April 2025: Q1 San Francisco Apartment Insider

Hello and Good Morning-

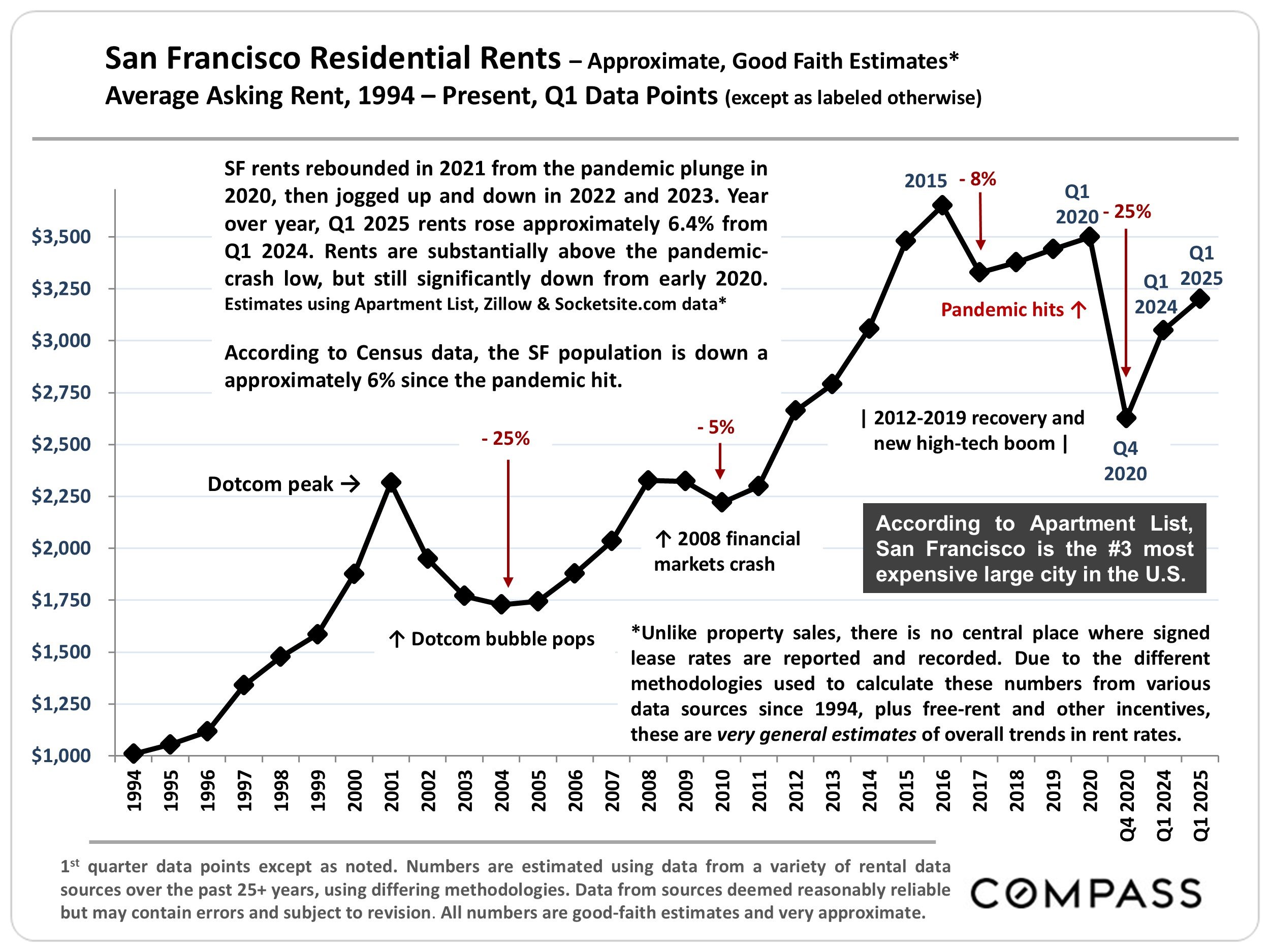

As I reported last quarter, the second half of last year realized a nice upswing in the apartment market in terms of transactions. Rents have followed and are moving up after the city saw year-over-year drops in its median rents for the previous two years. San Francisco still has lower rents than it did before the pandemic, down by about 14% from its July 2019 peak of $3,270. But apartments are filling up again and San Francisco’s vacancy rate is now just 5.5%. The median asking price for a one-bedroom rental in San Francisco was about $2,810 a month, 5% higher than in February 2024. Median asking rent for a two-bedroom is now $3,394 in San Francisco.

In a positive sign of more (potential) renters, the mayor is leading by example on the return to office policy. He is asking city workers to get back to the office four days a week by the end of April. Hopefully corporate leaders will take notice and follow suit if they have not done so already.

There are some new laws to be aware of. First, for owners of 15+ unit properties, landlords must offer tenants the option to have their positive rental payment information reported to at least one nationwide consumer reporting agency. When do you have to report?

