2022: June San Francisco Real Estate Insider

As we approach the half-way point to the year, depending on your preferred media outlet, we are either experiencing a stalled housing market with high inventory levels or, the market is still continuing to chug along at a high pace. As usual, reality is somewhere in the middle.

The Fed policies to curb inflation are definitely impacting the housing market. The interest rate hikes are painful to buyers – and the hikes are not yet over (the average rate on the 30 yr. fixed is ~4.75%). Couple that with the tech sector down ~20% in the stock market, and now we are seeing layoffs and/or hiring freezes. This does not bode well for a City (and mini-region) that is addicted to the tax revenue from those employees of these said tech companies (and the massive ecosystem of small businesses dependent upon them).

So what is “really” happening in the market in San Francisco? In the agent community we are see and hearing more stories of (a) deals falling out of contract,

(b) no request for disclosures on new listings, (c) multiple request for disclosures on a property yet no offers, and (d) simply low interest on something that would sell in the first two weeks of listing a few months ago. Does this mean it’s a buyers’ market and sellers should start to panic? No. We are in a cooling mode. Nothing more; nothing less. Quality homes are still getting a ton of interest and selling quickly. The homes that have some “issues” and are not in move-in condition are not selling – or at least at the asking prices. Buyers are not throwing caution to the wind on offers – we are seeing offers with inspection and appraisal contingencies on some deals. That sounds crazy but for a buyer to be competitive over the past five months their offer needed to be “clean” with no contingencies. As far as segment related activity, here is what I am seeing:

<$2M: still hot for quality homes

$2m-$3m: finicky but the segment has definitely slowed

$3m-$5m: slowing

$5m-$8m: slowing

$8m+: slow pace going back to fall ‘21

As far as inventory, many sellers are moving their list dates up from a preferred fall market to a summer market. This is providing some with a feeling that they have a better shot now at their desired sales price than they do in the fall when it’s expected that rates and inventory will both be up.

Speaking of interest rates and mortgages, adjustable rate (ARMs) and interest only loans are both becoming more popular as the 30-year loan rates are the highest. Interest only loans have always been popular at the top end of the market, but we are seeing more buyers use that product.

