Q3 Sea Cliff - Lake Street Insider

As we roll into the fourth quarter of what will be an unforgettable 2020, depending on your preferred media outlet, the real estate market is over-supplied and you can pick your price on a house, or the housing market is as hot as ever. As usual, the truth generally falls into the middle somewhere.

San Francisco is definitely experiencing an outward migration and inventory is up (considerably). The majority of the inventory is in the condo segment as sellers look to buy a single family home in San Francisco or elsewhere. Large community living is not terribly popular right now. Local buyers want and expect a move-in ready home with no issues or “challenges.” Available homes (as well as condos) with such challenges or lofty price expectations are sitting and buyers will wait for price reductions. Homes that are in turn-key condition with market pricing are selling quickly; and most with multiple offers. In the condo market, buyers are more aggressive in their approach. Buyers are not bringing a paring knife to the sellers’ price expectations; they are bringing a machete. To put the condo market into perspective, 78% of all price reductions in the city are concentrated in the condo market. Active condo listings have more than doubled in a year, with 1,375 condos/lofts listed at the end of August compared with 643 in the same period last year. The inventory is also at its highest point since 2008.

The outward migration of residents is not new; it’s been going on since COVID started. Why are people selling and leaving is more interesting. In short, the majority of people are leaving due to (a) loss of urban amenities (b) taxes / cost of living (c) perceived better quality of life elsewhere and (d) a COVID-induced acceleration of a planned move out of San Francisco a few years down the road. The latter was also precipitated by the San Francisco public school dilemma: only two hours of distance learning per day (compared to local private & parochial and most other outbound counties with much higher student engagement). That leaves working (at home) parents in a bit of a pickle as they try to balance work/school/family all under one roof.

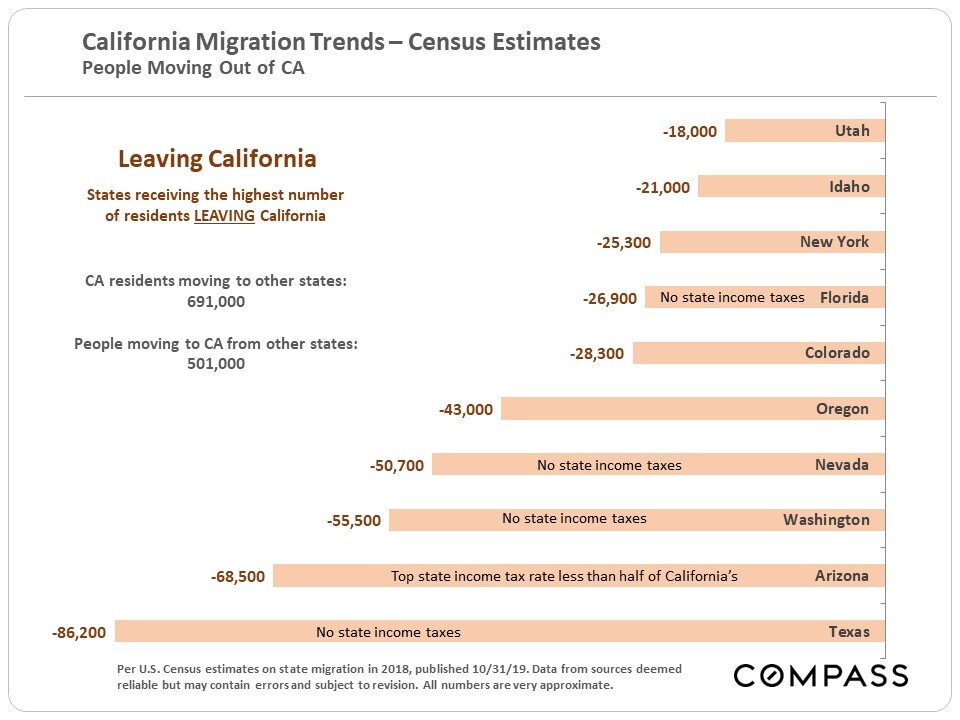

Where is everyone going?

What is the trend aside from a primarily neighboring state migration? Taxes. Aside from Oregon, no state has a higher income tax rate (if they have an income tax) over a high 6% (Idaho). California is over 13% and likely moving higher. Legislative threats of more taxes on entrepreneurs and high earners only exacerbate the issue. Texas has been poaching California business for the past several years with the lure of low/no taxes, lower cost of living and better quality of life for employees; their efforts are actually working. I have a client that moved to Houston to open a new office for his company. He sent me the images of the house he just bought in one of the best neighborhoods. A custom home on a lake that would be worth $15m in Marin only cost him $2.1m or ~$300 per foot. I’m not saying living in Houston is like living in Kentfield, but the cost differential does not go unnoticed.

More on migration trends.

In our corner of the City activity is mixed. Inventory is up in Sea Cliff but sales are slower than usual. For reference, there are currently seven homes available in Sea Cliff; three over $12m (and four under). The ultra-luxury market is finicky right now. Those buyers are more engaged in the financial markets and tend to act (or not act) today on what markets may look like in Q1 2021.

Inversely, activity in the Lake Street Corridor is way up as most any single family that comes to market is selling quickly with multiple offers. There were 10 sales in the quarter; more than double the prior quarter and more than three times the year-over-year quarterly number. Home prices in the corridor are more palatable to a larger audience (than prices in Sea Cliff); so the demand should not be surprising.

On to the numbers.

The top sales were both very nice houses.

In neighborhood news, the saga of 224 Sea Cliff will not end. If you recall as of my last quarterly report, the trustee had accepted an offer of $13,700,000 and was looking for over-bids (the sale was in bankruptcy court). I do not think the deal was approved by the numerous creditors and now the home is back on the market at a highly increased price of $17,500,000. I suspect the new price would appease the creditors with some room to negotiate.

Last quarter I reported on 178 Sea Cliff and the proposed remodel that was less than popular with the immediate neighbors. Just recently the Board of Supervisors denied the discretionary review and approved the demolition of the home with all supervisors but one in favor. The board and a historic resource expert went to the extent to comment that the Seacliff neighborhood is a historic resource, and a house (in the neighborhood) can also be a historic resource. But, they said that one house cannot damage historical resource as a whole (i.e. the neighborhood). Supervisor Peskin commented that the 178 Sea Cliff “structure is not worthy as a contributor” to the historic resource of the neighborhood. This is somewhat of a double-speak as many owners (all over the city) were denied their preferred plan based on the fact that the Board of Supes said their home was vital to the “character” of the surrounding neighborhood. This is why it helps to hire a connected architect, insider or plan expeditor.