2022: August San Francisco Real Estate Insider

Hello and I hope your summer is going well!

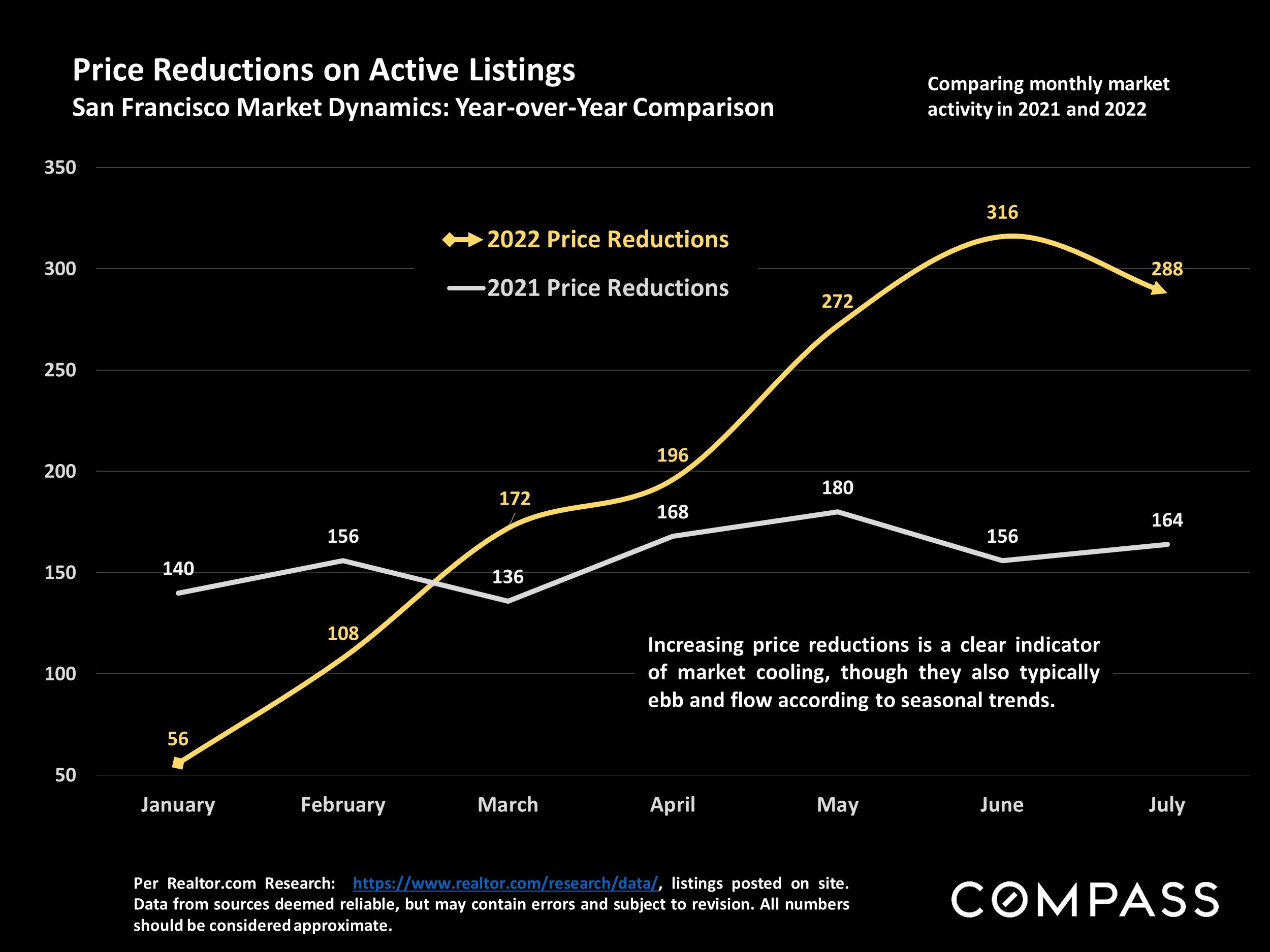

Inventory is up! If you compare ‘Q1 to mid-May onwards, the “feel” in the agent community is night & day. As pending interest rate hikes loomed on the horizon, ‘Q1 was insanely competitive for buyers hurrying to beat the increase. As the interest rate increases kicked in (along with rising inflation, finicky stock market and lacking consumer confidence), the buyers started to hit the sidelines. Currently, buyers have choices. For reference, the number of condos and single-family homes for sale in San Francisco is about 30% higher than at the same time last year.

As we head towards Labor Day, the talk is turning to “what will happen with inventory this fall?” That is always an unknown until we get to the first half of September, but I’d expect the inventory levels to increase. Fall has traditionally been one of the biggest inventory periods and I’d expect that to continue. Although a lot of sellers moved their fall sales up to summer, buyers should continue to see some good values in the coming months.