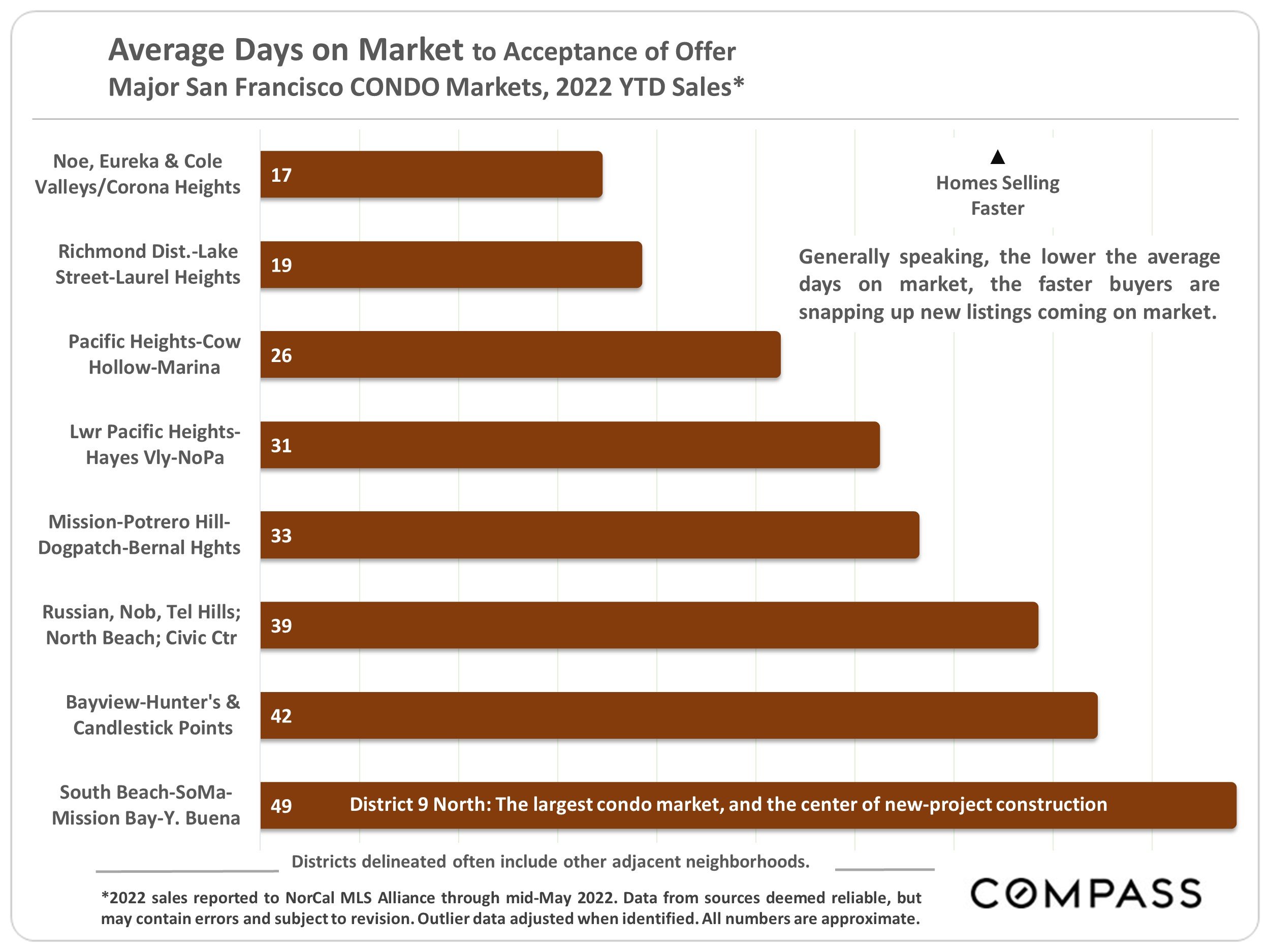

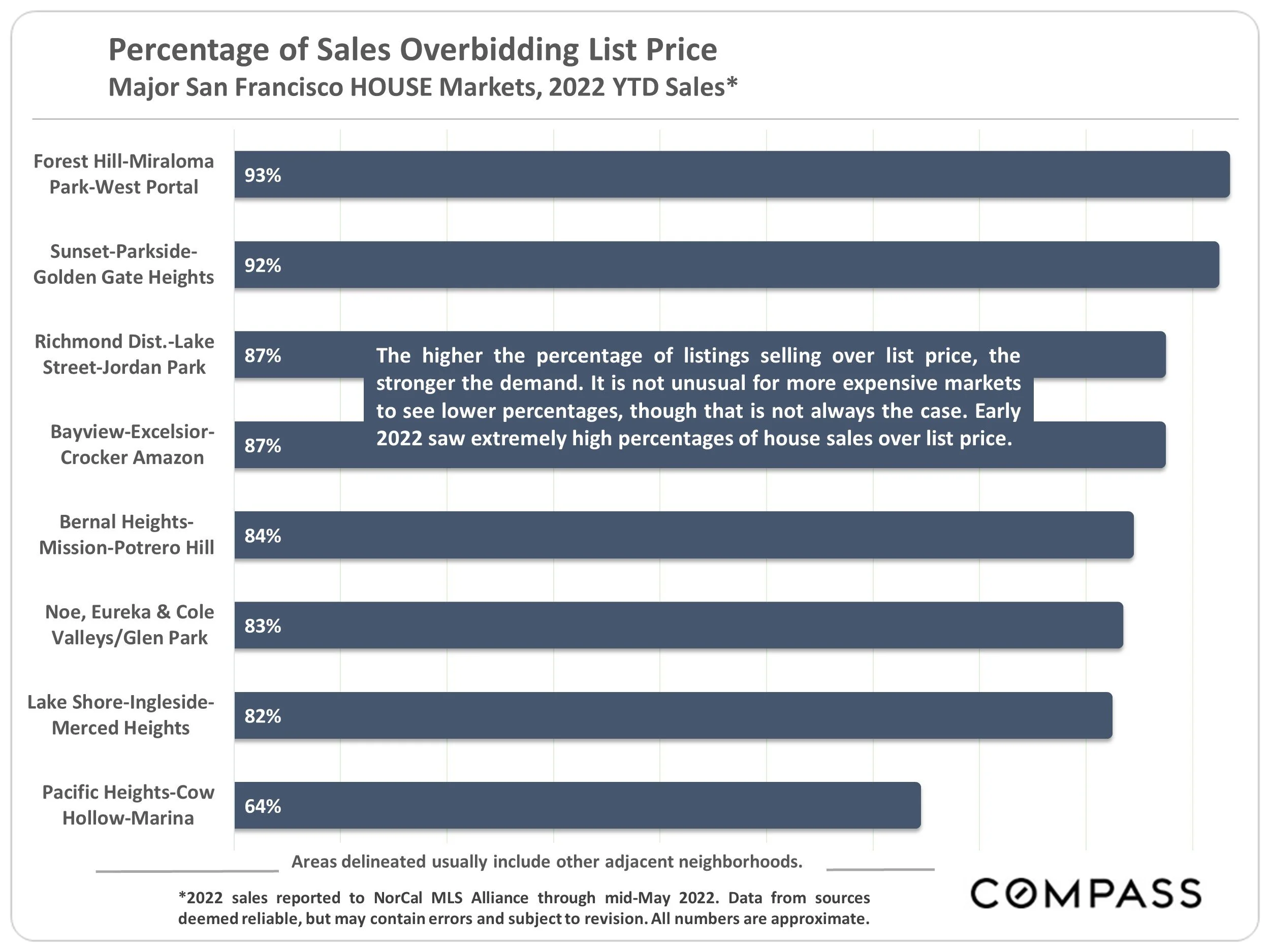

I added some charts below that add some insight to neighborhood specific desirability and competition levels.