July 2022: Q2 San Francisco Apartment Insider

Hello and I hope you had a great Fourth of July holiday! As we enter the second half of the year, the real estate market, albeit a major economic engine, seems to be fading out of the limelight as the focus of the (media) attention skews towards the big picture – inflation, possible recession, employment and the stock market. No doubt the current economic picture is a concern to everyone. Nobody likes to pay $150 to fill their vehicle with gas, lay off employees, or watch their retirement portfolio drop by 20%.

I have a lot to cover as it relates to rentals so let’s jump into it. First, return to office (or not). To increase the pool of potential renters, it’s clearly advantageous to have employers call employees back to the office. But, over the last two quarters, San Francisco employees have pushed back on RTO and with the skilled labor shortage, employers have acquiesced.

In San Francisco downtown specifically, office attendance has been even lower than reported. Kastle (a company that provides key card systems) provided swipe data for the eight ZIP codes that make up the city’s office-heavy northeast. The data shows that the rate of worker return, relative to pre-pandemic levels, has not broken 30% and was 26.4% the week of May 18, the most recent period the company provided. Pre-recessionary projections for return to office called for 2 to 2 ½ days a week in the office. As we enter recessionary waters and employees fear a possible layoff, employers will have the leverage to get employees back to the office; optimally at least three days a week or more. If this plays out, expect to see a nice jump in apartment demand.

We also have the mayor continuing to push employers to reopen offices. Her motivations are slightly different, but the goal is the same; money. Before the pandemic, office work was responsible for a whopping 72% of the city’s gross domestic product, according to the Controller’s Office — work that was heavily concentrated in the Financial District, the Market Street corridor, the Embarcadero and Mission Bay.

If the mayor cannot get the tax receipts flowing again, she will be blamed as the leftist on the board try to hang this around her head. Is it premature for the City to consider rezoning in the eastern end of San Francisco?

On the political front, remember when San Francisco lawmakers passed Ordinance No. 265, which became effective on January 18, 2021? It requires landlords to report certain rental information about their units to the Rent Board. As of July 1st, landlords are required to deal with the ordinance deemed the “Rent Board Housing Inventory.” Reporting requirements apply to all residential units in San Francisco, including single-family homes and owner-occupied units, not only units that are tenant-occupied. You are not required to participate, but a landlord who fails (to participate) will not receive a rent increase license and be deemed ineligible to impose annual allowable and/or banked rent increases on a tenant.

I’m sure you are not upset that AB 2179 expired on June 30th. The statewide emergency eviction protection was limited to only those tenants that had an application submitted (for rent relief) on or before March 31, 2022. If you still have non-paying tenants that cite COVID-related hardship, you should call your attorney.

One more item to be aware of for (San Francisco) landlords. Proponents for a tax on vacant homes say they have gathered enough signatures to qualify their measure for the November ballot. The Empty Homes Tax- if approved - would apply to owners of vacant units in buildings with three or more units, if the units in question had been vacant for more than 182 days. Single-family homes and duplexes would be exempt. Tax would range from $2,500 to $5,000 in the first year, depending on the size of the unit. It would increase to a maximum of $20,000 in later years. Obviously more details on tax / fees need to be worked out, but, this is a paper cut to the severed arm. The highly social wing of the BOS blocks new housing development at every turn, yet somehow finds “40,000 vacant units” to tax into occupancy?

On to rents.

Having hit $3,500 at the end of May, the weighted average asking rent for an apartment in San Francisco has since ticked up another 2% to $3,575 a month, which is 11% higher than at the same time last year and 17% ($525) above last year’s low point for rents.

That being said, the average asking rent for an apartment in San Francisco, (which measures 2.5BR when counting a studio as having 1BR), is still 13% ($525) lower than prior to the pandemic and 20% ($950) below San Francisco’s 2015-era peak. The average asking rent for a studio is currently holding at around $2,100 a month, which is 18% lower than prior to the pandemic and nearly 30% below peak. Anecdotally, San Francisco is the last major metropolitan area in the country where rent prices are lower today than they were in March 2020.

