January 2022: Q4 San Francisco Apartment Insider

Happy New Year. Another COVID year in the rear view mirror and I am excited about 2022! Hopefully you are as well! I have a lot to cover so let’s jump right into it.

First; rents. The weighted average asking rent for an apartment in San Francisco was $3,325 in December. That is approximately 8% higher than at the beginning of the year but still 19% lower than pre-pandemic (and nearly 26% below its 2015-era peak). The average asking rent for a one-bedroom in San Francisco is $2,800. That is encouraging as its 5% higher than at the beginning of the year (but still 20% lower than pre-pandemic levels).

Over in Oakland, at the end of the year, the weighted average asking rent for an apartment was $2,440 a month. That is 7% higher than at the end of last year (pretty close to San Francisco’s uptick). The average asking rent for a two-bedroom trended up to $2,700 (for the first time in 16 months).

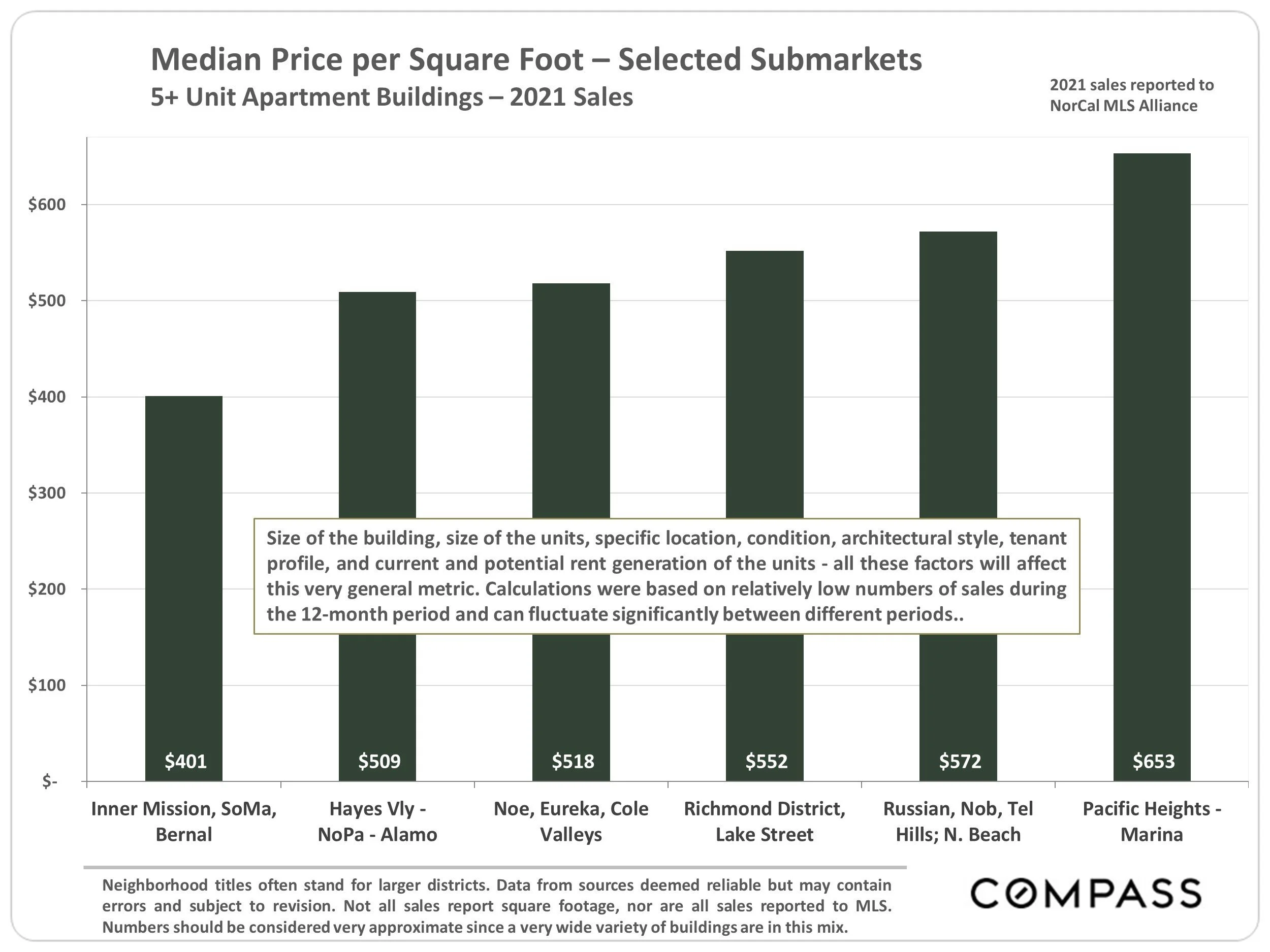

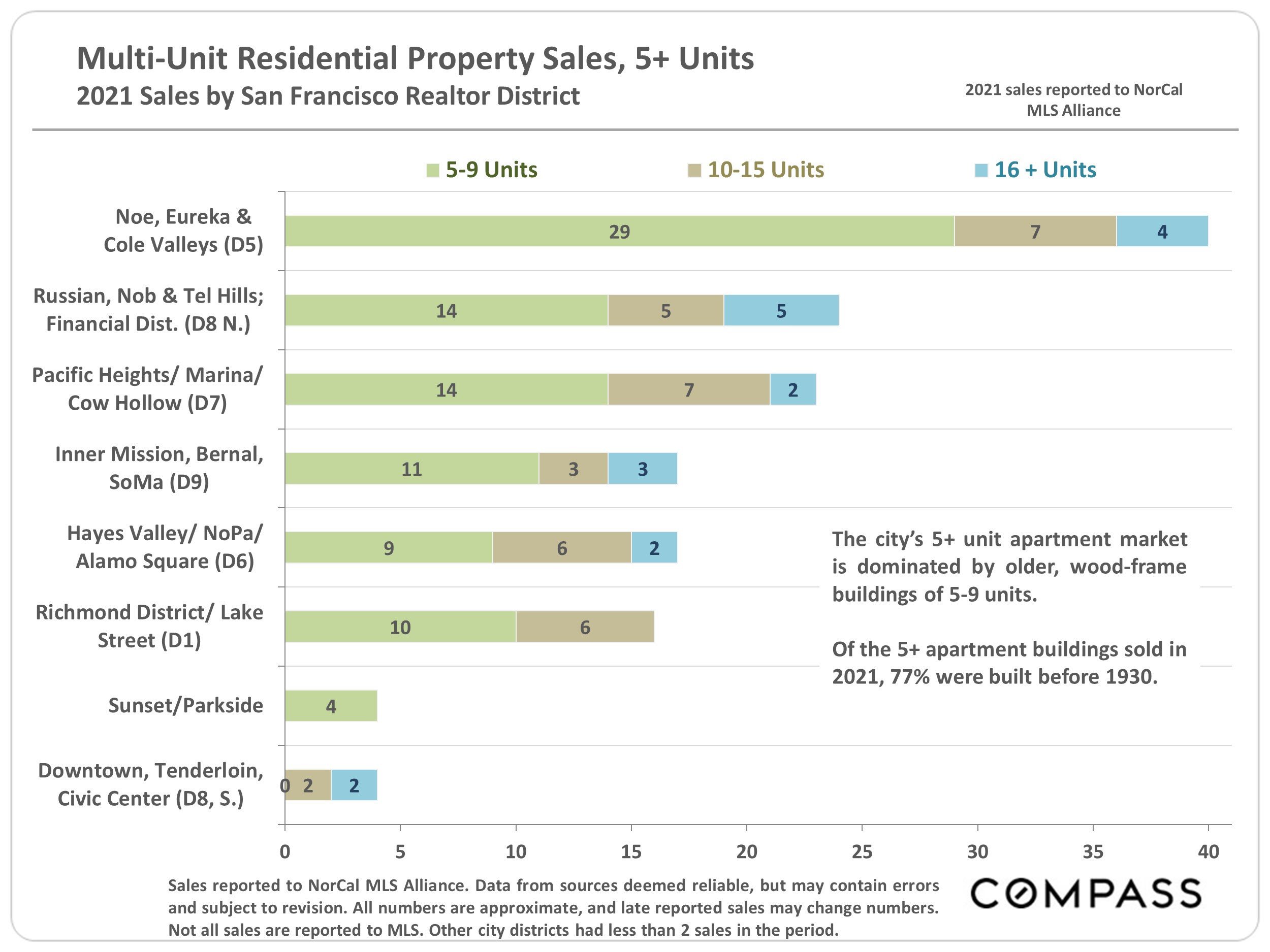

Looking at sales, apartment properties are up over 2020 numbers, but spotty with many buyers looking for bargains. One semi-common bad idea I noticed (from some sellers) was pricing their buildings at pro-forma – and not at current income (when they had several non-paying tenants taking advantage of the eviction moratorium). On the other end of the spectrum, well-located assets with upside and amenities were selling. Case in point: 475 Chestnut Street in North Beach; a seven units property. I listed & sold this asset for $620/ft. and just under $600k/unit. I didn’t have a ton of buyers showing interest, but the ones I did have were motivated (and that is all it takes when it’s not a sellers’ market).

What can we expect this year for rentals? General inflation will likely push rents up eventually, but if office re-opening keep getting pushed back, the uptick will remain slowed. Will we ever see full office re-openings? Not anytime soon. I’m not too optimistic that the average worker will ever be in the office five days a week…ever again. I see management more concentrated in the office; but they are not your typical renter (most own). Rents in areas like downtown, SOMA and Mission Bay should still remain at a deep discount while central to northern neighborhoods will see an uptick in rates.

