January 2022: Q4 Sea Cliff - Lake Street Insider

Happy New Year! Another COVID year in the rear view mirror and I am excited about 2022. Hopefully you are as well.

Another COVID year in the rear view mirror and I am excited about 2022! Hopefully you are as well! The number of homes sold in 2021 is set to be one of the highest on record. The fourth quarter was extremely active too. Even though inventory was very high, most available homes found a buyer quickly. The only San Francisco segment that was spotty was the ultra-luxury market ($10M+). I am seeing traditional San Francisco sellers/families (in the ultra-luxury bracket) holding steady if their kids are entrenched in schools. Newcomers to this market are most likely looking outside of San Francisco. Premium Bay Area markets like Woodside, Atherton, Ross, Kentfield, Alamo, etc. all proved more desirable (and performed well above the San Francisco market) in ‘Q4 and that will not change this quarter.

As far as what I expect to see for the local market this year, I expect the demand for single family homes will still be greater than the inventory (not only SF but in the region). Houses with amenities like gyms, offices, large outdoor space, spas, etc. will continue to stand out against their competition. Interest rates will increase, but I do not see this as a dampener for San Francisco and A-level cities. I expect the activity to be strong out of the gate in January. Some may still prefer to list properties in (old) seasonal cycles; but I tend to list when seller competition is low (or when you can stand above the competition), a seller wants to sell and demand is present. The time of the year is barely a secondary consideration.

Last year I covered the top markets for departing Californian’s looking for greener pastures. Well, after a year and a half of COVID-life, many of the top destinations made the latest list of cities with the greatest decline in housing affordability. The top five markets (Y-o-Y decline):

Phoenix (33.7%)

Charlotte, N.C. (32.3%)

Tampa, Fla. (30.9%)

Jacksonville, Fla. (29.3%)

Memphis, Tenn. (27.5%)

On the same theme and looking forward to some undervalued housing markets (that should attract buyers this year). Here are some “gem” markets where price appreciation will outpace the national average. These markets include (in A/O):

Dallas-Fort Worth, TX

Daphne-Fairhope-Farley, AL

Fayetteville-Springdale-Rogers, AR

Huntsville, AL

Knoxville, TN

Palm Bay-Melbourne-Titusville, FL

Pensacola-Ferry Pass-Brent, FL

San Antonio-New Braunfels, TX

Spartanburg, SC

Tucson, AZ

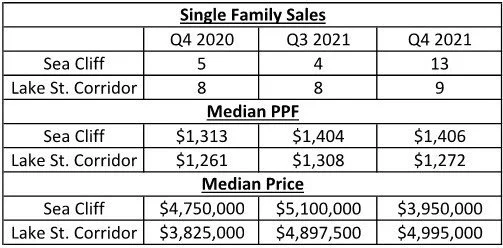

On to our corner of the City. The sales activity was very high last quarter; especially in Sea Cliff. Sale activity was up 225% in Sea Cliff with 13 homes trading hands. Obviously, lots of owners feel ‘now’ is the time to sell with the almost perfect storm of bull market(s), wealth creation and luxury demand. Let’s not forget some (seller) motivation from the potential tax increase(s) in the Build Back Better Act (BBB). I do not see the ‘Q4 level of activity in Sea Cliff continuing in ‘Q1; we move back to a modest number of sales.

In the Lake Street Corridor, the demand continues to be underserved by inventory. The buyers are there; not the sellers. I expect the sales activity in the Corridor to slowly increase towards ‘Q2.

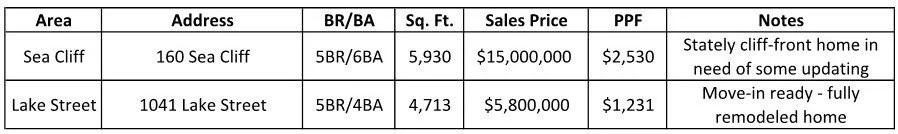

On to the numbers for the quarter.

The top sale of the quarter was 40 Sea View Terrace. It sold off market. The home traded at a premium although it’s likely going to get updated. The new owner could gain hero status if the hometown baseball team wins the series this year. Sea View Terrace is a desirable street as (a) its perched high up in the neighborhood and (b) is very quiet and affords privacy and (c) has superb views.

That is it for now.