Regarding interest rates, the national average on the 30-year fixed mortgage actually fell to 5.22% last week when the Fed announced its latest rate hike. The rate fell even further Friday to 5.13%. It is expected that the Fed will hike rates another .75% to 1% in September. But, most of the buyers I am working with are seeing mid to upper 4% loan rates for their purchases.

Speaking of lenders, as consumers continue to save their cash, banks are flush with deposits (your money). But yields on the average big-bank savings account are at a very low at 0.13%, providing little to no protection against rising inflation (which is around 9%). Banks raise yields to attract deposits, but currently have little incentive to do so. Think about this; cash sitting in a bank right now is losing about 7% - 8.5% of its value every year. This is great motivation to put your cash to work; equities, real estate, treasury's, etc.

Looking at jobs, there was a very encouraging labor market report last week. The U.S. labor market remained red-hot in July despite expectations job growth would cool (as tighter monetary conditions and company layoffs stoked fears of a recession). Hopefully that report will keep many San Francisco employers from more job cuts.

Thinking about a move? The Economist Intelligence Unit (EIU) released their Global Livability Index ranking of the top 10 best and 10 worst places to live in the world in 2022. The index scored 172 cities in five categories: culture, health care, education, infrastructure, and entertainment. Note, no U.S. cities made the list (but our friendly neighbors to the north are well represented). I’d expect health care to be a major limiter for U.S. representation.

The top ten:

Vienna, Austria

Copenhagen, Denmark

Zurich, Switzerland

Calgary, Canada

Vancouver, Canada

Geneva, Switzerland

Frankfurt, Germany

Toronto, Canada

Amsterdam, Netherlands

Osaka, Japan and Melbourne, Australia (tie)

The bottom ten:

Damascus, Syria

Douala, Cameroon

Harare, Zimbabwe

Dhaka, Bangladesh

Port Moresby, PNG

Karachi, Pakistan

Algiers, Algeria

Tripoli, Libya

Lagos, Nigeria

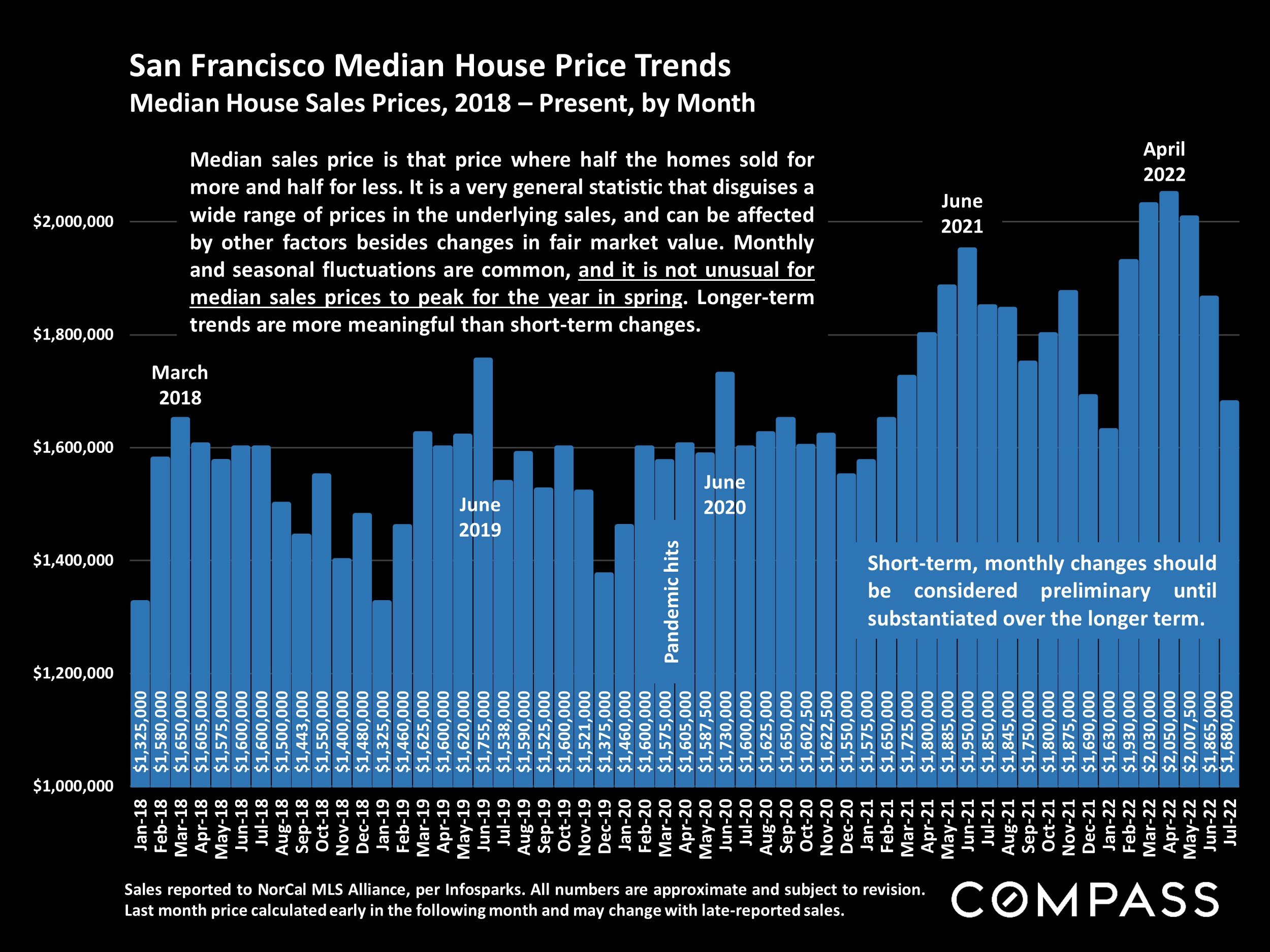

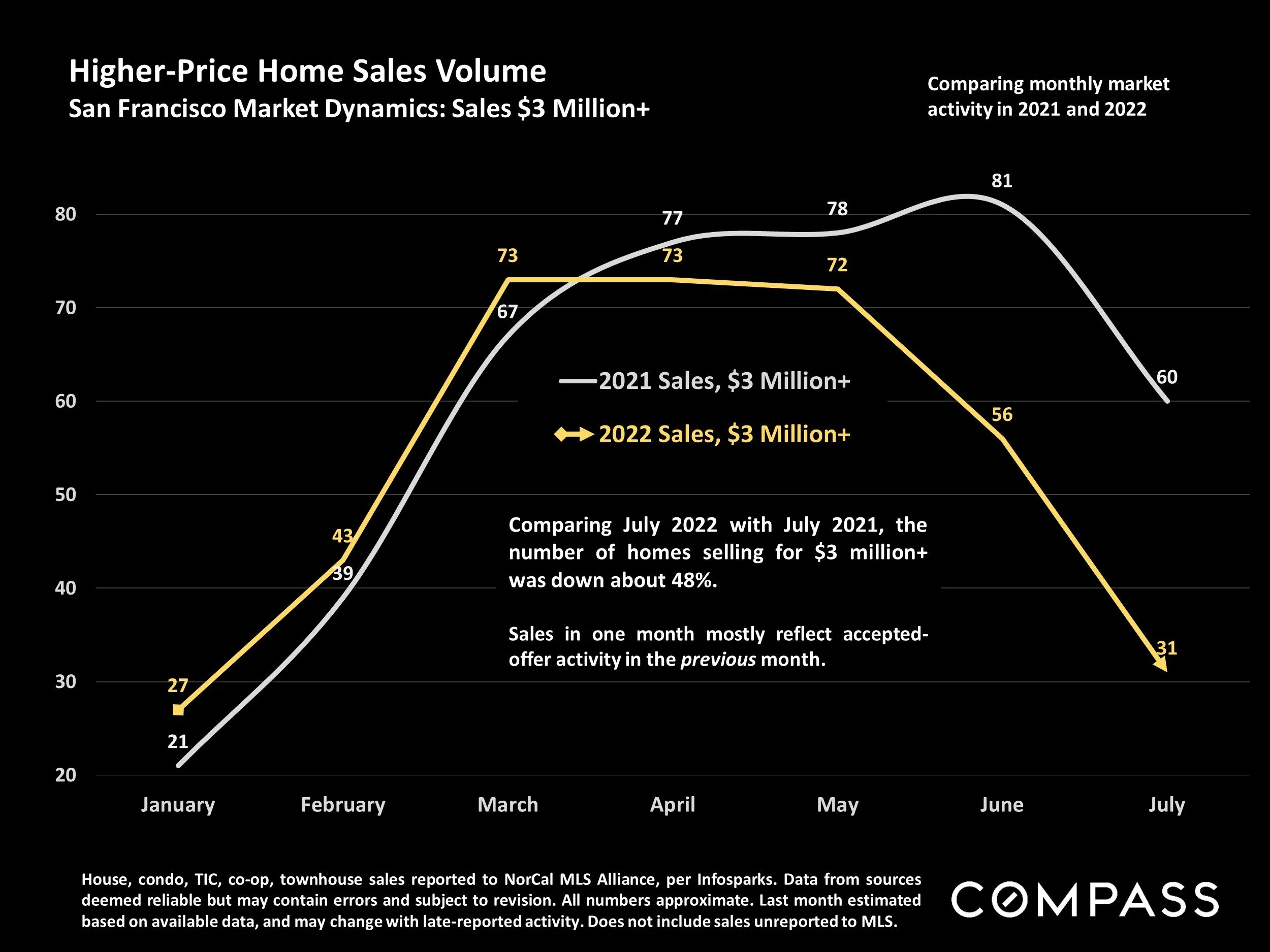

On to data points from the San Francisco market.

Although the slides show a market that shifted towards the buyer, keep in mind that we are still seeing multiple offers on nice homes that are in move-in condition, in good locations. That was the norm earlier in the year, but not now.