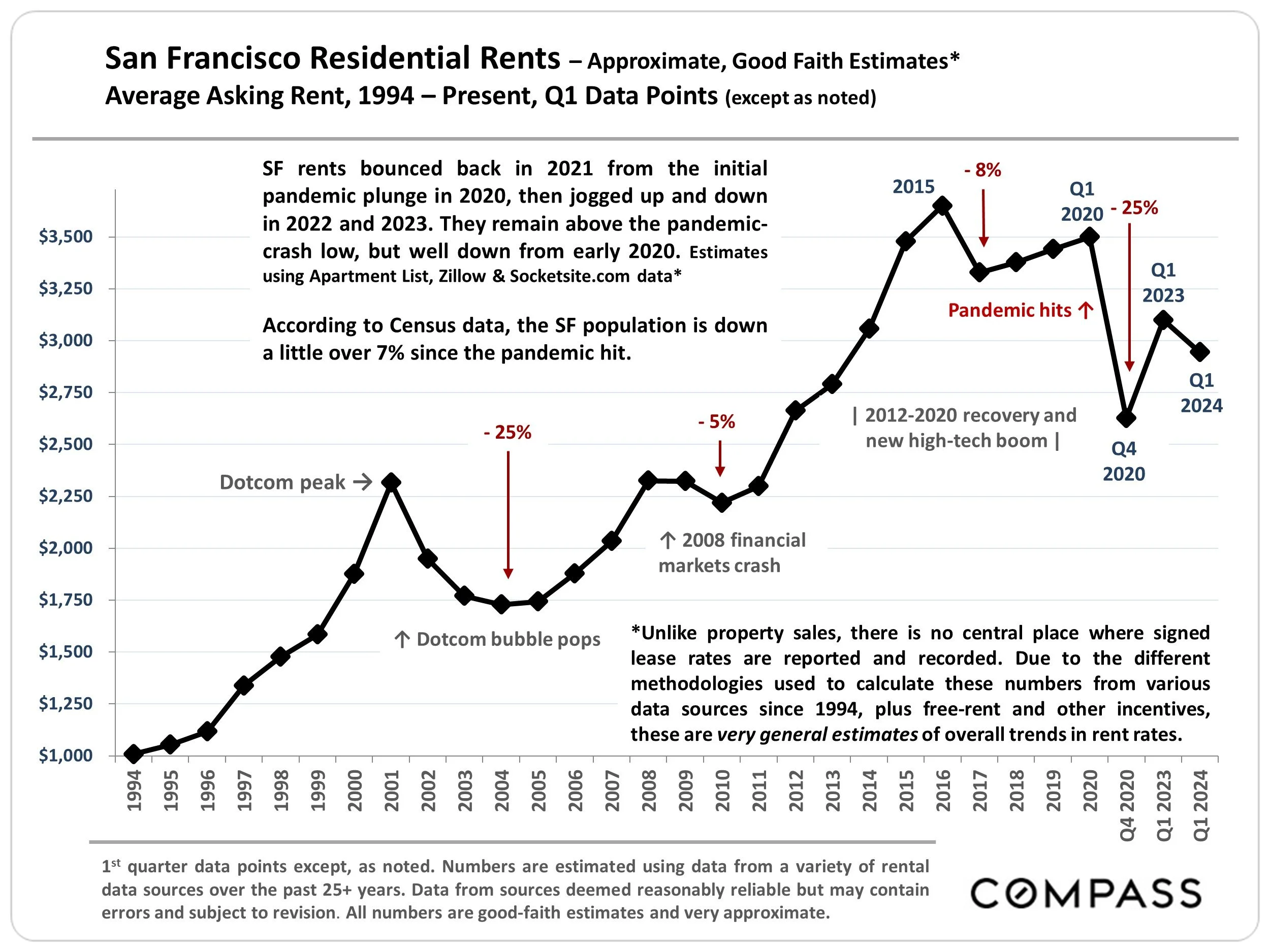

On to rents in San Francisco.

