January 2023: Q4 San Francisco Apartment Insider

Happy New Year! I hope you had a relaxing break and are ready to get back to work and have a prosperous 2023.

There are several large moving parts within the City and local government that will impact your ability to attract tenants to your vacant units. From the employer policy of “work at home” to tech layoffs and dwindling city tax rolls; these issues will impact your ability to successfully run a business.

First, on the downtown front, the office market continues to struggle. It will get worse before (if) it ever gets better. The vacancy rate for 2022 was approx. 27%, compared to 19% in 2021. Tech layoffs have increased at major employers including Salesforce, Twitter, and Meta. Companies are increasingly looking to reduce costs, which translates to a reduced footprint. As I mentioned earlier this year, the City needs to get onboard with re-zoning now if they want to generate more tax revenue from this part of town. The first domino to fall in the rezoning of empty office buildings just happened. The owners of the Warfield Building (988 Market Street) filed an application to convert the eight-story structure from office space to residential. This application will be watched by many (by those for the status quo and those that need a solution to monetize their asset). I’ll keep my eyes on this and report back next quarter.

Second, speaking of downtown, the hits keep coming for San Francisco as it relates to a loss of tax revenue. So far, properties totaling $59 billion in assessed city value are asking for a reassessment in 2022 that, if granted, would amount to a decline in property value of $26 billion. Not all appeals will be grated, but regardless it will be a huge loss in tax revenue.

Not only is the line very long at the Assessor’s Office in terms of appeals by office building owners, now the hospitality and retail building owners are getting in line. Two examples, the Parc 55 in Union Square is asking The City to cut its assessment nearly in half from $561 million to $286 million. And, Macy’s is asking The City to reduce the assessments on its four Union Square properties by approximately $200 million; which represents about 50% of the current assessment.

So what is the City going to do to make up for lost revenue? San Francisco is facing a projected $728 million deficit over the next two fiscal years as the city confronts falling tax revenue amid a lackluster recovery from the pandemic. Mayor Breed’s office told city departments that it’s forecasting a shortfall of more than $200 million in the 2024 fiscal year and a $528 million deficit in the 2025 fiscal year. Breed is asking departments to prepare for 5% budget cuts in the first year and 8% in the second. Those projected cuts seem wholly inadequate due to the fact that the city must pay higher wages to its employees due to collective bargaining agreements with its unions, and it’s grappling with growing health care costs and increased pension obligations. Should we expect the elected to institute more parcel taxes and put the burden on the minority instead of shoring up their budget by cutting waste and significantly reducing headcount?

If you own rental property across the Bay in Alameda County, The Fair Chance Ordinance is now law and (Alameda County) became the first county in the nation to prohibit landlords from conducting criminal background checks on prospective tenants. The cities of Oakland and Berkeley banned routine criminal background checks in most housing applications in 2020.

In December I heard from a few building owners about an article they read in the news about a tenant buyout agreement that cost an owner $410,000 (for two tenants to move out). That figure is quite sensational, and makes for great headlines but it’s definitely not the norm. If you check public records at the San Francisco Rent Board, the average buyout is $43,000. But, not all buyouts are the same as all tenant / landlord dynamics are different. Some landlords have success with a waiver of past debt for possession; others are happy to pay six figures to get possession.

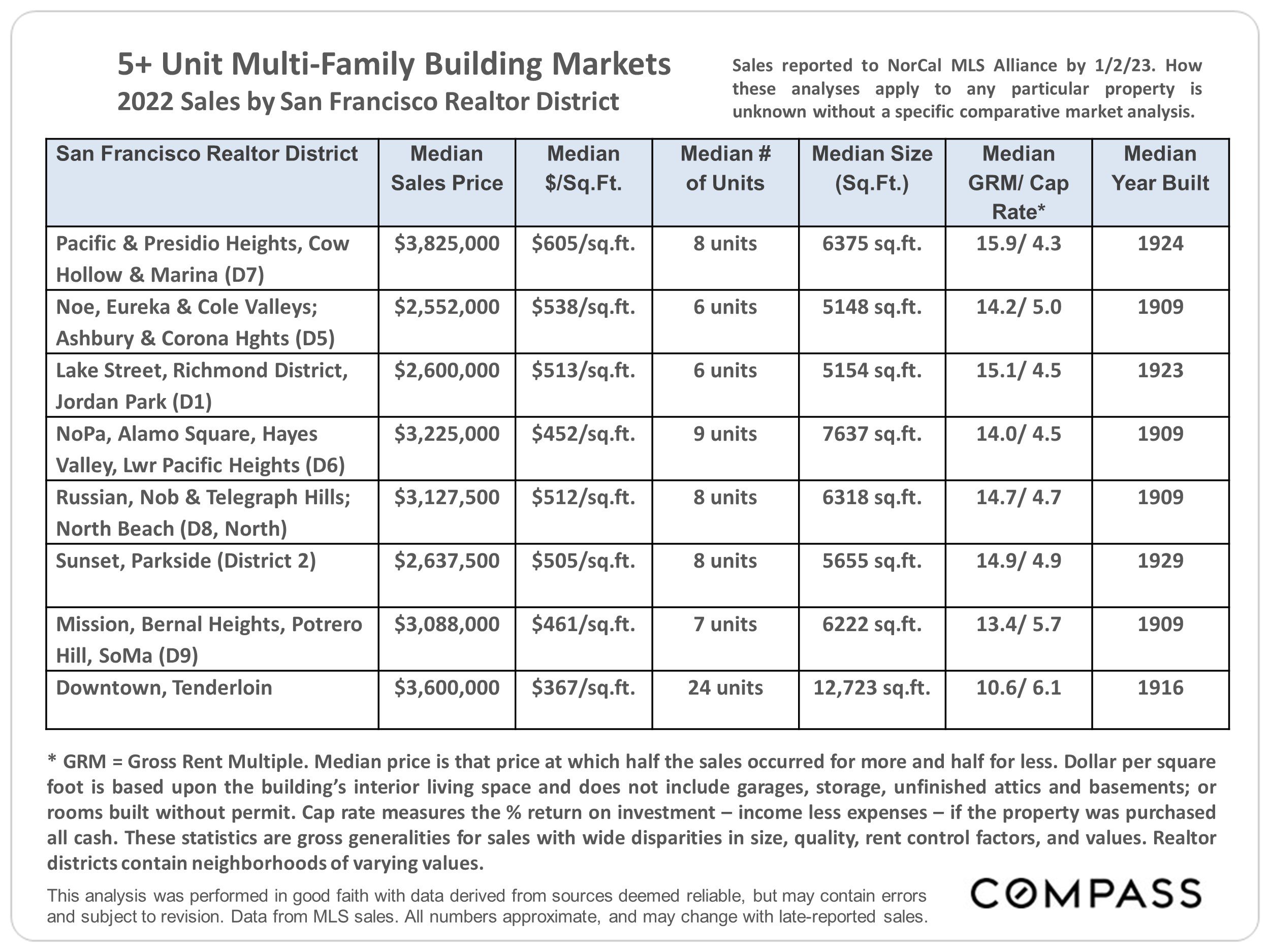

On to the numbers:

Good news; the average asking rent for an apartment in San Francisco is ending the year around 5% higher than at the end of 2021. We are still nowhere near the pre-pandemic levels (about 15% down) and definitely well below the 2015ish peak (about 22% below).