July 2024: Q2 San Francisco Apartment Insider

Hello & Happy Saturday.

Hopefully you and your family had a great 4th of July holiday. As we settle into summer, the economic & political issues that help drive the market are in flux. Plus, November looms large for owners throughout the state; the election results will “sink or swim” a lot of landlords.

Statewide, the Justice for Renters Act seeks to repeal Costa Hawkins – again. The Act restores cities’ power to enact vacancy control, an option currently blocked by passage of the 1995 Costa-Hawkins law. This will be the third try and hopefully the voters outside of the core Bay Area are not fooled.

Locally, Aaron Peskin has taken his mayoral campaign straight to the tenant advocates in San Francisco. If he wins the mayor’s office, expect him to swiftly enact vacancy control. Peskin asserted at the first mayor’s debate about extending rent control to vacant apartments. To be clear, Peskin could only bring vacancy control if he is elected mayor and the statewide Justice for Renters Act ballot measure passes in November.

Also locally, Peskin authored new legislation that puts housing providers in a position to bear the majority of the cost for general obligation bonds (issued to fund capital construction projects that benefit all San Franciscans). The measure was heard by the full Board in April and then crossed Mayor Breed’s desk with no opposition. Under the old law, landlords could pass through 50% of the bond amount to tenants. Now, landlords are only permitted to pass through the difference between the bond amount from the year the tenancy began and the current year’s bond amount. This adjustment effectively reduces the allowable pass-throughs, leading to a substantial decrease in income for landlords who relied on these pass-throughs to offset their property tax liabilities.

Looking at downtown, San Francisco continues to lag well behind other large metros in terms of return to office numbers. The latest occupancy numbers show that office vacancies in the city continue to climb. The vacancy rate in ‘Q1 hit 36.6%, which is a slight increase from the 35.6% in the fourth quarter of 2023. Due to this downward trend, we are still experiencing office building “walk-away’s” and building sales in low $200 per foot range.

On the apartment front in San Francisco, Maximus Real Estate Partners, owners of Parkmerced, the second-largest residential development west of the Mississippi river, is at risk of defaulting on its nearly $1.8B mortgage. The mortgage was transferred to a special servicer (a third-party entity often brought in to manage loans at risk of default). The transfer will likely open the door for a renegotiation on the debt. Barclays and Citibank provided $1.5B in financing in 2019 with an additional $275M mezzanine loan from Aimco. In 2019, Maximus was to start construction on its long-planned expansion of the property; increasing unit count from 3,221 to 8,900 apartments. Yet, no construction seems to be coming anytime soon.

Also of note, Goldman Sachs and local operator Ballast Investments are working to hand approx. 1,200 San Francisco apartments back to their lender after defaulting on debt tied to the properties. The lender is RBC Real Estate Capital Corp. and it appears they originated loans for $687.5M for three portfolios containing approx. 1,200 apartments across 82 properties. Did the portfolio lose enough value to drop below the outstanding debt? That is unknown, but highly likely. It could be an opportunity to re-negotiate with the lender (or walk away). A deed-in-lieu transaction should take place between the parties. RBC appears to be moving forward with a new San Francisco-based multifamily operator to run the apartment buildings as they figure out their long term plan.

