January 2025: Q4 San Francisco Apartment Insider

Hello and Happy New Year-

I hope you had a relaxing holiday break and are as excited about 2025 as I am.

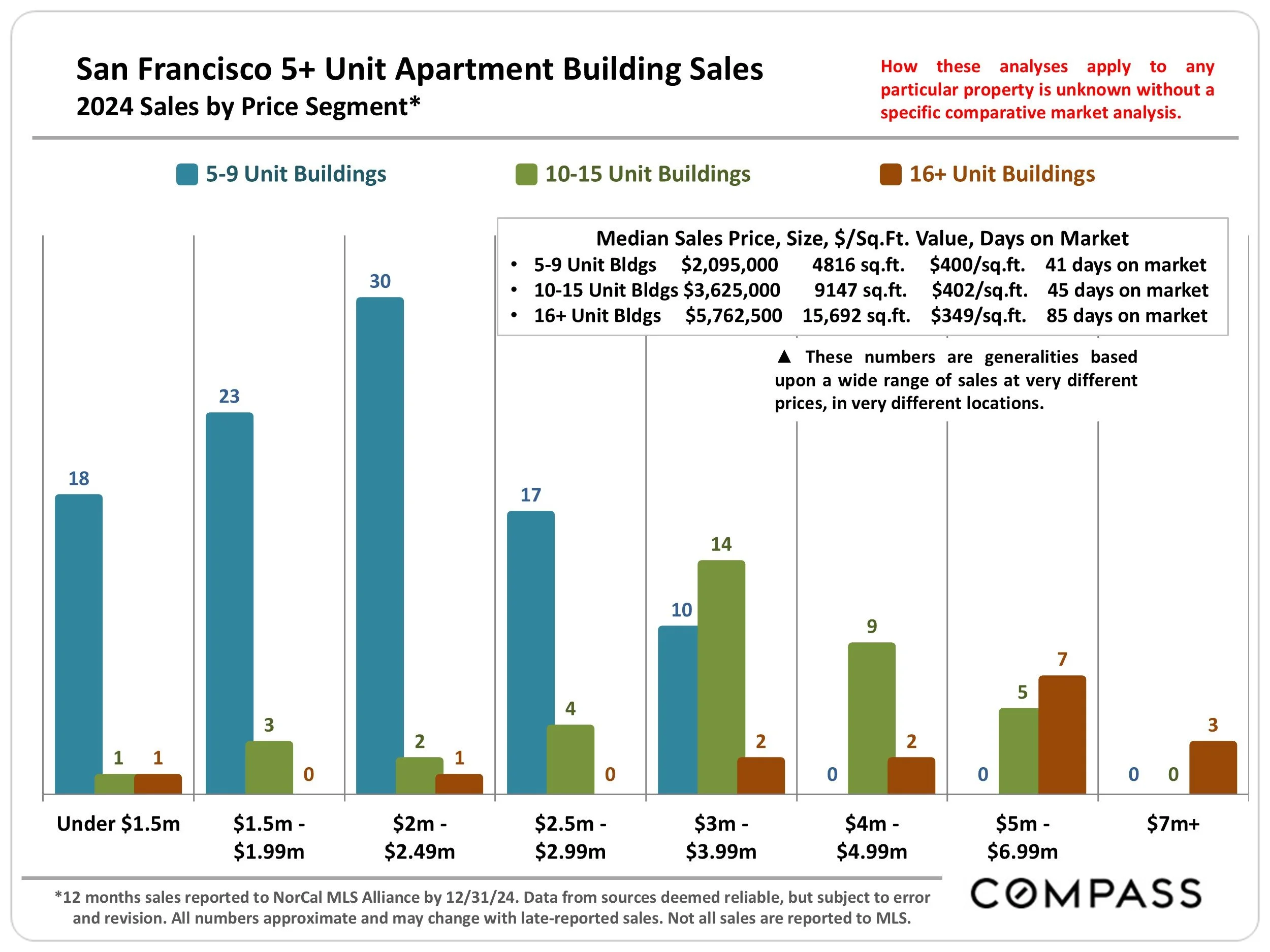

