February 2023: San Francisco Real Estate Insider

Over the past four weeks the market has picked up significantly in terms of motivated buyers entering the market (or resuming a previously terminated search).

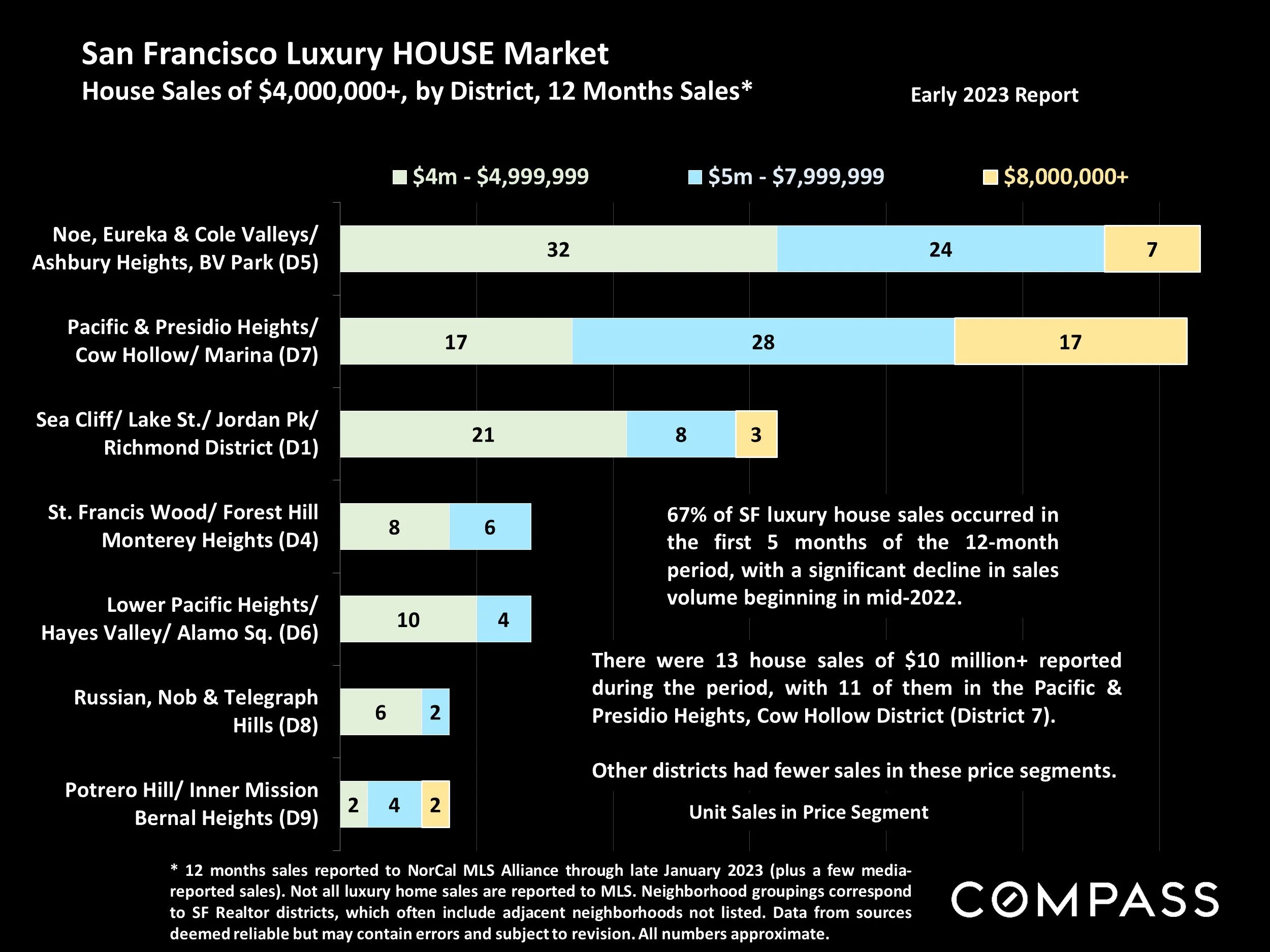

Traffic at open houses is way up as well as offer activity on single family homes and quality neighborhood condos. Lots of single family homes are receiving multiple offers, resulting in the need to have an offer date (remember those?). The most active segment is homes listed under $5 million. The luxury segment is showing signs of life again as well.