The weighted average asking rent for an apartment in San Francisco is $3,300 a month. This is:

9% lower that at the same time last year

~20% lower than pre-pandemic numbers

The average asking rent for a one-bedroom in San Francisco now approx. $2,900 a month. This is:

3% lower than at the same time last year

~17% lower than pre-pandemic numbers

The average rent on a two-bedroom apartment in SF is approx. $3,850 a month. This is down approx. 4% from the same time last year.

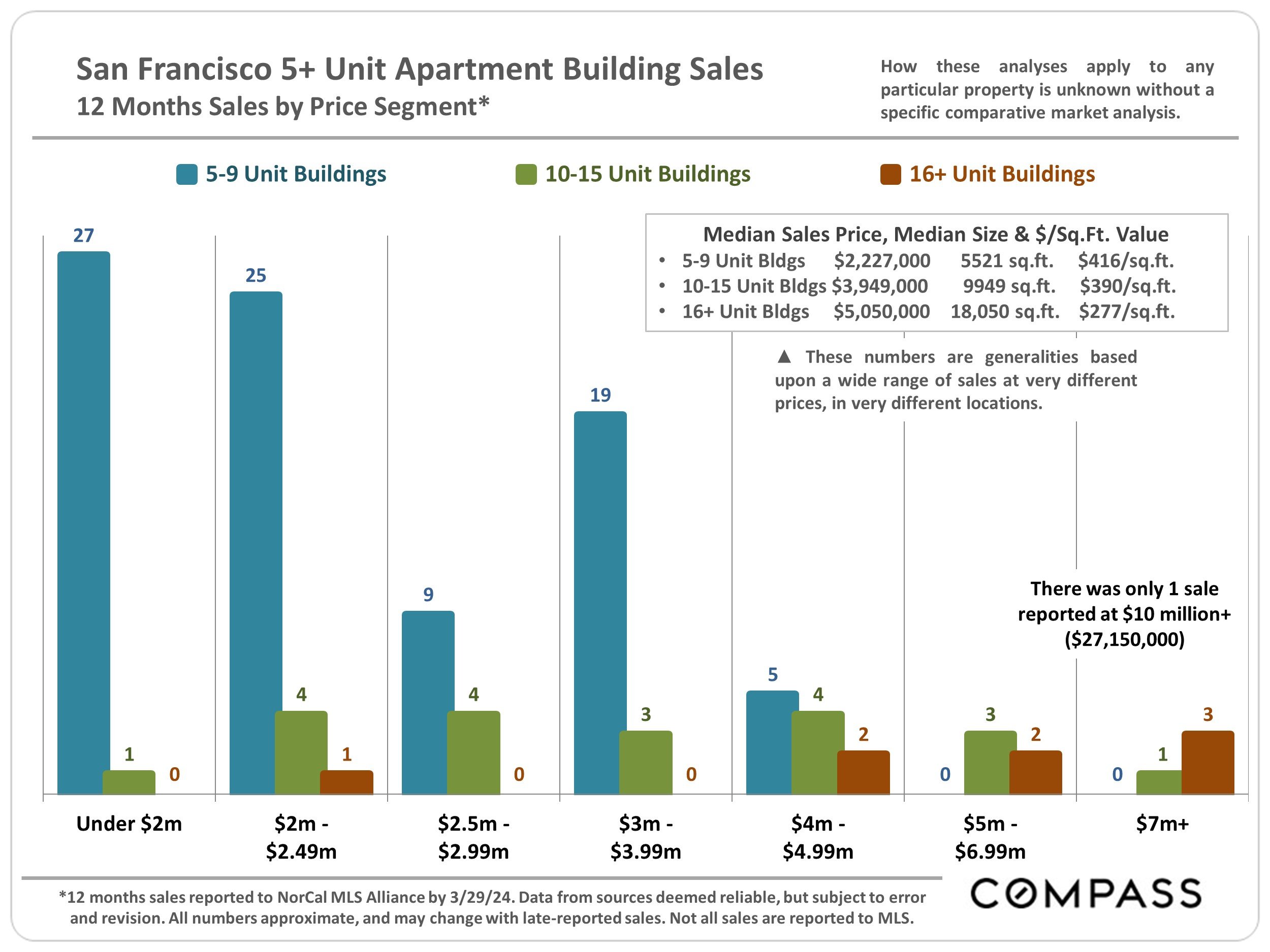

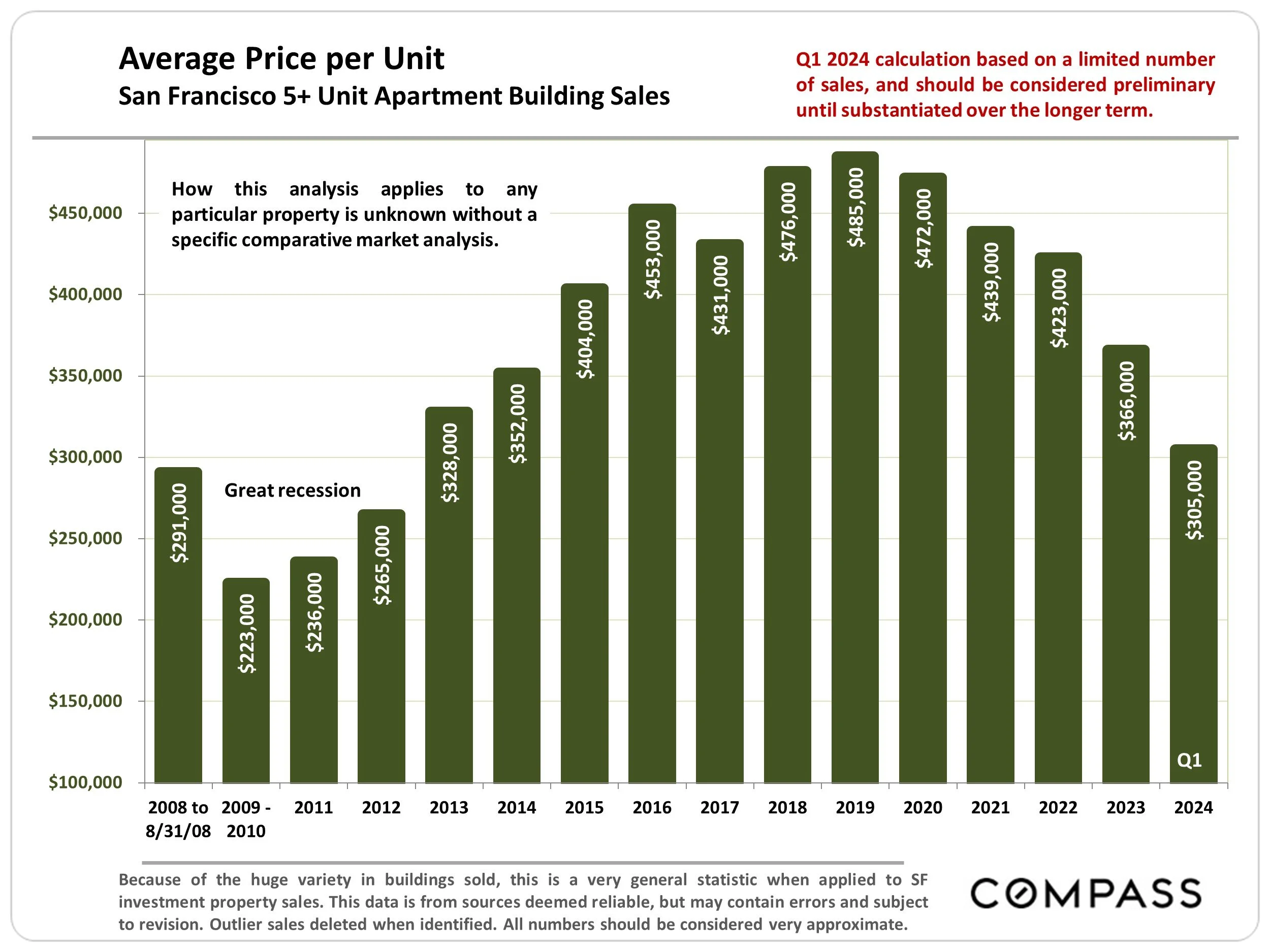

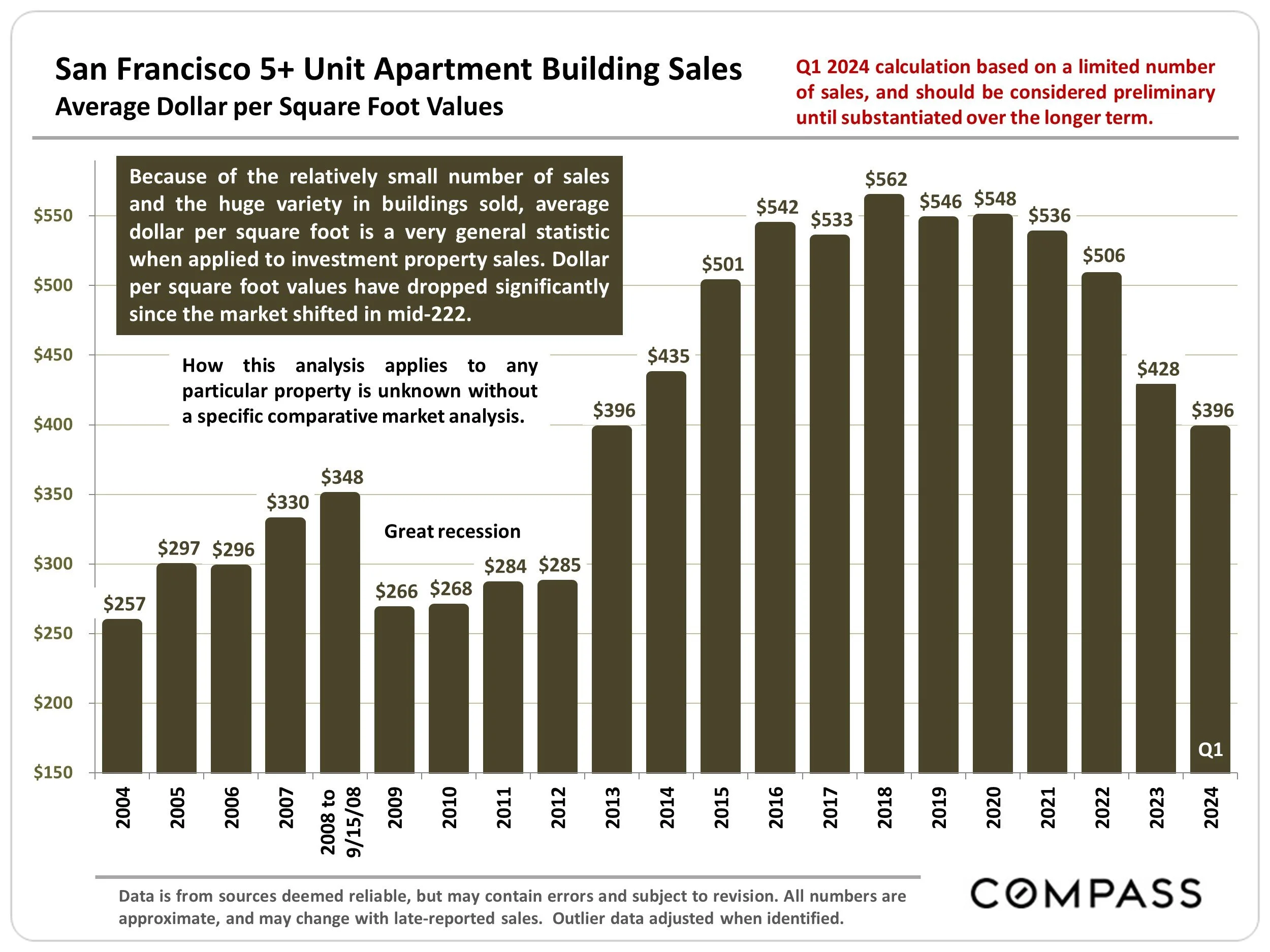

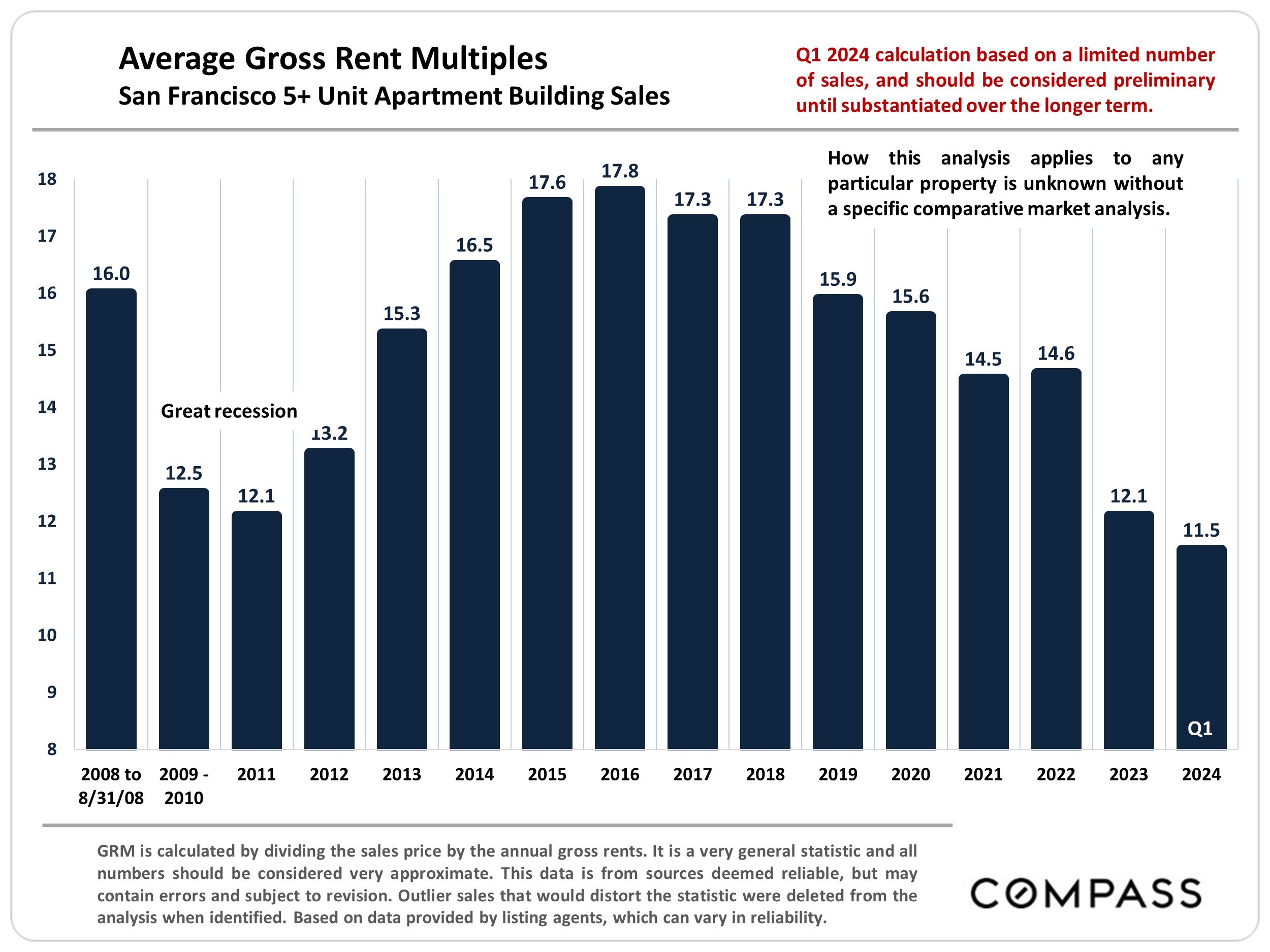

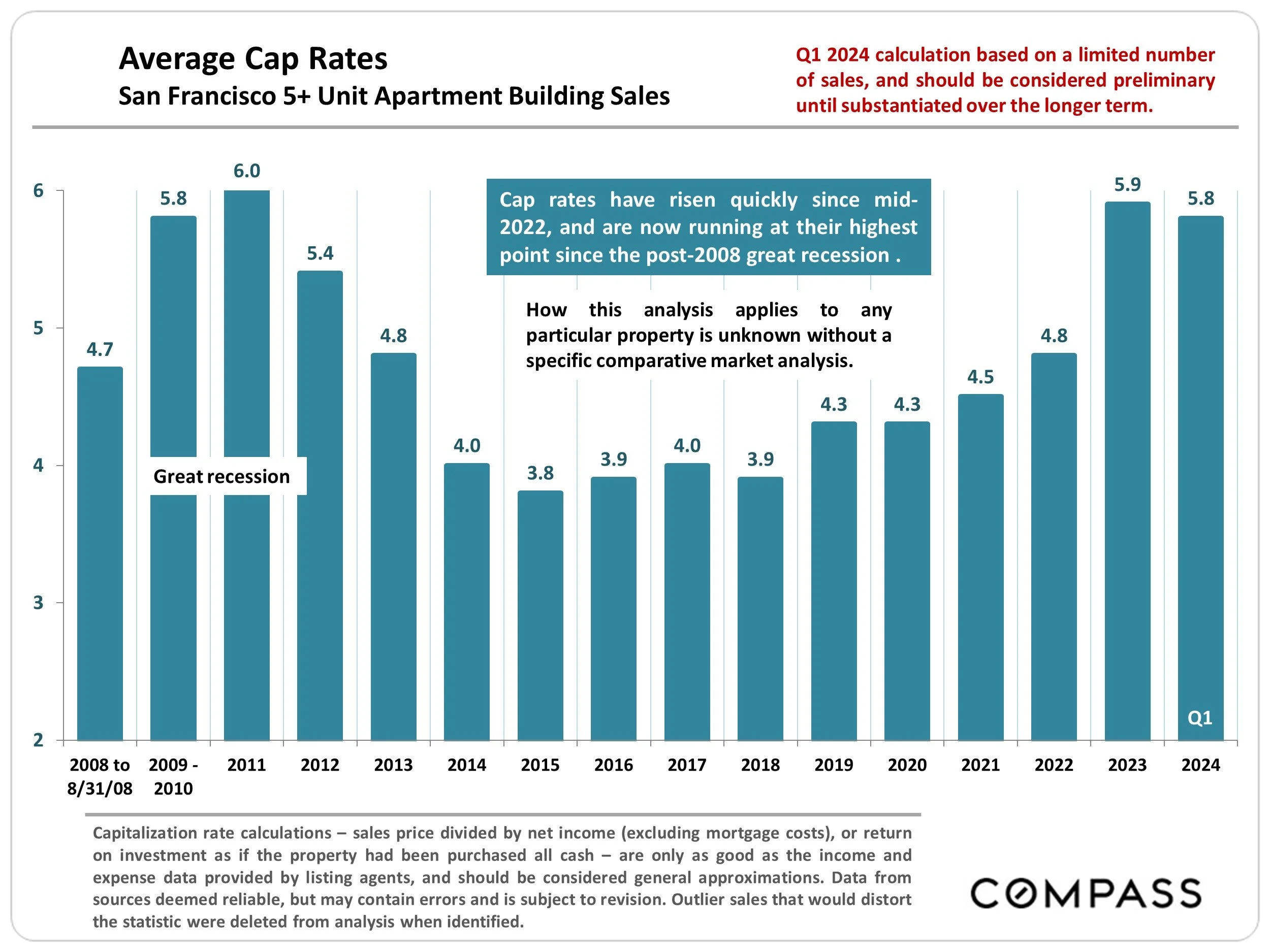

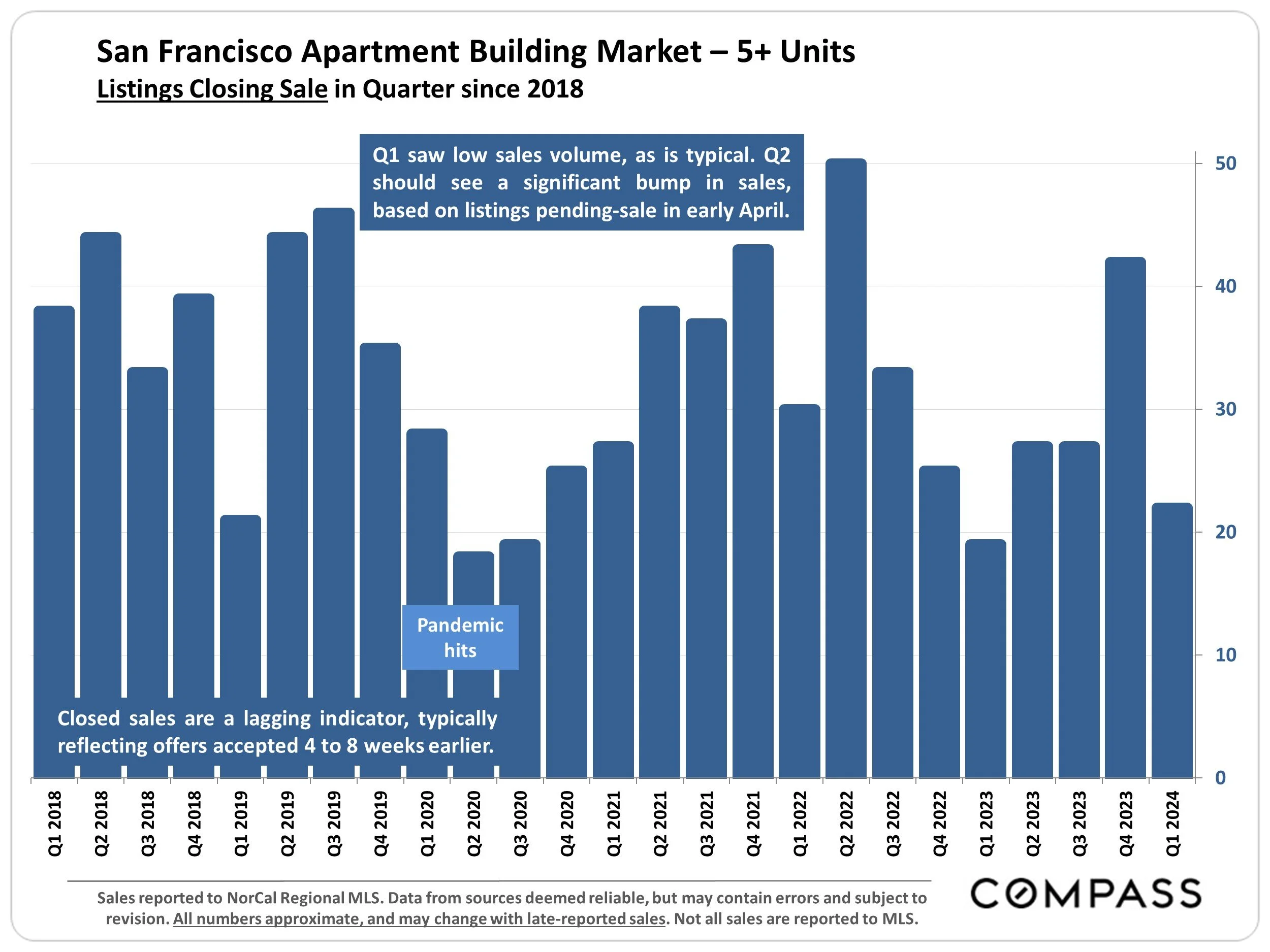

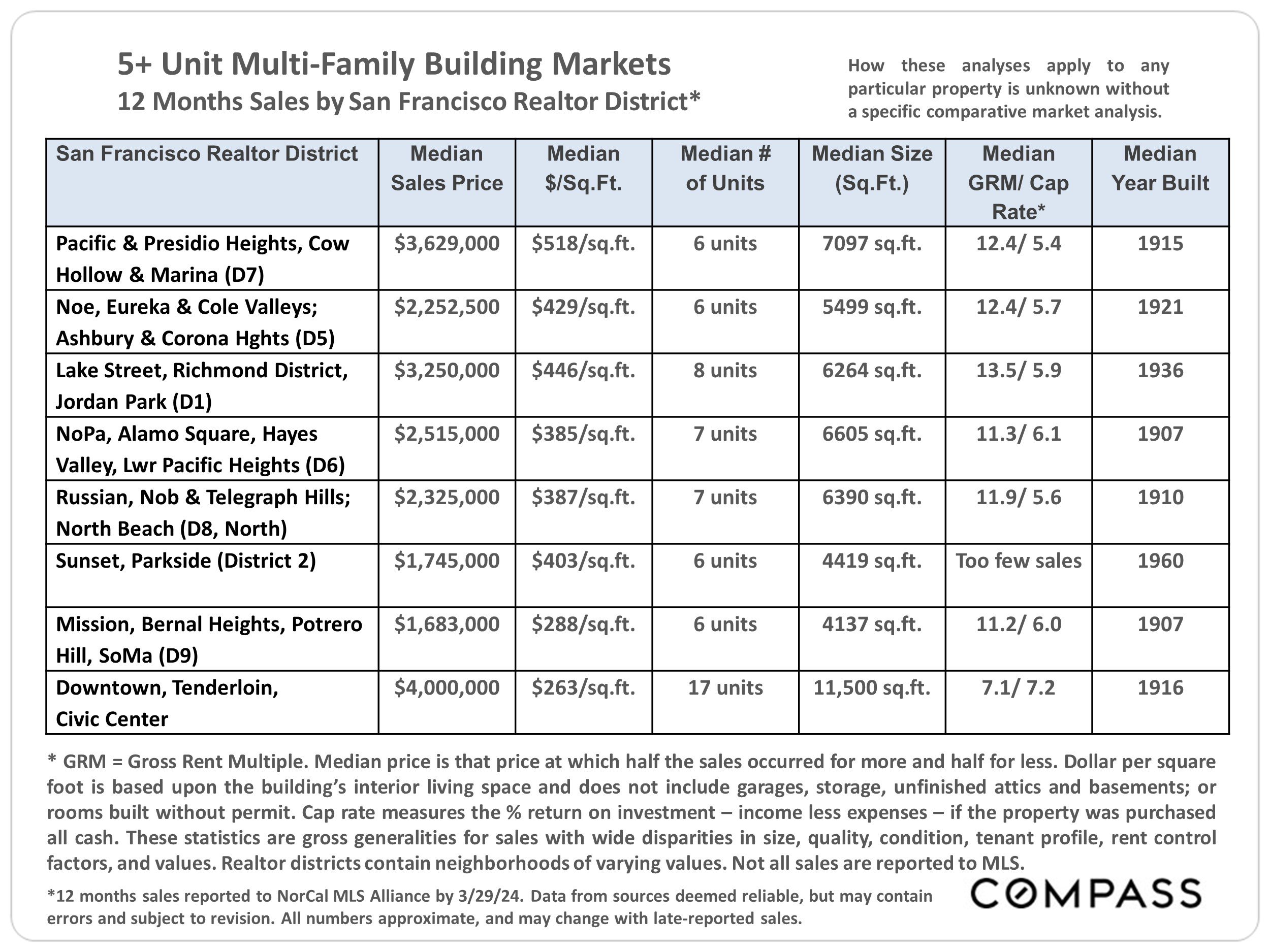

On to the numbers for the quarter.