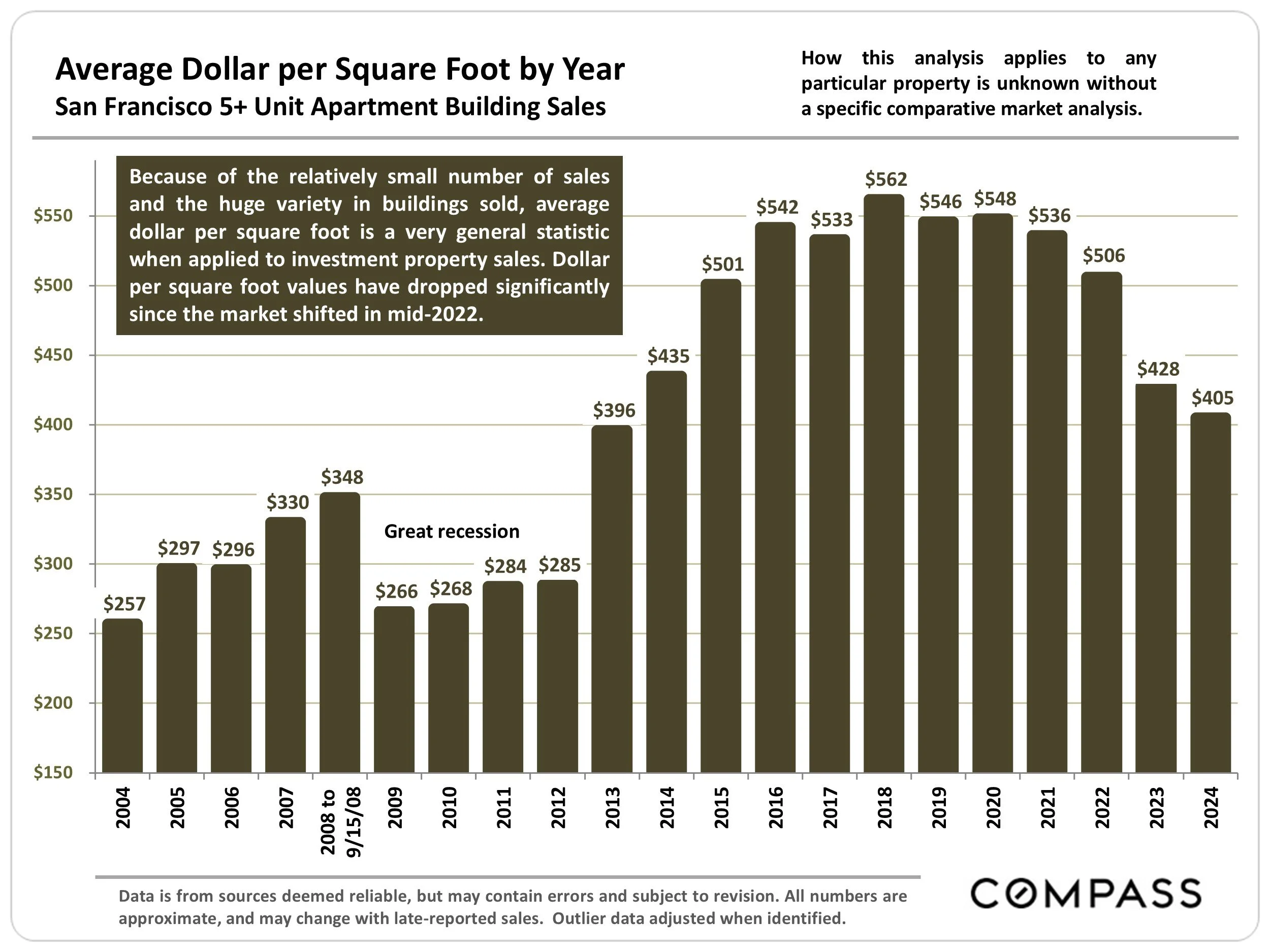

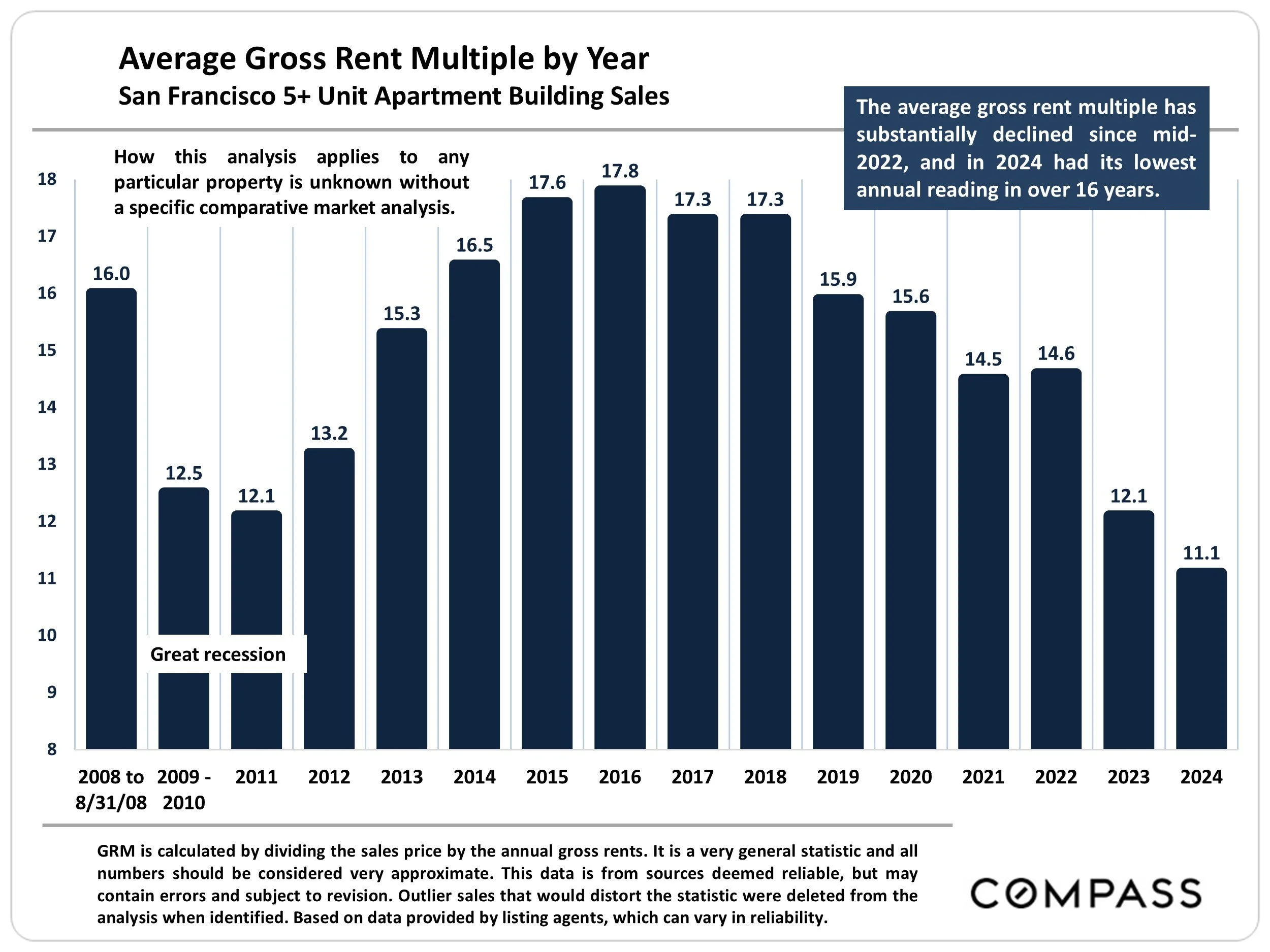

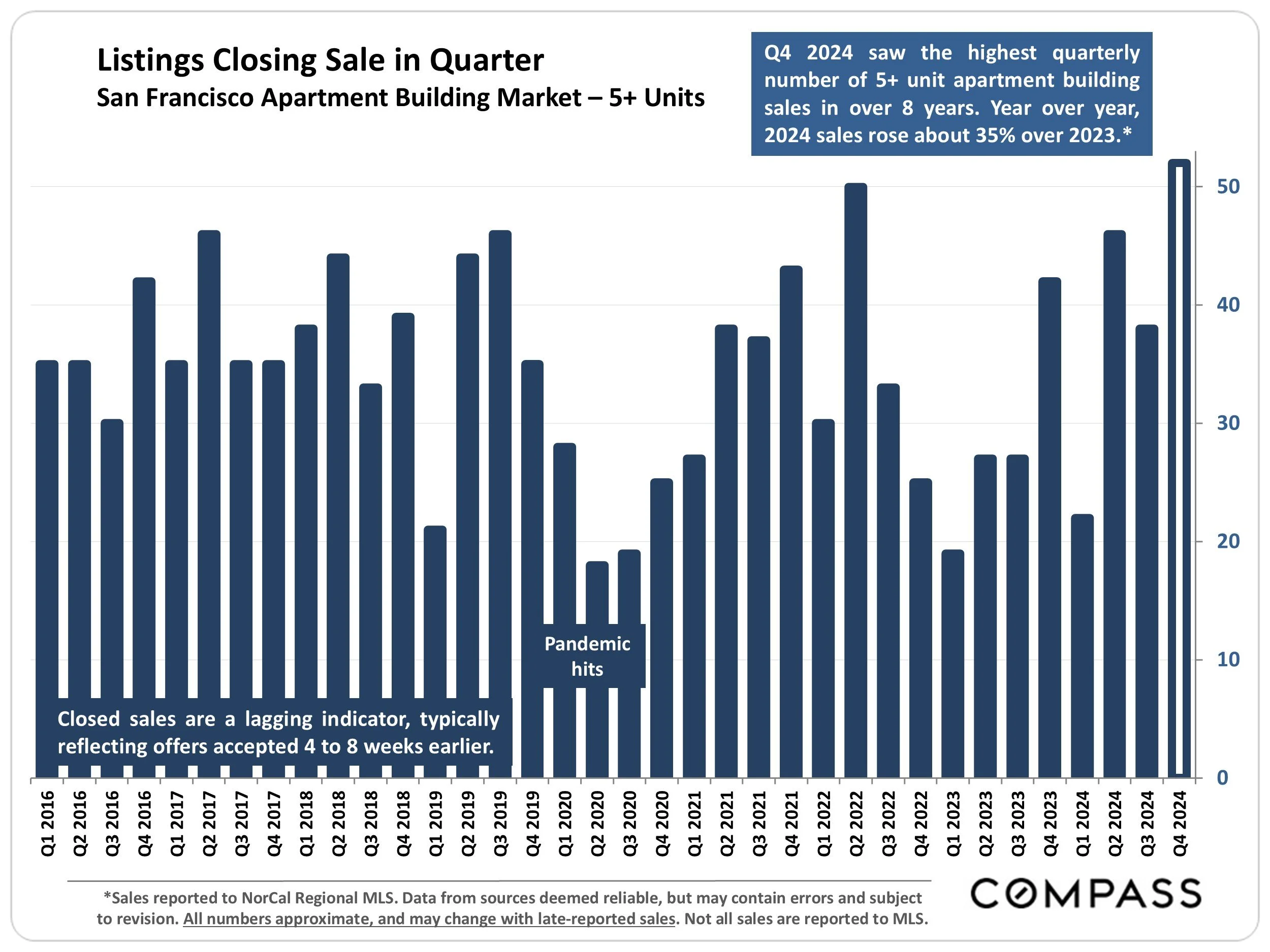

What a difference a year makes for San Francisco apartment activity. The year started off slowly but the second half of the year was the most active we’ve seen in some time.

San Francisco apartment sales volume increased by about 35% (vs. 2023) and there was a 69% rise in closed transactions for properties of 10+ units. In the fourth quarter alone, we saw the highest number of sales (in a quarter) since 2008!

Why and where in San Francisco is this happening?