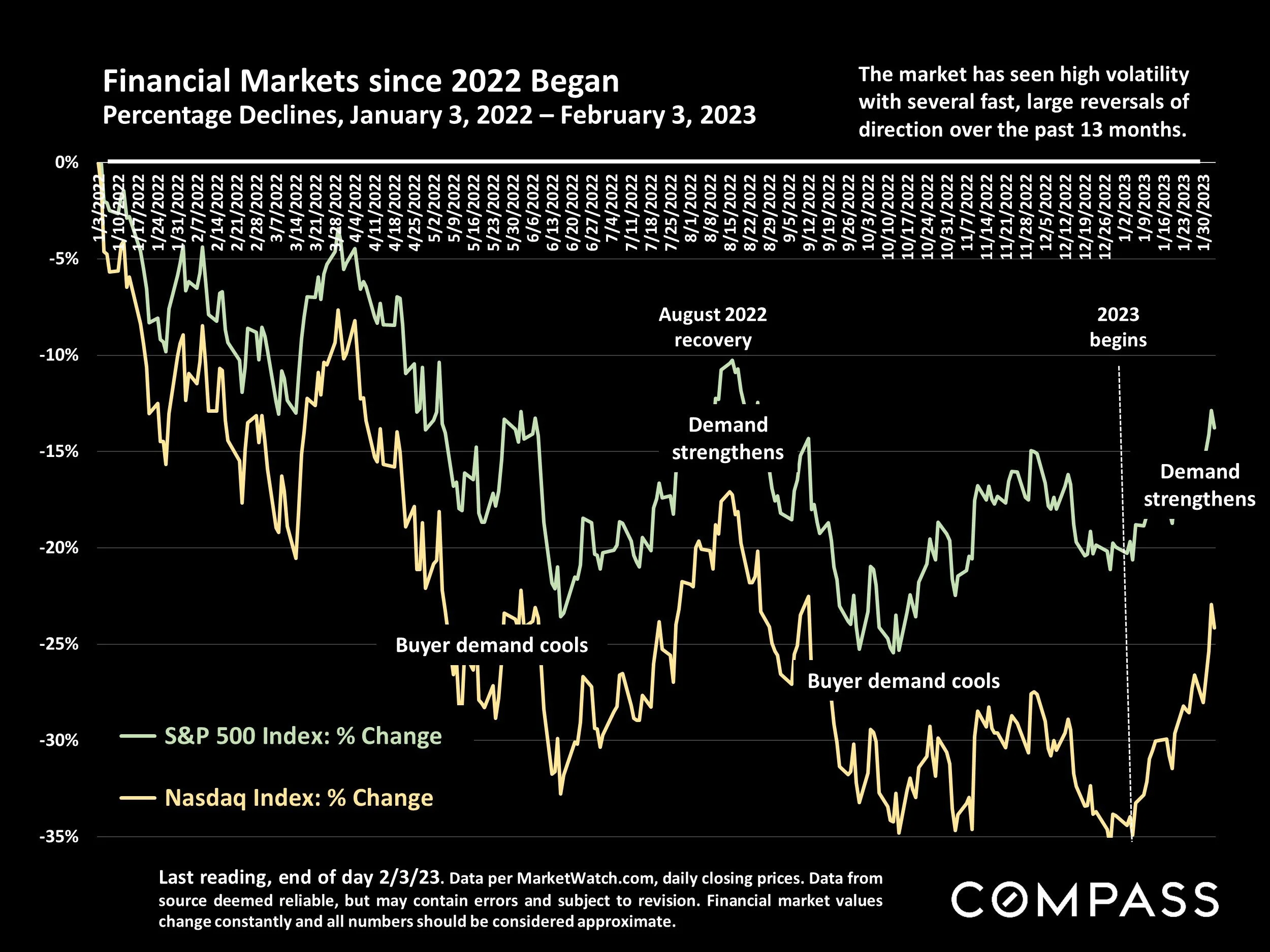

So why the sudden change from a slow second half of 2022? There is no single reason but I do see a strong upward trend in the equity markets as well as a common buyer sentiment that interest rates have or are close to peaking (and once rates start to drop, many more buyers may be back in the market pushing prices up again). It seems to be a winning trade to pay more on your financing now versus paying more on your home later (you can always refinance out of your mortgage to a lower rate later).