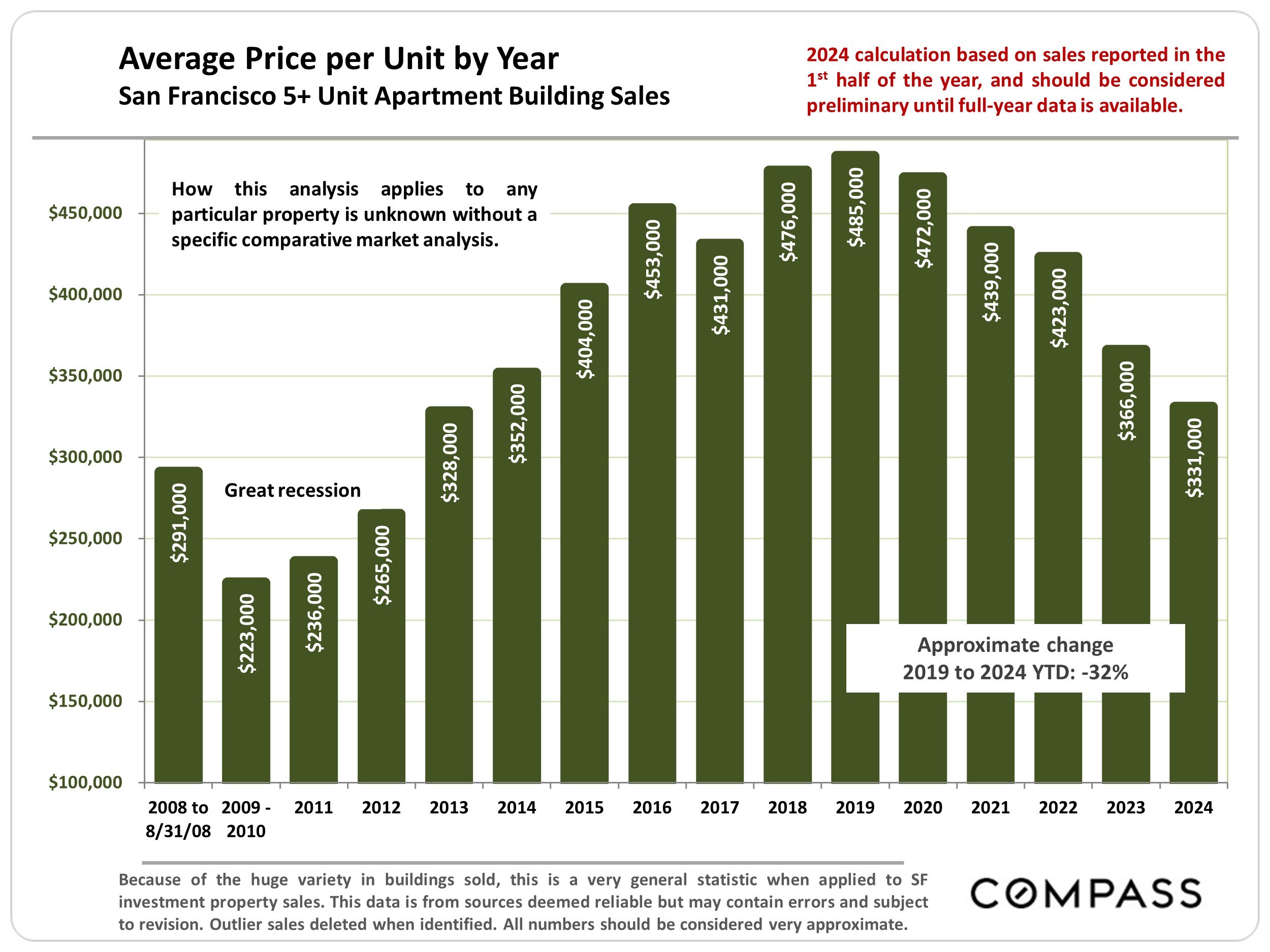

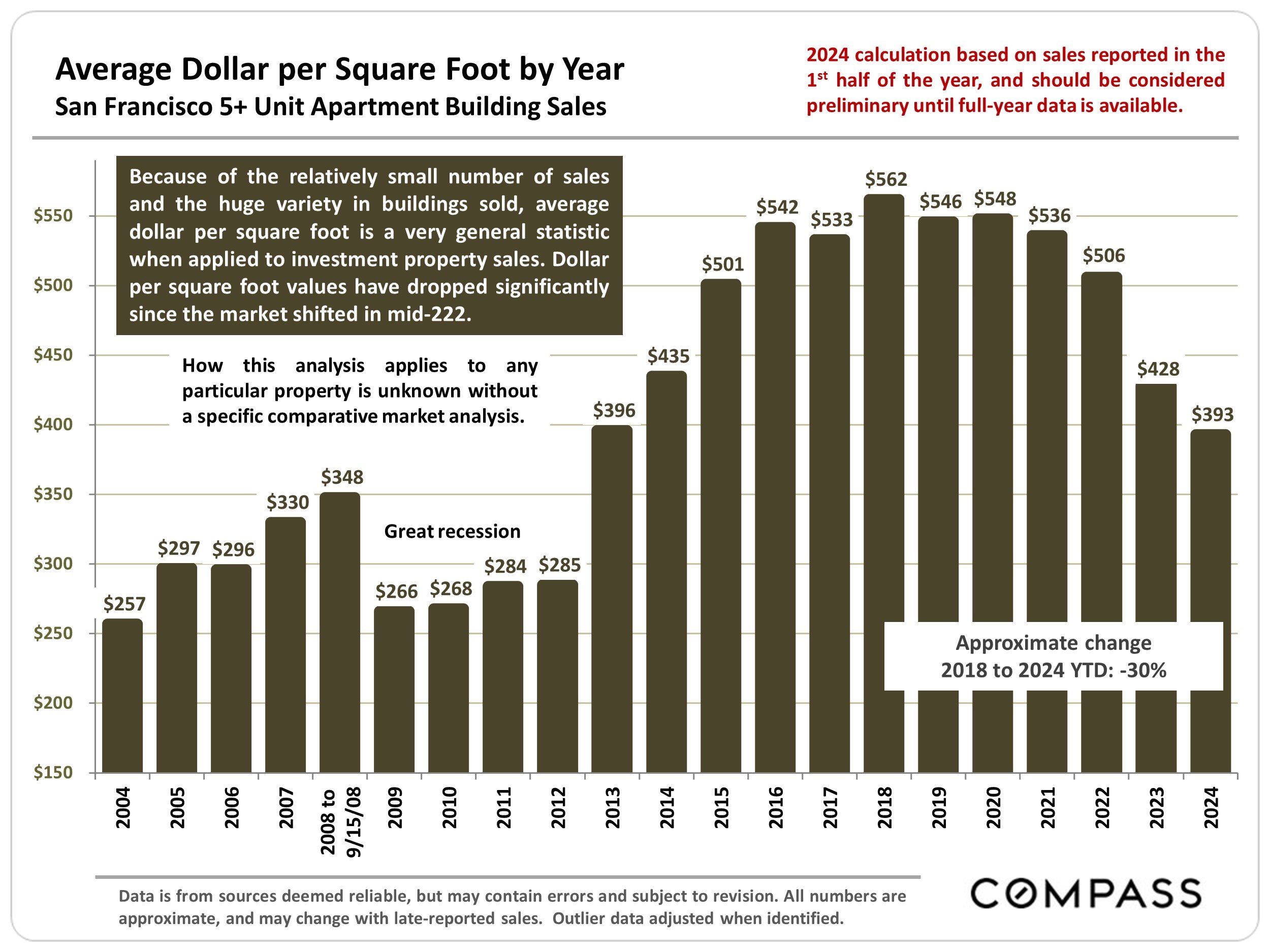

Looking at the local market for 5+ unit multi-family building sales over the past quarter, the numbers are up- way up. Sales in Q2 more than doubled from Q1, while the absorption rate (the percentage of listings going into contract) hit its highest quarterly percentage since 2018. The median days on market for sold properties in Q2 was 42 days. Case in point; a colleague and I listed 1653 Grant Avenue – a 16 unit property on the border of North Beach and Telegraph Hill for $6.5M (6.2 CAP - 11.3 GRM - $455/ft.). This was a well maintained building and we received eleven offers. It will close well north of asking.

Looking at rents, over in Oakland, the average asking rent for an apartment is just under $2,300 a month. That is down 11% YoY and 13% lower than pre-pandemic numbers.

On to the numbers for the quarter in San Francisco.