January 2023: Q4 Sea Cliff - Lake Street Insider

Happy New Year! I hope you had a relaxing break and are ready to get back to work and have a prosperous 2023.

Although the real estate market had some negative forces over the past quarter (inflation, the cost of money, layoffs, stock market, etc.) it was actually very active. The fourth quarter started slow but picked up steam and finished strong. I saw a lot of buyers that were very aggressive from mid-November through the year end and most were able to get their new home. Inventory was fairly good; not 2020 low’s but enough product on the market to motivate most buyers and sellers alike.

Citywide, prices were down. That shouldn’t be a surprise as the cost of money was up…way up. I think you need to look at downward prices with a grain of salt. The numbers from the last half of ’22 were down from our exuberant Covid hangover. That demand spike was an anomaly, something we’ll likely never see again. So, if the Covid spike promptly put you up 20%, but the market took a 10% pricing hit over the past six months, you are still doing very well.

Speaking of pricing, the top sales of 2022 were pretty impressive. The most expensive house sale was 2790 Broadway Street. This 12,000 foot Gold Coast home sold (off market) for $34,500,000. The top condo sale was 999 Green Street #3201 & #3202. These two condos were adjoined to live as one home. This was one of the most stunning condos on the west coast. The 10,315 foot condo (over two levels) sold for $29,000,000.

Looking at interest rates, there appears to be optimism that rates will stabilize in 'Q1 and possibly drop as we get further into 2023. I have clients that are using alternatives to finance their purchases. Some clients used a margin loan to buy a home before selling their primary residence. They pay back the loan after selling their former home, negating the need to sell any stocks. Obviously, these loans are riskier when equity markets are super-hot, but not so much now. Secondly, 3-2-1 buy down loans are back in favor. In a 3-2-1 buy down mortgage, for a fee, the loan’s interest rate is lowered by 3% in the first year, 2% in the second year, and 1% in the third year (from market rate). The seller (or buyer) can pay for the buy down as part of the purchase negotiation.

On to our corner of the City.

The 4 Star Theater is officially open. The theater was on and off the market but found its way into the Cinema SF family of small venues (Balboa Theater and Presidio Heights’ Vogue Theater). The theater will primarily host rotating special weekly and monthly programs, curated films and one-off special events.

In Sea Cliff, back in ‘Q4 2020 I referenced the sale of 190 Sea Cliff Avenue ($24 million) as the new owner also owned 170 Sea Cliff and 178 Sea Cliff (three contiguous lots). At the time, 178 Sea Cliff was approved to be demolished. Well, the next phase in the grand plan has been revealed. Permits to build a new 8,000 square foot home have been approved and recently issued. Now, plans to demolish the adjacent home at 170 Sea Cliff and build a (proposed) three-level, 8,500 square feet home with a large basement and an enclosed pool have been submitted (below is a rendering from the application).

The proposed site would pretty much live as a family compound with the two homes sharing a common central driveway (that would access the underground garage). I do not see any information that would seek to adjoin 190 Sea Cliff. But, simple access could always be created via northern yard space.

I’ll keep you updated on this as it winds its way through the process.

On local market activity, last quarter we experienced a spike in activity from 'Q3. This was expected as I referenced (last quarter) there were no sales in Sea Cliff and that I knew a lot of inventory in the Lake Street Corridor was being held back over the summer for the fall market. Over the past six months demand was strong as the median days on market was a low 19 days in the Corridor and 31 days in Sea Cliff. Lake Street Corridor sales came in at 102% of asking and Sea Cliff came in slightly over 100%. So much for a down market.

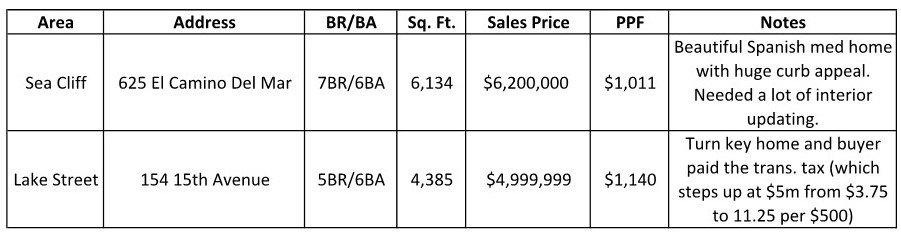

Here are the numbers for the quarter.

Here are the top sales of the quarter. 625 El Camino Del Mar was on the market for approx. a year. It is an “original” Sea Cliff home and the buyer found a good value. I’m sure they will be spending a lot of money on a renovation, but they will end up with a super home.

As we get closer to tax season, a few things to keep in mind as it relates to deductions and your home.

Mortgage Interest

Loans up to a maximum of $750k including loans for 2nd homes (if they stay within the limits of $750k)

Home equity loans

Mortgage insurance

All capital gains up to $250k for singles and $500k for married couples on a home you sold (that you had lived in for at least two of the past five years)

Property tax deductions

Single, up to $5,000

Married (filing together) can deduct up to $10,000

You can deduct the discount points of your mortgage

Recent home improvements as long as they are deemed necessary, i.e. an improvement to accommodate a medical condition, installing utilities that were previously unavailable, etc.

Home office related expenses if you are running a business from home (sorry, working from home for an employer does not count)

That is it for now.