Looking at the runway to spring, I expect to see a solid level of inventory come to market as well as a competitive marketplace for the single family home buyers searching under the previously mentioned $5 million mark.

A high level view of the S&P 500 and NASDAQ trend below. Lets hope it continues to move upward as we move towards spring.

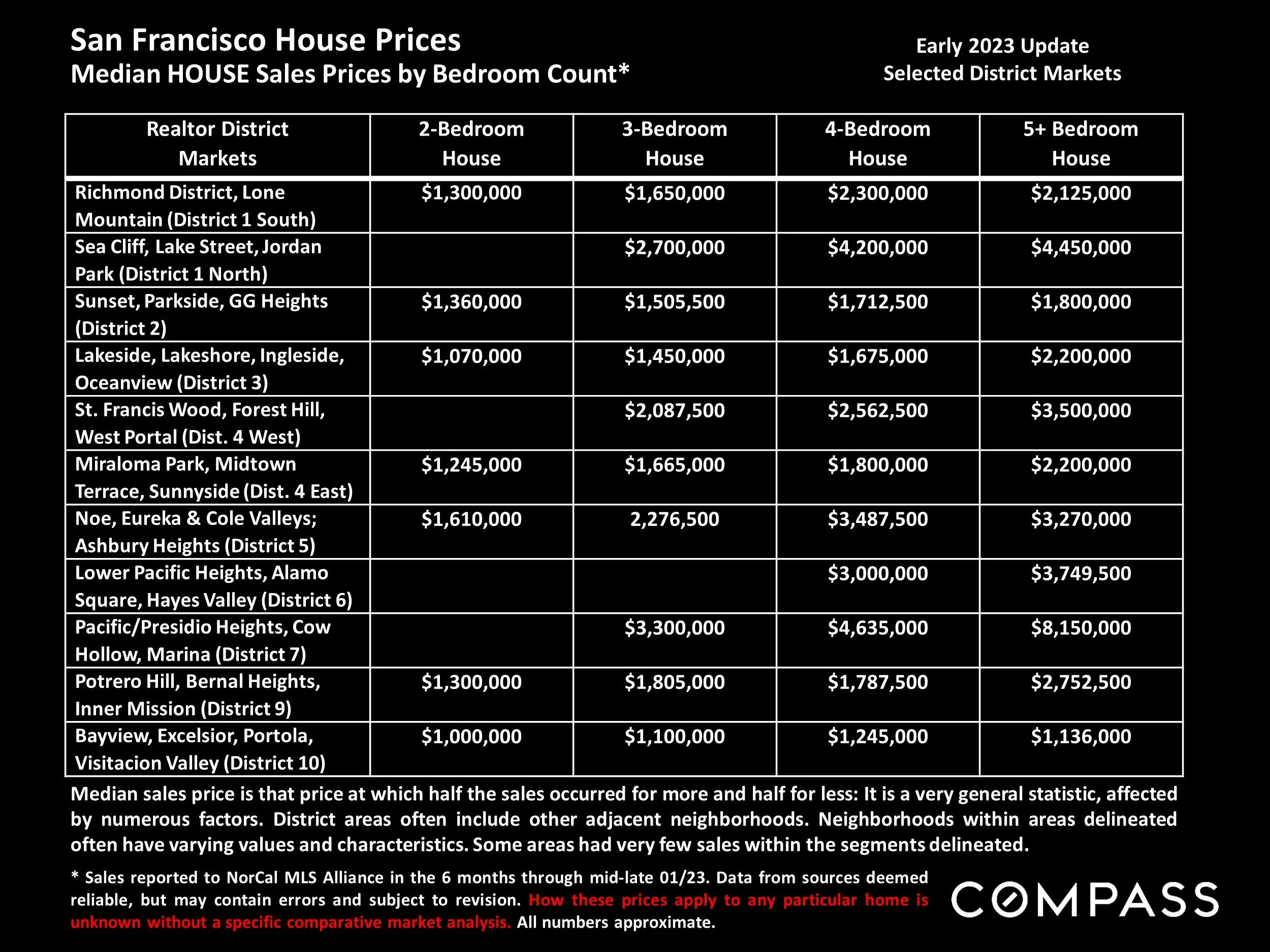

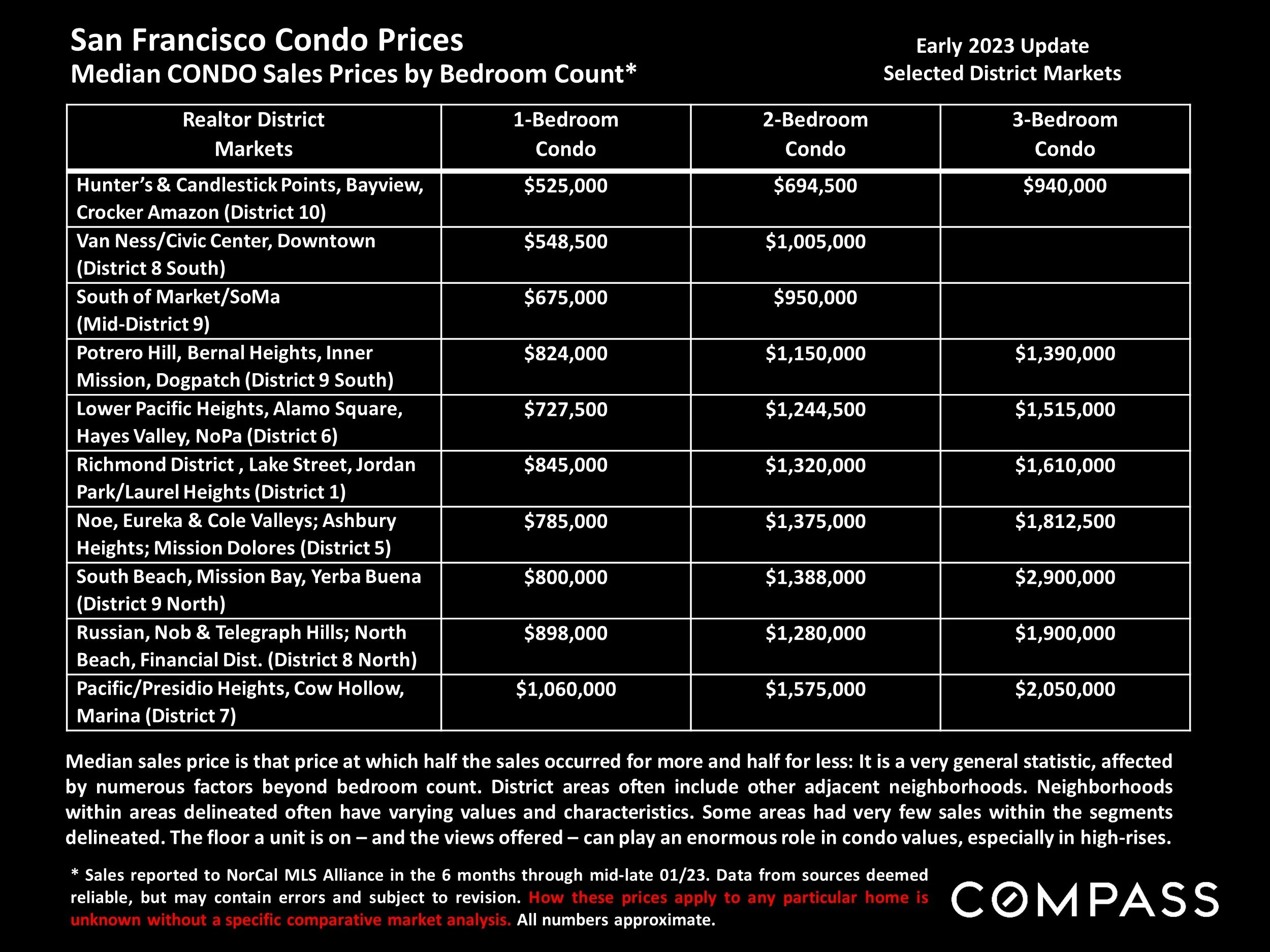

Looking at single family and condo pricing by select neighborhood and bedroom count, the charts below should help you get a better understanding of the price of entry.

As mentioned above, the luxury segment is showing signs of life after a slow second half of '22. It is too early in the year to get a full picture of the luxury market, but if the equity markets continue to trend upwards, I'd expect the activity in the luxury segment to follow.