The rent moratorium (AB 832) ended and hopefully (if you had non-payers) you exercised your right to take your debtor to small claims court. Stories are all over the map on results; as previously reported most negotiated keys for some debt forgiveness. The one landlord hammer that created fear was the threat of an ugly scratch on a tenants credit report. As far as the state and local rent relief programs; I can count on one hand the number of successful cases I’ve heard from landlords. The program was / is so poorly implemented that Ms. Breed folded the San Francisco effort into the state program (Housing is Key) as to try to eliminate more waste, fraud, confusion, etc.

Speaking of confusion and waste, the storefront vacancy tax (that was deferred for a year) is scheduled to kick into effect this year. If you recall, the tax affects storefronts that are empty more than 182 days in a year (at a rate starting at $250 per linear foot of storefront facing the street). The rate would rise to $500/ft. and then $1,000/ft. for additional years that a space is vacant. The tenant, not the landlord, would be subject to the tax if the space remains vacant even if it’s leased. Considering the massive loss of retail businesses and the lack of motivated businesses looking for space in an uncertain landscape, this tax should be scrapped ASAP. I’d expect the BoS to take this up in January (and hopefully kill or delay to ’23).

On the office front, vacancy rates continue to hover in the 20% range in San Francisco. On paper, downtown does not look too bad as the average office lease still has three-and-a-half to four years remaining (and large tenants are paying), owners of office properties are fine. But, if you go downtown, it’s really quiet on the streets, most workers are remote. Once the major leases expire I’d expect to see a lot of downsizing. A downtown resurgence – in ~2025 would likely be fueled by new (small) business demand – not existing (business) expansions.

On to the numbers.