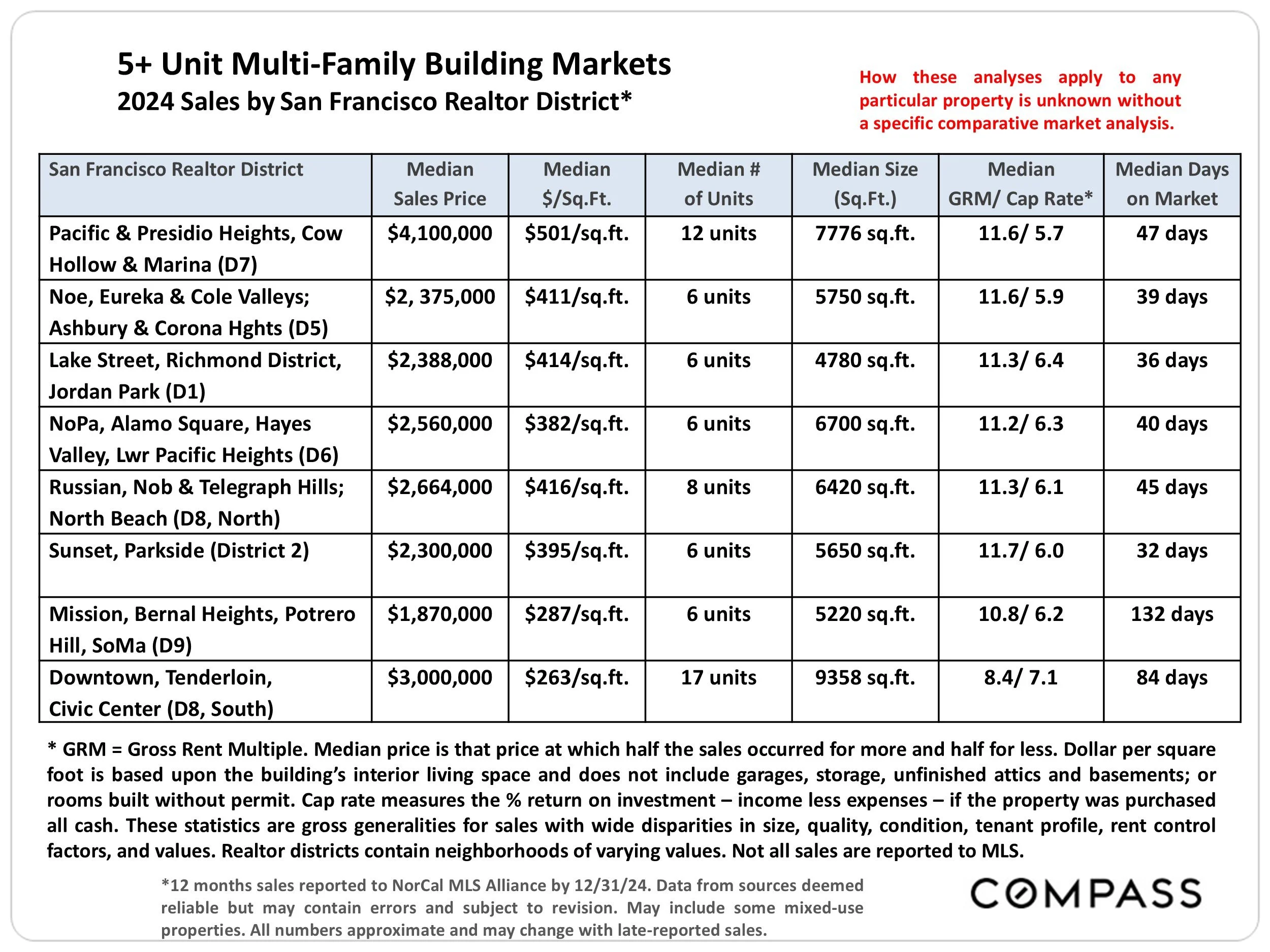

As for the why, we see private equity and institutional investors making a return. These investors are picking and choosing; looking to acquire one or two well-located properties every few months.

As far as the where are the sales occurring, the hottest neighborhoods are all north of Bush Street. Renters are actively seeking nice apartments on the north side of the City, pressuring rent rates upward.

So who are the sellers? They are primarily the smaller “mom & pop” landlords. This owner segment was pushed to the limit over the past few years with overly burdensome regulations that make it very difficult to operate. At some point, owners become fed up and want out.