For leases consummated on or after April 1, 2025, the offer must be made at the time of the lease agreement and at least once annually thereafter.

For existing leases as of January 1, 2025, the offer must be made no later than April 1, 2025, and at least once annually thereafter.

Second, we have a new law on screening fees. Assembly Bill 2493 strictly limits when and how a landlord or agent may charge a potential tenant a screening fee. The main thrust of the law will give a landlord two options:

Option one: charge a screening fee only for the selected tenant. Screening fees must be returned to all other applicants. The first option sets no conditions on the landlord’s application process, provided that the landlord agrees to return any charged screening fee to any tenant-applicant not selected for tenancy. This is the simplest option, but it will limit the landlord to charging exactly one screening fee at any given time for a property, regardless of how many tenant applications are reviewed.

Option two: adopt the statutory application procedure and charge a screening fee to all tenant applicants who were considered even if not selected. The second option will allow the landlord to collect a screening fee from tenant-applicants even if they are not chosen for tenancy, but only if the landlord adopts an application screening process whereby all completed applications are considered in the order received, and as provided in the landlord’s written, disclosed screening criteria.

Also, keep in mind the Rent Board changed their address. For those of you that need to serve notices, the Rent Board staff moved to the seventh floor (25 Van Ness Avenue).

Over in the southwest corner of the city, San Francisco’s largest apartment complex, Parkmerced, slid into receivership after the owner defaulted on nearly $1.8b in loans. A court appointed the San Diego-based Douglas Wilson Companies to serve as a receiver for the 152-acre, 3,221-unit complex at 3711 19th Avenue. Although the site was primarily approved for the redevelopment in 2011, the project never broke ground. The proposed redevelopment would have added 5,700 homes, 230,000 square feet of shops and restaurants, 80,000 square feet of offices and a 64,000-square-foot community center.

