October 2022: Q3 San Francisco Apartment Insider

Hello and I hope you are well as we enter the final quarter of the year! Starting off with the downtown scene, I have three quick snapshots that show the cruel impact of the pandemic:

Office leasing and sales activity

Office building owners filing petitions with the Assessment Appeal Board

Return to office (RTO) activity

First, office leasing activity continues to be slow. San Francisco has an approximate 86.2 million square foot office space market and in Q2 the vacancy rate was at 24.2%. Class B & C properties are really struggling with new leases as most companies looking for space are going right to Class A properties. With almost a quarter of office space empty, downtown is pretty quiet. Keep in mind, there are tens of millions of additional square feet (under lease) but empty or running on a very low percentage of worker occupancy.

Second, looking at office building sales; the values are (obviously) way down. The market is not slow; it’s at a standstill. There have been several buildings for sale over the past half year and we have not seen a solid sale. As examples, Wells Fargo recently listed 550 California Street for $160M (~$450/ft.). While the guidance price was a good 25% below what the 355,000 S.F. building would have fetched before the pandemic, the bids submitted were much lower; about $250/ft., which is about 45% below expectations. That’s 70% below 2019 values.

UBS Realty Investors recently marketed 455 Market Street, a 374,000 square-foot complex that is 80% leased. While the seller sought close to $280M (~$750/ft.) the pre-pandemic values would have been $900/ft. Bids received were closer to $500/ft. or about $187M. Neither seller consummated a sale; both will hold their properties.

Third, and with huge implication to the City budget, many office building owners have filed petitions with the Assessment Appeal Board. These owners (with many more likely to follow) are looking to reduce their taxes (rightfully so). The Assessment Appeals Board heard eight to ten cases for downtown/SOMA buildings in September alone! Many are seeking an approximately 50% reduction in value. The hotel owners are lining up to file their own appeals as well. In one specific case alone, The Westin St. Francis (owners) filed their appeal with the city arguing the hotel’s two parcels should be valued at $101 million for 2022-2023 assessment purposes (the city assessed the properties at a combined $1.04 billion). The Board of Supervisors has not yet approved the property tax rate for fiscal 2022-2023, but based on the previous year's rate, the difference in tax would be roughly $10.8 million.

This downtown information all flows right into the recent (re-booted) effort to get workers back to the office. Last quarter, I predicted that the recession and tightening job market would afford employers the needed leverage to get workers back to the office. So far, that has not been the case. I still feel we have a long way to go to get out of the current recessionary environment; I still believe the RTO effort will pick up steam.

Keep in mind the Housing Inventory reporting is due as on July 1 for owners of 10+ unit properties. No penalties are assessed for late reporting (after the July 1), however, the landlord will not receive a rent increase license and will not be eligible to impose annual allowable and/or banked rent increases on a tenant until reporting is completed for that unit. Owners of buildings with less than 10 units will receive a Rent Board Housing Inventory Informational Notice this fall. Reporting for those buildings will be on March 1, 2023.

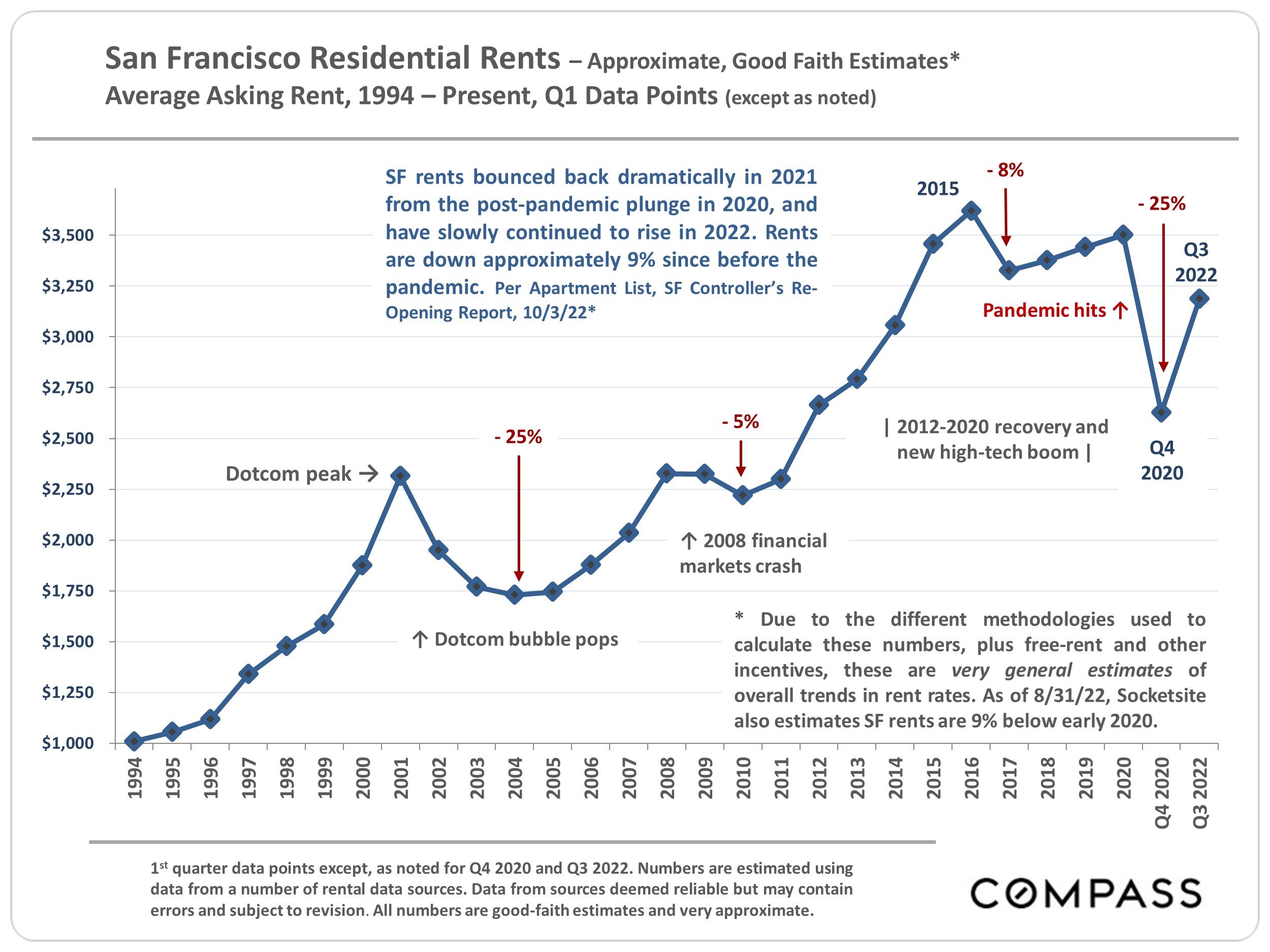

On to rents and the quarterly numbers. Rental rates have improved since my Q2 report. Obviously, we would like to see more demand, but I am optimistic RTO will be stronger than any downward pressure applied by potential layoffs and employer downsizing.