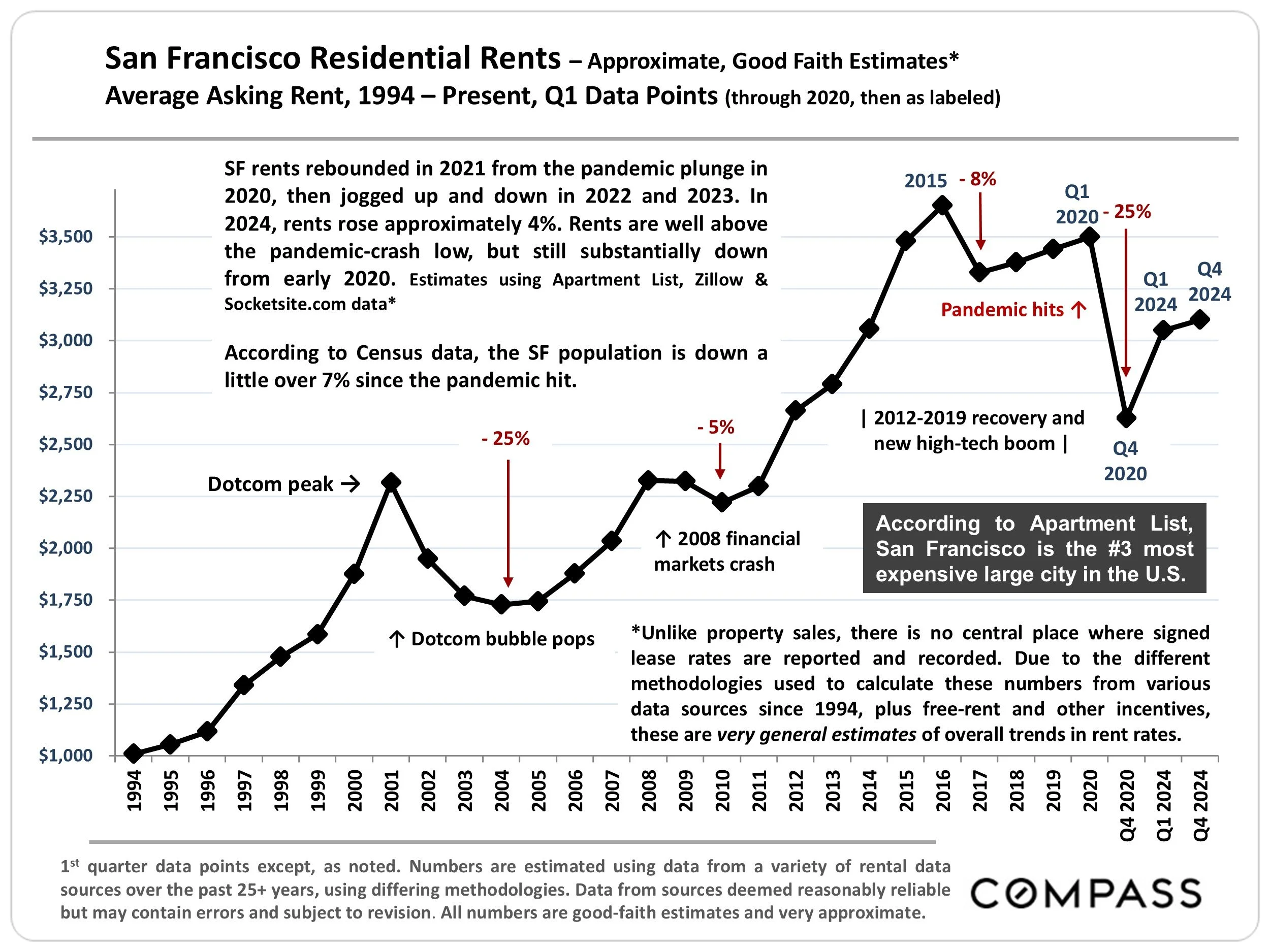

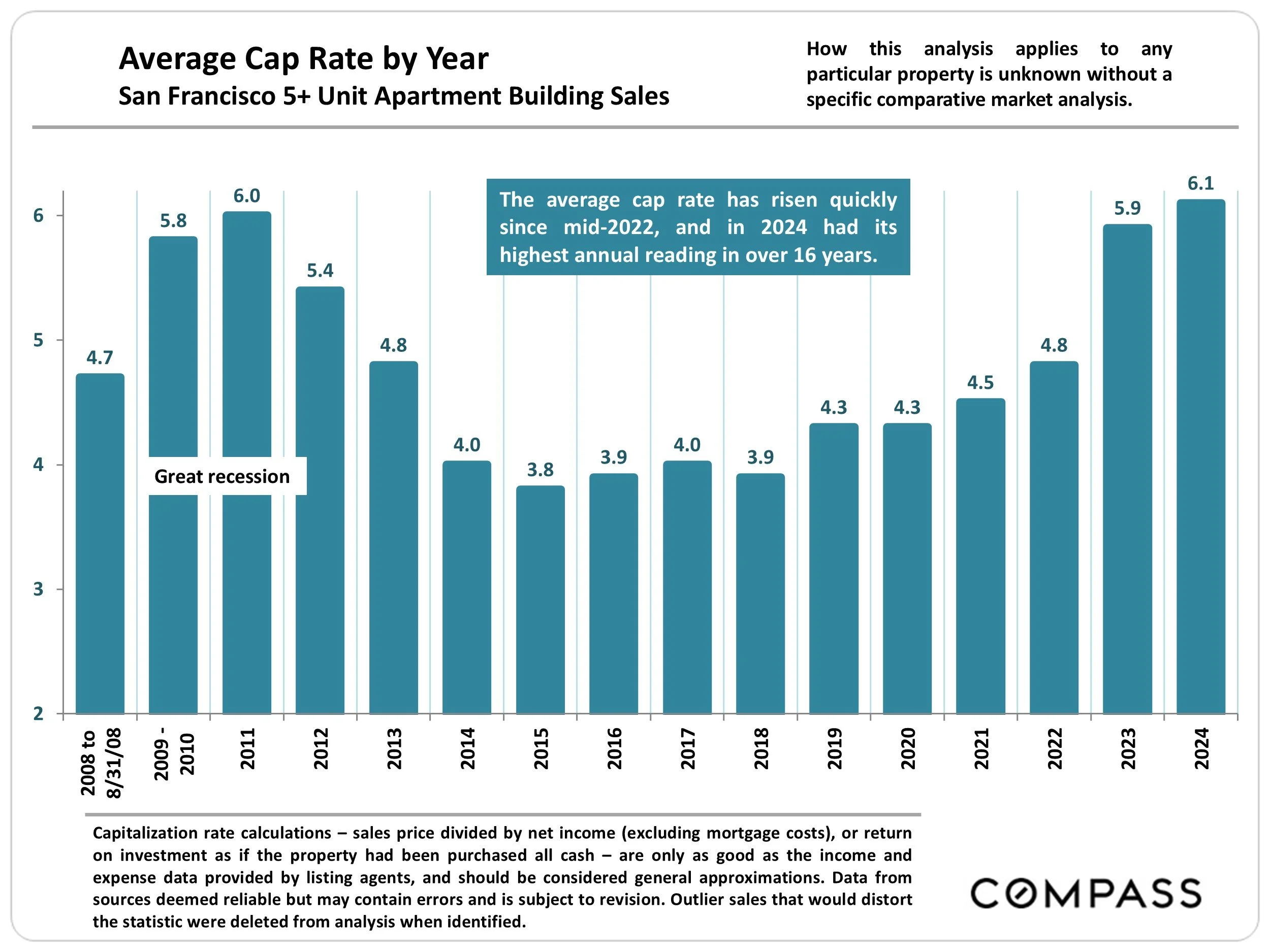

Rent rates in San Francisco are also on the upswing! Last quarter rents were up about 4% and the expectation is for this to continue in ‘Q1.

Did you check the Rent Board website for your annual increase allowance? Although your insurance, water, garbage, etc. bills are rising, the allowable rent increase for covered units effective March 1, 2024, through February 28, 2025, is a meager 1.7%.

For those of you with apartments over in Oakland, it continues to be (more) difficult to be a landlord. On December 3rd, the local politicians approved the following amendments to the Oakland Rent Adjustment and Just Cause Eviction Ordinance.

Limit banking of CPI rent increases to expire after five years and after the sale of the property unless the property is transferred to a close family member. Currently, owners are allowed to bank up to ten years of rent.

Prohibit rent increases for owners delinquent on business taxes unless the owner demonstrates financial hardship and enters into a payment plan.

Extend tenant petition deadlines from 90 days to 180 days.

Prohibit no-fault evictions for owners delinquent on business taxes.

In a positive sign downtown, the office vacancy rate fell slightly as we closed out the year. The rate dropped to 34.3% (from 34.5%). Although slight, the drop is the first decline since ‘Q1 of 2020. Let’s hope the trend continues for 2025 as “those” workers are your (future) tenants.

On to the numbers for the quarter.