October San Francisco Real Estate Insider

As we roll into the fourth quarter of what will be an unforgettable 2020, depending on your preferred media outlet, the real estate market is over-supplied and you can pick your price on a house, or the housing market is as hot as ever. As usual, the truth generally falls into the middle somewhere.

San Francisco is definitely experiencing an outward migration and inventory is up (considerably). The majority of the inventory is in the condo segment as sellers look to buy a single family home in San Francisco or elsewhere. Large community living is not terribly popular right now. Local buyers want and expect a move-in ready home with no issues or “challenges.” Available homes (as well as condos) with such challenges or lofty price expectations are sitting and buyers will wait for price reductions. Homes that are in turn-key condition with market pricing are selling quickly; and most with multiple offers. In the condo market, buyers are more aggressive in their approach. Buyers are not bringing a paring knife to the sellers’ price expectations; they are bringing a machete. To put the condo market into perspective, 78% of all price reductions in the city are concentrated in the condo market. Active condo listings have more than doubled in a year, with 1,375 condos/lofts listed at the end of August compared with 643 in the same period last year. The inventory is also at its highest point since 2008.

The outward migration of residents is not new; it’s been going on since COVID started. Why are people selling and leaving is more interesting. In short, the majority of people are leaving due to (a) loss of urban amenities (b) taxes / cost of living (c) perceived better quality of life elsewhere and (d) a COVID-induced acceleration of a planned move out of San Francisco a few years down the road. The latter was also precipitated by the San Francisco public school dilemma: only two hours of distance learning per day (compared to local private & parochial and most other outbound counties with much higher student engagement). That leaves working (at home) parents in a bit of a pickle as they try to balance work/school/family all under one roof.

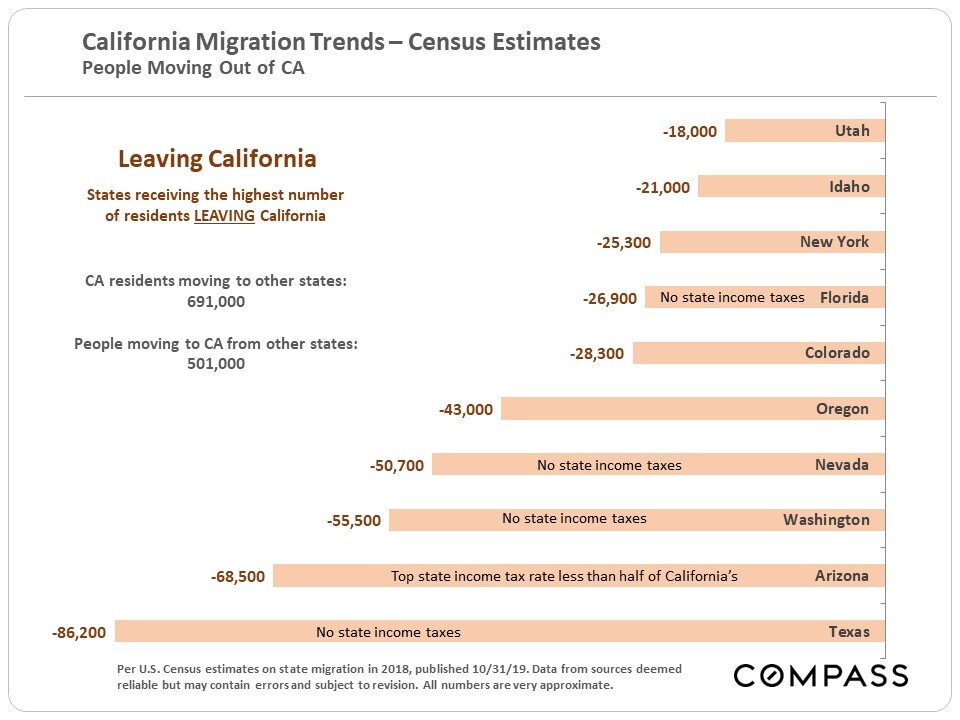

Where is everyone going?

What is the trend aside from a primarily neighboring state migration? Taxes. Aside from Oregon, no state has a higher income tax rate (if they have an income tax) over a high 6% (Idaho). California is over 13% and likely moving higher. Legislative threats of more taxes on entrepreneurs and high earners only exacerbate the issue. Texas has been poaching California business for the past several years with the lure of low/no taxes, lower cost of living and better quality of life for employees; their efforts are actually working. I have a client that moved to Houston to open a new office for his company. He sent me the images of the house he just bought in one of the best neighborhoods. A custom home on a lake that would be worth $15m in Marin only cost him $2.1m or ~$300 per foot (a slumping oil and gas sector helped his cause). I’m not saying living in Houston is like living in Kentfield, but the cost differential does not go unnoticed.

More on migration trends.

The table below compares Q3 statistics across five years. Since the dynamics of the SF house and condo markets have significantly diverged since the pandemic struck - the condo market has been weaker - we broke some of the 2020 stats out separately in the table, and then in some of the charts following.

As referenced above, the inventory of condo listings on the market has been soaring, and price reductions are heavily concentrated in the condo market. Hundreds are still selling each month and that number has been rebounding in the last couple months - but increases in supply continue to outpace demand. Within the condo market, the high-rise segment appears to be the weakest, almost certainly due to pandemic-related reasons.

Luxury Home Sales by Quarter

Q2 is typically the strongest selling season for luxury homes, but the pandemic changed that dynamic in 2020. Though the SF luxury segment recovered in Q3, in many other counties around the Bay, luxury home sales have soared to all-time highs.

Active inventory has been surging in recent months (first chart below), as has the months supply of inventory (second chart). As mentioned before, the supply of condos for sale is currently dominating SF inventory.

But the number of price reductions - again heavily concentrated in the condo market - has jumped to its highest point in many years. In certain segments, sellers are now competing for buyers, instead of buyers competing for listings.

Median House & Condo Sales Price Trends by District

The three charts below are focused on the districts in which the greatest number of house or condo sales occur. The first two refer to house sales and the third to condo sales.