Across the Bay in Oakland the weighted average asking rent for an apartment ticked up another percent over the past month to $2,500, which is 8% higher than at the same time last year and 9% ($215) above last year’s low point. The average asking rent for a studio hovering around $1,700, which is only 6% lower than prior to the pandemic but over 20% below peak. As such, the average discount for renting in Oakland versus San Francisco, which had dropped from 35% prior to the pandemic to 25% early last year, has ticked back up to 30%.

In Oakland, landlords must now absorb the costs of rising inflation. City Council members voted to limit permissible annual rent increases to 60% of the rise in consumer prices, or 3%, whichever amount is less. This is more draconian than the San Francisco increase. By the way, the current San Francisco increase (2.3%) is the largest since the early ninety’s!

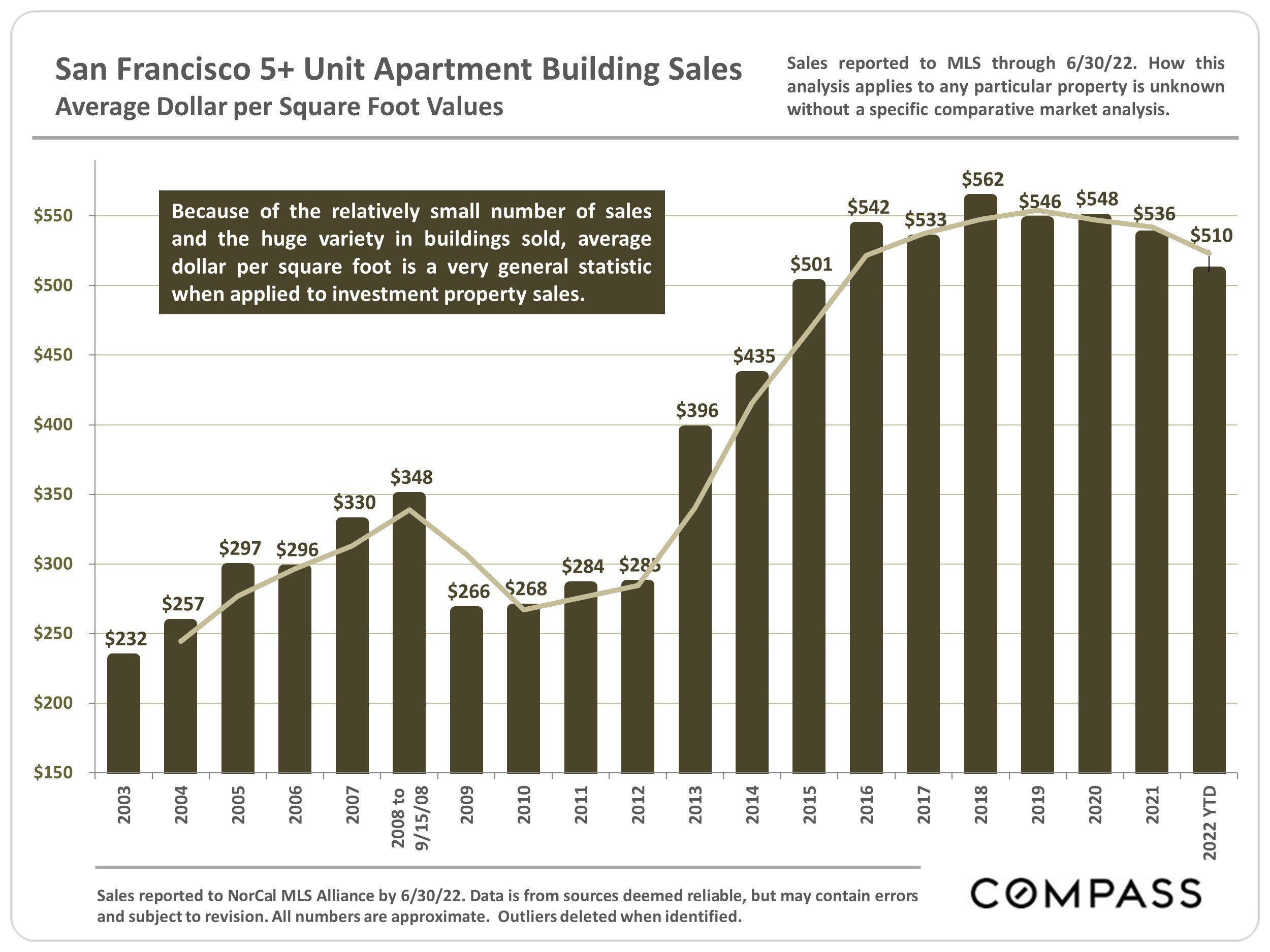

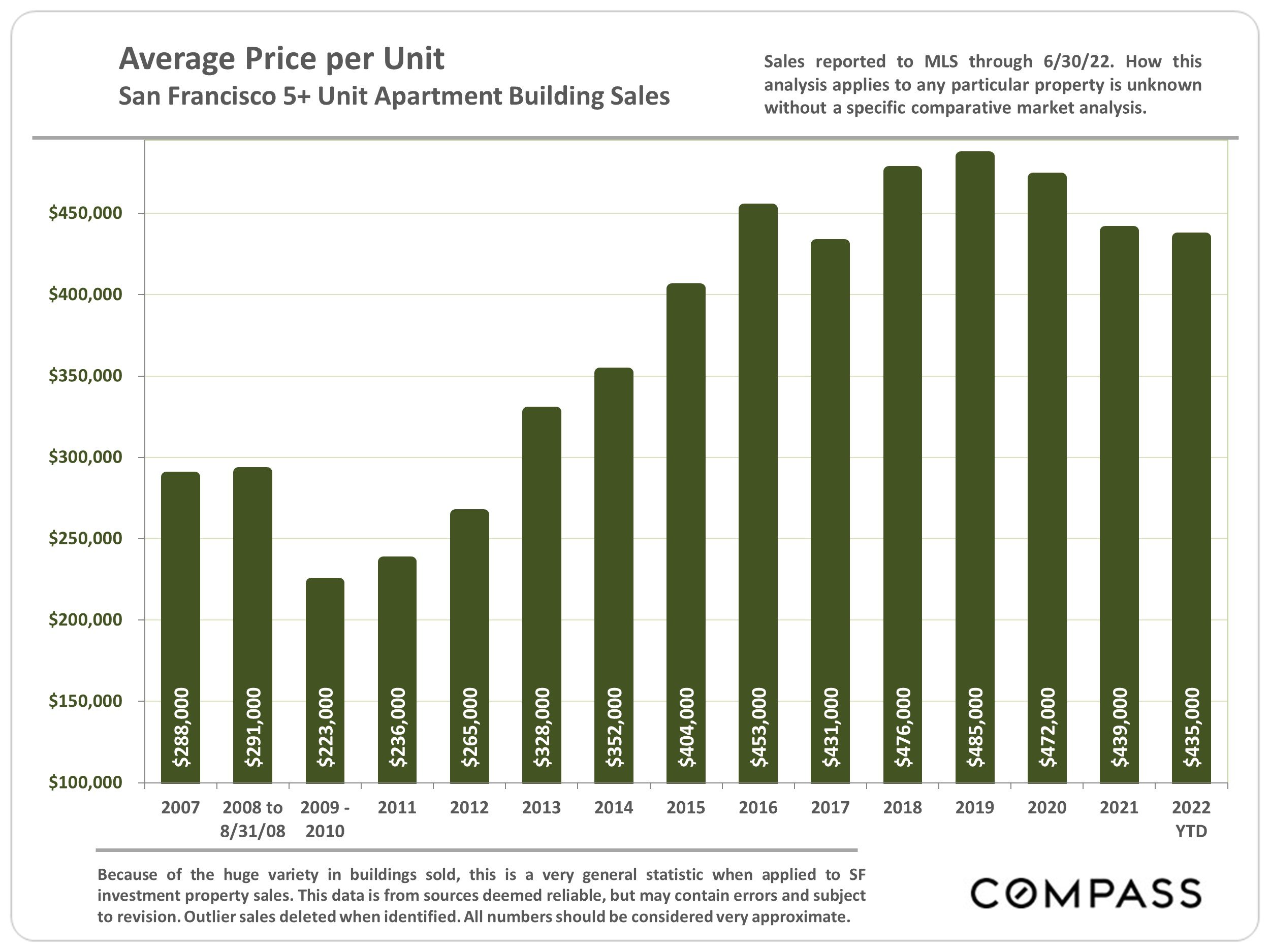

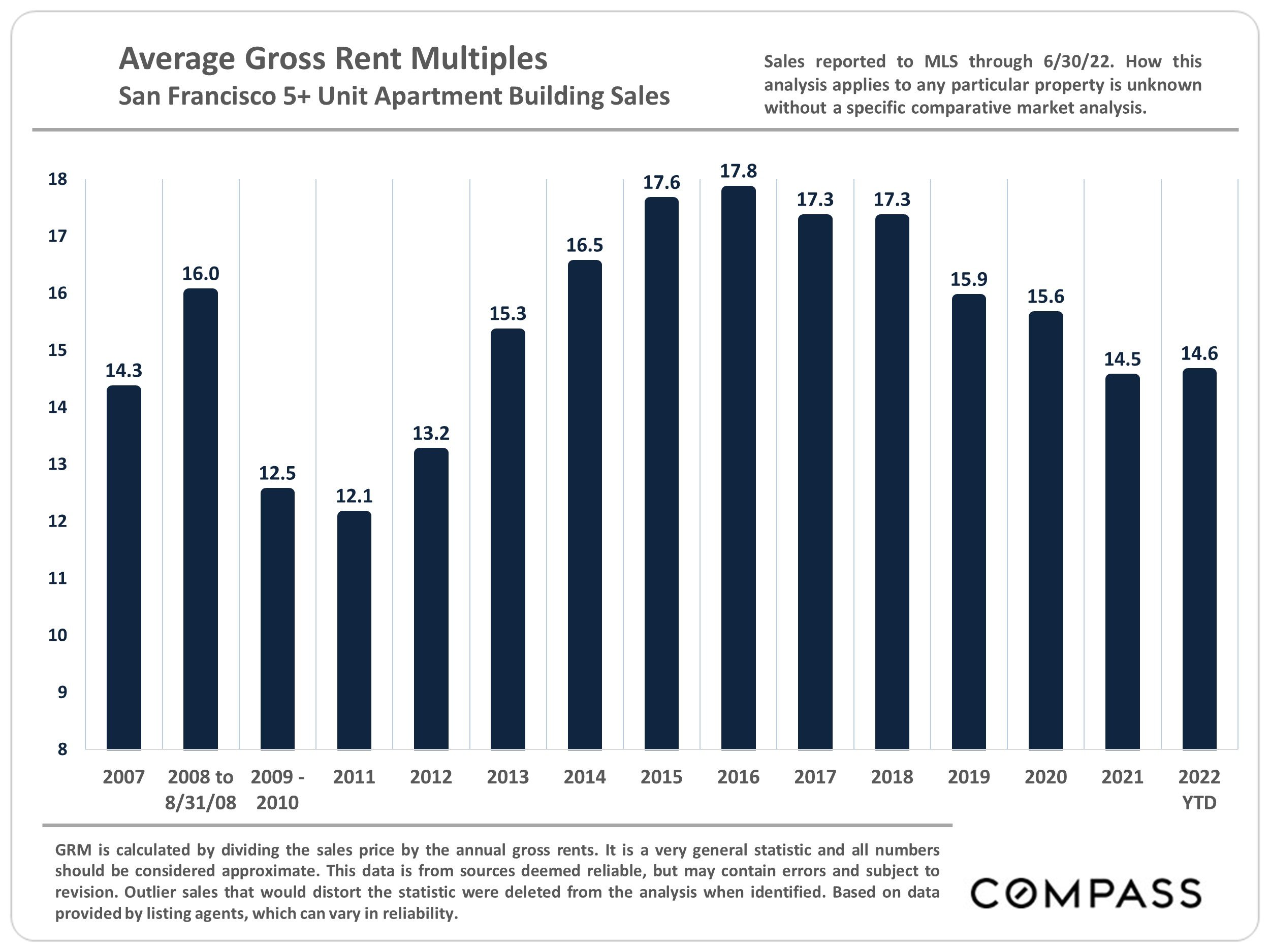

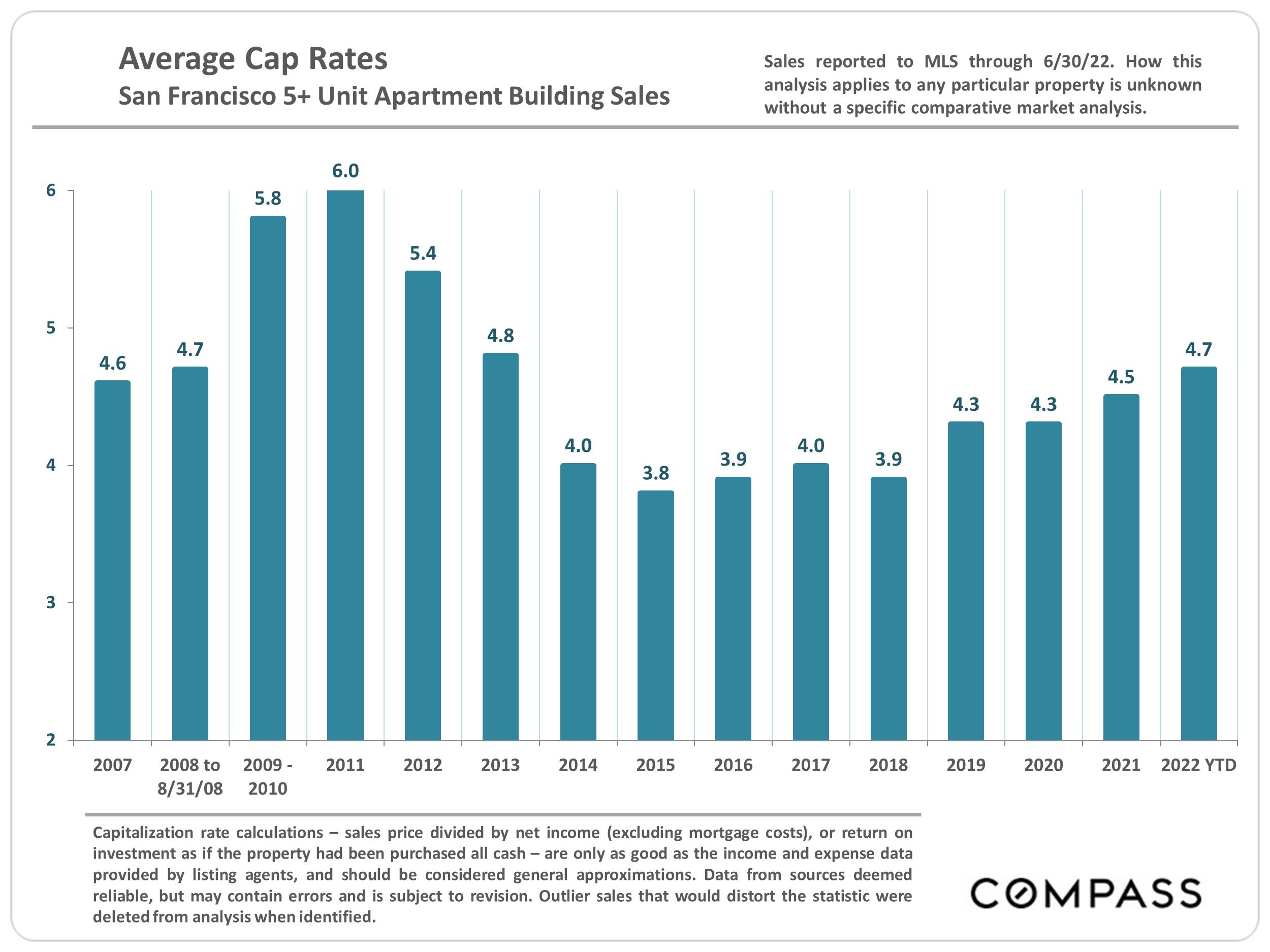

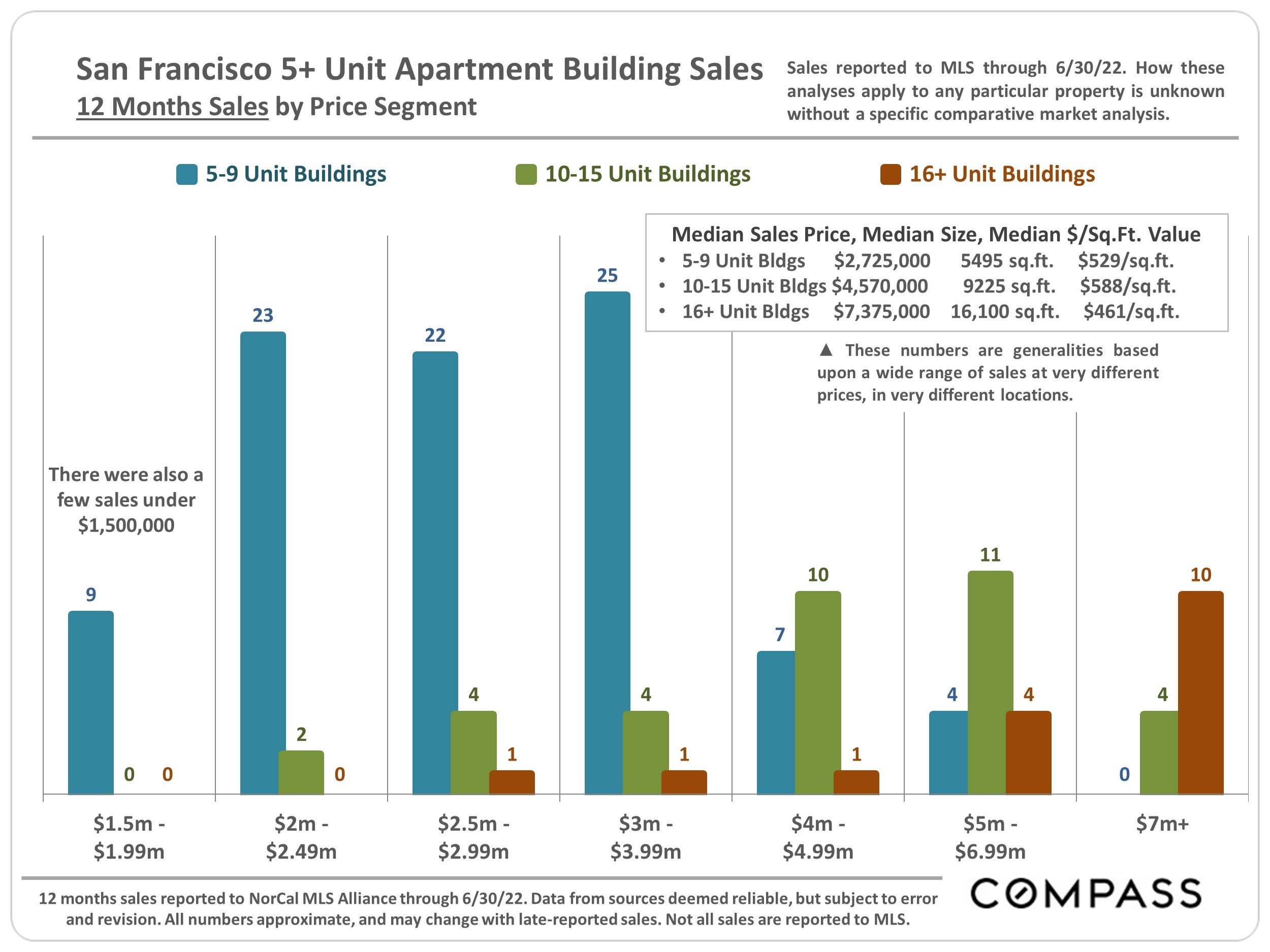

On to the numbers.