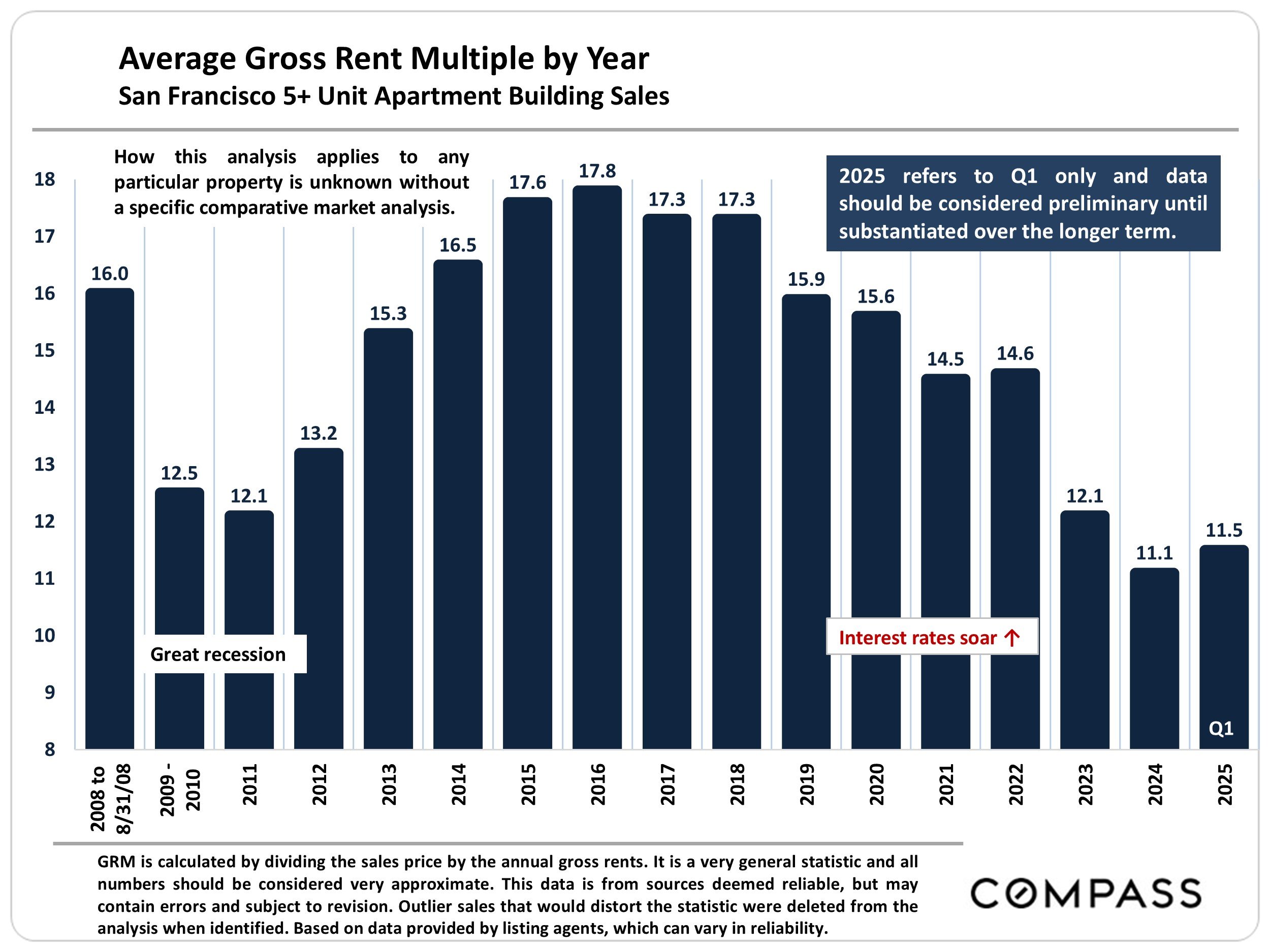

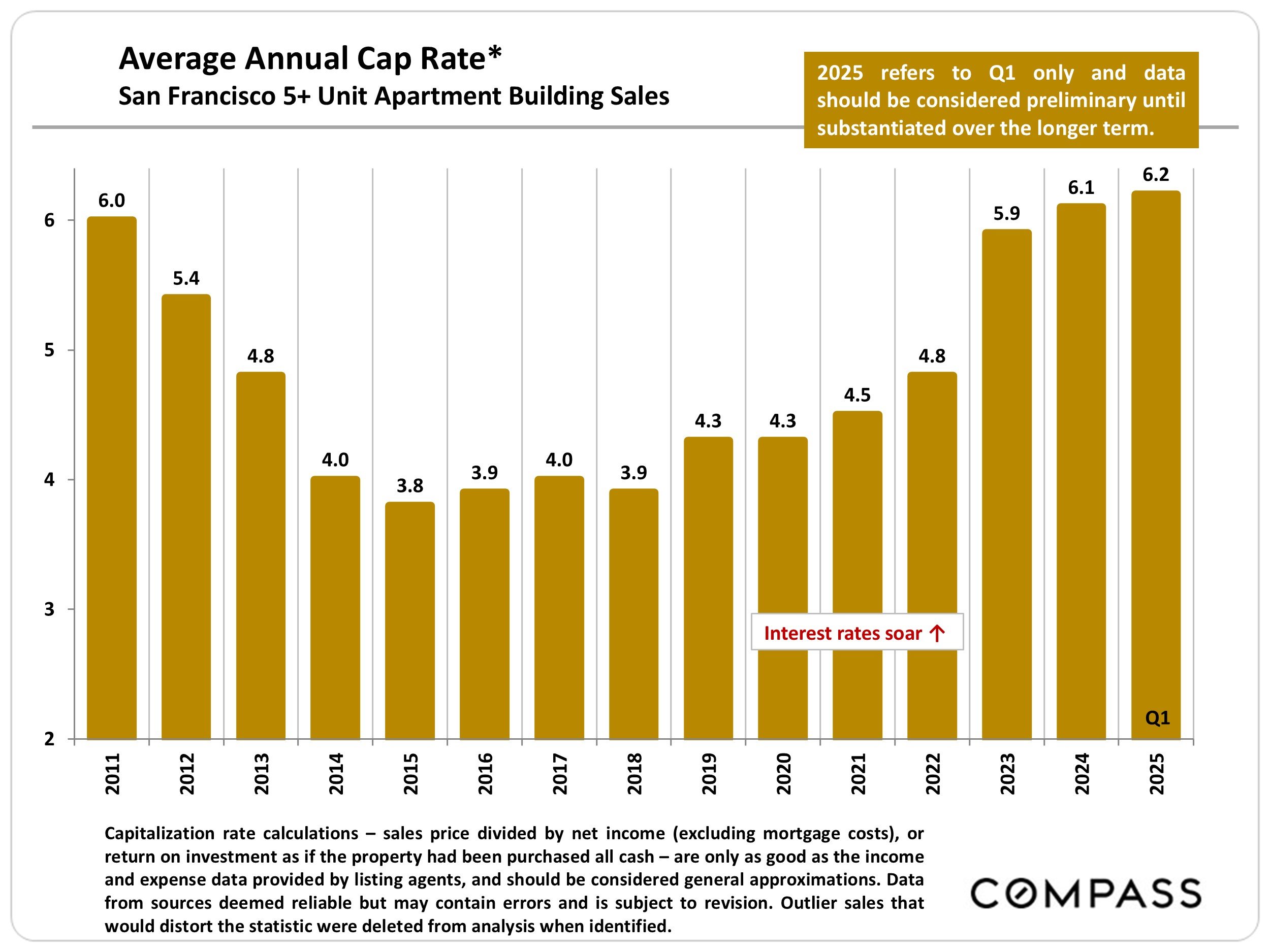

The numbers for the quarter: